Will Lending Plateau in 2019?

During the past few years, lenders charted record-high activity across property types and markets. But escalating asset prices, rising interest rates and regulatory shifts may force adjustments in 2019.

In the decade since the global financial crisis, real estate commercial and multifamily lending originations have been on an impressive upswing. But volume is beginning to decline in some sectors due to rising interest rates, unsustainable price growth and other changing conditions.

In 2017, $530 billion in commercial and multifamily mortgage loans closed, according to the Mortgage Bankers Association and the party continued into 2018. During the second quarter of 2018, originations were up 4 percent year-over-year and 32 percent over the first quarter, according to the MBA’s Quarterly survey of Commercial & Multifamily Originations Index.

What accounts for this volume? Real estate markets have enjoyed mostly tailwinds from favorable demographics, durable job growth, a thriving underlying economy, strong property fundamentals, rising values and low interest rates.

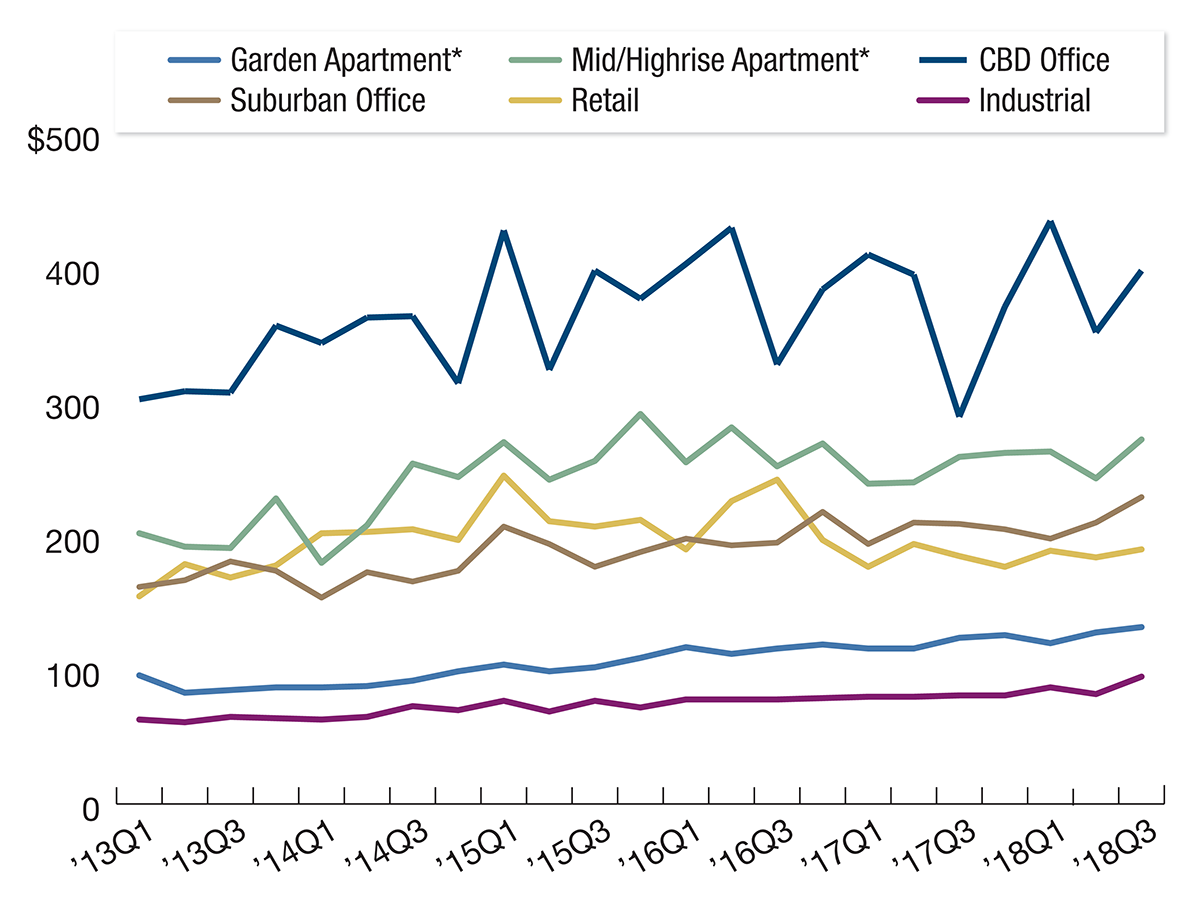

Vaulted valuations

2018 pricing

“All of those factors have pushed borrowing and lending to record levels,” explained MBA Vice President of Research and Economics Jamie Woodwell.

