Costly Upgrades Loom for US Transmission Grid

Infrastructure and distribution upgrades needed to handle increased electrification demands could cost up to $90 billion by 2030 and several times more by 2050.

San Diego Gas & Electric workers repair power lines. (Photo: San Diego Gas & Electric)

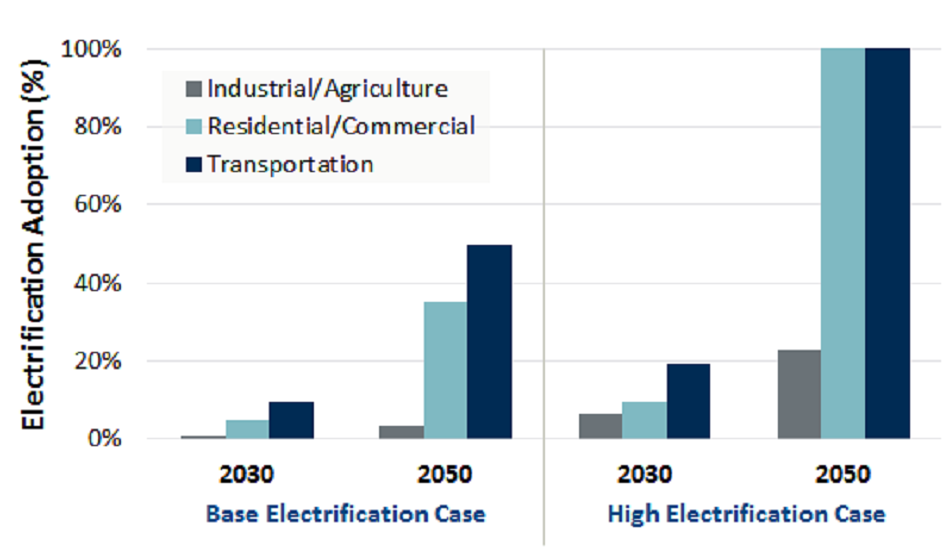

Demands and changes caused by the increasing electrification of transportation and heating in the United States will require transmission infrastructure and distribution upgrades totaling $30 billion to $90 billion by 2030 with an additional $200 billion to $600 billion needed between 2030 and 2050.

Those statistics come from a new report prepared by The Brattle Group for WIRES, a trade association that advocates for transmission investment. The study, written by Jürgen Weiss, Michael Hagerty and Maria Castañer, estimates that the number of electric vehicles on the road will jump from one million today to seven million by 2025 and increase exponentially from there.

Demand will also come from changes in residential and business heating as more electric heat pumps are used throughout the U.S., not just in warmer climates. The report notes that technology advances could also lead to more electrification of many industrial processes.

“This is a new form of load that is being driven by several things. It’s being driven by policy in certain places aiming to reduce greenhouse emissions. It’s also being driven by consumer preferences,” said Hagerty, Brattle Group senior associate and co-author of The Coming of Electrification of the North American Economy: Why We Need a Robust Transmission Grid.

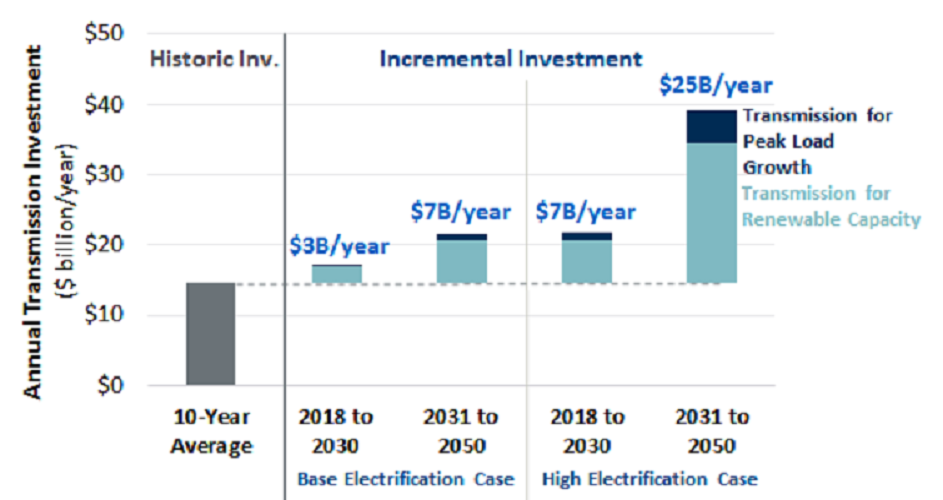

Based on the average annual transmission investment over the past 10 years, the report projects investment levels would be 20 percent to 50 percent higher through 2030—or about $3 billion to $7 billion more spent each year. Those numbers increase  significantly from 2030 through 2050, requiring a 50 percent to 170 percent increase in transmission investment, or between $7 billion and $25 billion a year. The high electrification numbers are assuming electrification will be powering all transportation and space and water heating needs by 2050.

significantly from 2030 through 2050, requiring a 50 percent to 170 percent increase in transmission investment, or between $7 billion and $25 billion a year. The high electrification numbers are assuming electrification will be powering all transportation and space and water heating needs by 2050.