But MBA’s third quarter figures may (or may not) indicate a directional change. Commercial and multifamily loan originations dipped 3 percent from second quarter and 7 percent from third quarter last year. The drop off in lending in the third quarter was driven by a 30 percent decline in hotel loans, a 28 percent decrease in retail loans and a 17 percent dip in office loans. By contrast, multifamily and health-care originations in the third quarter ticked up by 13 percent and 18 percent, respectively. Industrial loan originations were relatively steady over the same period.

Woodwell expects the appetites of borrowers and lenders to continue in 2019, due largely to the increasing fondness for multifamily and industrial assets. (Despite a slower third quarter, year-to-date lending was actually just 1 percent off the first nine months of 2017.) He concedes, however, that loan transactions should plateau within the next two years.

“Each property type has its own story, leading to some differences in terms of investor demand and how different market players approach them,” noted Woodwell.

Apartments are the Darling

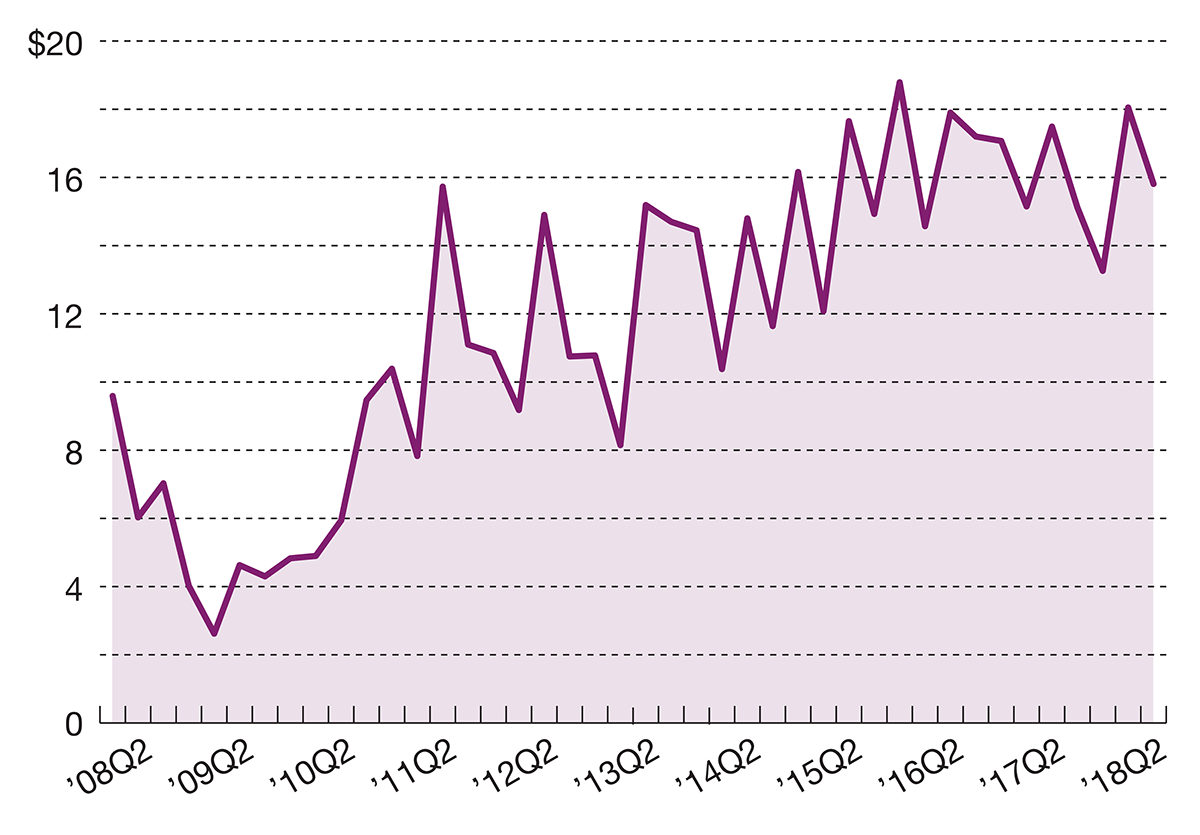

Multifamily accounted for the bulk of loans through September and, not surprisingly, the government-sponsored lenders led the charge. Life companies were also bullish on apartments, making them the next most active lender and a prominent player in the multifamily bridge loan market.

“The bridge lending space is already (very) active and a pretty saturated group,” said NorthMarq managing director David Link. But what distinguishes life companies is that their strategy will continue to focus on “competing for higher-quality assets and pricing their money accordingly,” Link continued.

Life’s larger share

Quarterly commercial mortgage commitments by life insurance companies

The industrial sector, which has outperformed for much of the current cycle, saw stable loan volume from second quarter to third quarter but a 19 percent increase over third quarter 2017.

Office and retail loans, on the other hand, were down 18 percent and 22 percent from second quarter to third quarter and 17 percent and 28 percent from third quarter 2017. The decline in office lending was due in part to office occupiers reducing their space footprints and coworking earning a larger market share. Meanwhile, demand for retail loans was down as a result of rising interest rates and increased e-commerce and online shopping.

Moderating rent growth is another challenge that the lending market will need to contend with in 2019, Link noted. Unlike earlier in the cycle, it is no longer reasonable to maximize value by relying on property income appreciation alone. As indicated by the CoStar Commercial Repeat Sale Indices, the retail sector experienced the highest price growth during the 12 months ending in September. Store closures were responsible for some of this increase, as higher-quality retail centers commanded higher prices and better performers strategically reduced their stock.