“The writing on the wall is clear; we’re headed toward a cleaner energy future. The transportation and heating sectors will be electrified—it’s just a matter of when,” Brian Gemmell, president of WIRES Group and vice president of transmission and asset management with National Grid, said in a prepared statement. “Transmission is the enabler of our electrified future, so we need to start planning now in order to keep pace with the coming increased demand and to ensure continued reliability of the U.S. electric system.”

Hagerty noted transmission upgrades can take as long as 10 to 15 years to develop from initial conception to completion and so it is imperative that utilities begin planning upgrades now.

Michael Hagerty, The Brattle Group

“From the industry perspective, they’ve been living through a period of very limited demand growth. The load isn’t growing all that much. But the conventional wisdom is that very significant changes are coming up for the next 10 to 30 years,” Hagerty told Commercial Property Executive.

Lower Rates?

Despite the increased spending required to support electrification growth, the report notes that the overall impact on increased transmission investment is likely to result in modest consumer rate increases and possibly even lower rates. The authors cite three reasons: transmission costs represent a small share of the rates; total investment will be spread over greater electricity demand with electrification; and the higher costs of transmission are likely to be offset by lower generation costs from low-cost renewable resources.

The mix of new generation resources handling increased electrification demand will differ by region due to resource availability, technology costs and policy objectives, according to the WIRES report. For example, in regions like the Pacific coast and Northeast, utilities, states and consumers are increasingly choosing low-cost renewable generation. Those numbers are expected to increase to about 90 percent by 2050.

“The main takeaway for the study is if you don’t think about transmission systems as you are aiming for these high goals, you will either miss the goals or pay a lot more to achieve the goals,” Hagerty said of renewable energy goals.

Grid Modernization Investments

Sanem Sergici, The Brattle Group

In a separate report prepared for the National Electrical Manufacturers Association (NEMA), The Brattle Group provides insight into the benefits and cost recovery for several recent grid modernization efforts in the U.S. The report, Reviewing Grid Modernization Investments, reviews 21 recent grid projects and offers 10 case studies assessing cost benefits to customers and utilities as well as cost recovery. The projects cover five key areas: distribution infrastructure hardening and resiliency; transmission infrastructure hardening; smart grid and distribution modernization; advanced metering infrastructure (AMI); and distributed energy resources (DERs).

During the past decade, several utilities and public commissions have made investments in new technologies, tools and techniques to modernize the grid. NEMA’s goal for the report is to document some of those projects and provide information for utilities and regulators contemplating similar investments so they can learn from the early adopters’ experiences.

“Contrary to popular belief, grid modernization efforts are not limited to those conducted in a few states, such as California, Illinois and New York, but are taking place in many states around the country, each starting with its own priorities, such as improved resilience or AMI infrastructure,” said Sanem Sergici, Battle principal and the study’s lead author, in a prepared statement. “Most utilities are willing to undertake grid modernization projects, provided they achieve timely cost recovery and an increasing number of regulators are willing to consider alternative regulatory models to enable these projects and broader utility innovation.”

“Contrary to popular belief, grid modernization efforts are not limited to those conducted in a few states, such as California, Illinois and New York, but are taking place in many states around the country, each starting with its own priorities, such as improved resilience or AMI infrastructure,” said Sanem Sergici, Battle principal and the study’s lead author, in a prepared statement. “Most utilities are willing to undertake grid modernization projects, provided they achieve timely cost recovery and an increasing number of regulators are willing to consider alternative regulatory models to enable these projects and broader utility innovation.”

The report, co-authored by Michelle Li and Rebecca Carroll, notes that while some of the investments were done solely on utility initiatives, most grid modernization efforts were undertaken in response to local or state policy requirements. For some utilities, renewal of their “customer engagement strategies” was also part of the impetus for investment.

However, even those utilities driven by state initiatives faced just as many hurdles in the regulatory process. In most cases, the regulatory approvals took more than a year—13 months on average—and were contingent on meeting the required threshold in a typical benefit-cost test such as the Total Resource Cost (TRC) test. Other approaches for cost benefits used included break-even analysis and proof-of-cost prudency.

The majority of the cases relied on cost recovery through general rate filings, although some use formula rates and rate riders to address lags in regulatory approvals. Some jurisdictions also introduced performance-based rates and incentives, particularly for meeting targets for increased utilization of DERs, beneficial electrification and increased system utilization. Brattle researchers expect this trend to continue as the urgency of grid modernization, DER integration and electrification continues.

You must be logged in to post a comment.