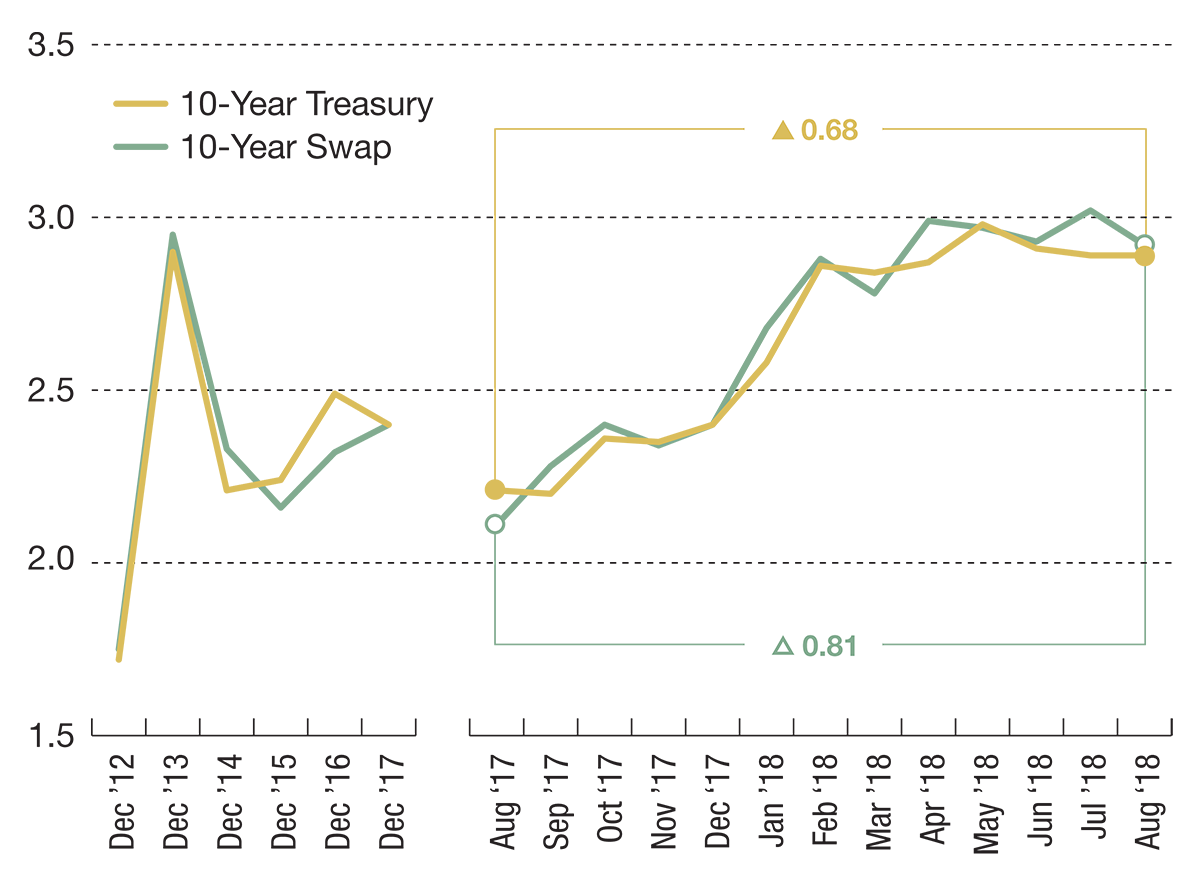

Interest Rate Volatility

The Federal Reserve’s monetary policy has had no material impact on the U.S. economy so far, according to Kroll Bond Rating Agency. The post-recession quantitative tightening, however, could decrease demand for commercial real estate assets as the protracted recovery continues.

Already, this year’s three scheduled rate increases seem to be pushing borrowers and lenders toward floating-rate and shorter-term debt. The flexibility of these loans, including their favorable—or in best cases, nonexistent—prepayment options has made them a suitable fit for transitional properties. Debt funds and REITs are also gaining traction within the transitional loan sector, as a result of increased liquidity in the collateralized mortgage loan obligation market, according to Cushman & Wakefield.

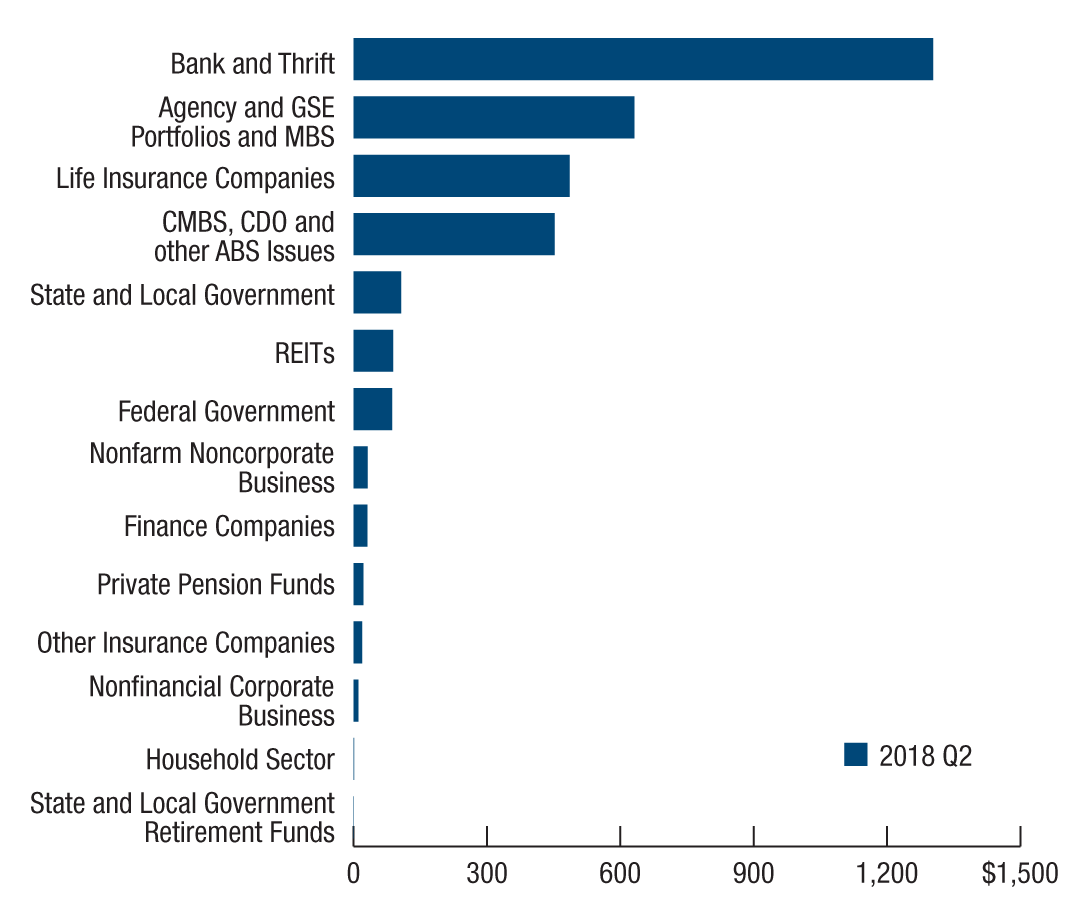

Liquidity rules

Commercial and multifamily debt outstanding

Source: MBA, Federal Reserve Board of Governors, Wells Fargo Securities, LLC, Intex Solutions, Inc. and FDIC

Late-cycle spread compression should help to offset some of the increase in short-term interest rates, especially as competition for value-add deals heats up, according to Dekel Capital Managing Principal & Founder Shlomi Ronen. “It seems as though sponsors have been willing to accept lower returns with respect to the (value-add) investment, so we’ve seen that market continue to be healthy,” Ronen noted.

Cushman & Wakefield measured the 10-year Treasury rate at 3.06 percent as of November, up 70 basis points from 2.36 percent one year prior. “We’ll see how long that will last. At some point, back-end investors will bid more aggressively (on corporate bonds) to get a face-value yield that will satisfy their returns,” Ronen predicted. This would counter the overall cooling trend that has occurred within the corporate bond market, spurred by higher interest rates.

“Interest rates have been cooperative for the past several years, and property fundamentals have been great, but this past year’s rise in Treasury (rates) has created more challenges in the acquisitions market,” Link commented. “Spreads have been erratic at times, as well. To see a good run in 2019, there needs to be some stability there.”

Rising rates

10-year Treasury yields and bank rates

The dynamic of lenders accepting lower spreads, however, seems to have reached its limit, notes Berkadia Executive Vice President & Head of Mortgage Banking Hilary Provinse. “Any additional increases in Treasury rates in 2019 will likely be passed through to borrowers and pressure cap rates,” she explained

Lenders could expect to see a dip in refinance transactions in 2019, as a result of so few 10-year loans being originated in 2009, Link suggested. Combined with uncertainty around rising rates, these trends could push investors to wait on the sidelines until things settle a bit.

To mitigate risk, Link recommended that borrowers lock in longer-term financing and sponsors sell projects that are moving toward stabilization: “I think most lenders and borrowers would be well served to move some of their floating-rate loans to fixed-rate products,” he advised.

A shifting landscape

Climbing rates have had a tempering effect on the secondary market also. Through November, both CMBS and REIT unsecured issuance were down from the same period last year, dropping by 14 percent and 40 percent, respectively, reported Cushman & Wakefield.

KBRA predicts that conduit issuance in 2019 will be down by nearly 15 percent from the low range of 2018 levels ($35-40 billion), at $30 billion by year-end. The rating agency attributes the decline to decreasing demand for longer-term fixed-rate instruments, fewer maturities and intensified competition among lenders.

Provinse pointed to regulatory shifts as an important trend to watch in 2019: “With leadership changes at FHFA and Freddie Mac, it may take a little while for regulatory reform to take center stage, but GSE regulatory capital reform, which we expect will be a priority in 2019, could definitely alter the competitive landscape.”

You’ll find more on this topic in the CPE-MHN Guide to 2019.

You must be logged in to post a comment.