COVID-19 and REIT Cap Rates

Early signs point to resilience for sectors experiencing tailwinds from structural demand changes, notes CenterSquare's Scott Crowe.

In a world of heightened uncertainty, we continue to believe that low interest rates and long-term leases should make real estate an attractive investment option. However, sectors will be impacted differently by both COVID-19 itself and behaviors and measures that will be taken to address the outbreak. While at the time of writing, REITs are likely oversold, pricing in the REIT market is diverging among those property types that will be impacted versus those that will remain resilient, which could point to the future direction of private market values.

Scott Crowe Photo courtesy of CenterSquare

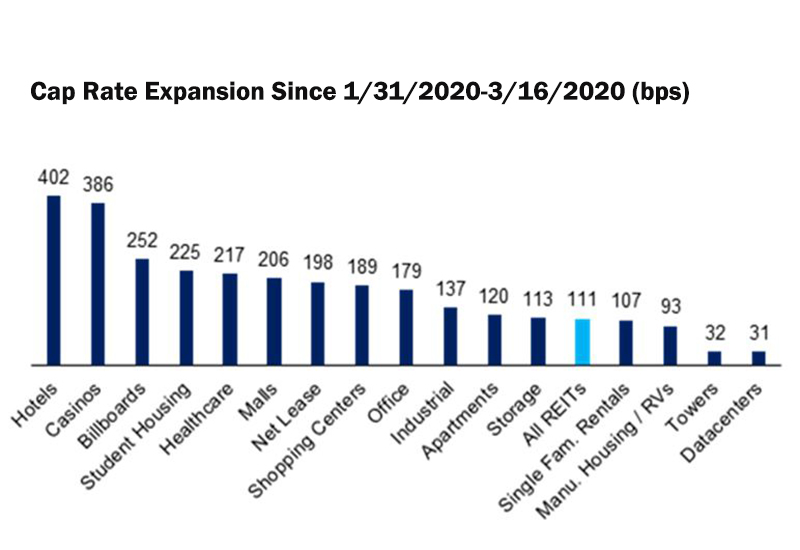

Cap rates are indicating vulnerability for hotels, senior housing, and malls as these sectors are most susceptible to the direct impacts from the ongoing spread of the virus.

Cap rates are indicating resiliency for those sectors experiencing the tailwinds from structural demand changes. Sectors seeing the benefits of the ever-growing demand for connectivity and data usage, notably towers and data centers, should not only prove resilient, but their importance will likely be heightened as businesses try to operate through the coronavirus quarantines and travel restrictions.

The markets are expecting among the highest level of resiliency for cell towers as growth stands to accelerate from the 5G buildout further assisted by the Sprint/T-Mobile merger. Additionally, the low labor requirements and high property level margins further insulate this property type from economic fluctuations. Cap rates here have only expanded by 32bps1, which is 8 percent of the reaction we’ve seen in hotels.

In a similar genre, data center cap rates have also remained relatively steady as resilient growth and accretive development keeps the property type attractive for investors. While we do expect a lengthening in the decision-making cycle which could lead to lower leasing levels, the fundamental demand drivers have data centers still screening favorably.

Source: CenterSquare Investment Management. Cap rates are based on CenterSquare public and private market cap rate estimates (1/31/2020–3/16/2020). Please refer to CenterSquare cap rate methodology.

Scott Crowe is the chief investment strategist of CenterSquare.

CenterSquare Cap Rate Methodology

CenterSquare REIT Implied Cap Rates are based on a proprietary calculation that divides a company’s reporting net operating income (“NOI”) adjusted for non-recurring items by the value of its equity and debt less the value of non-income producing assets. The figures above are based on 4Q19 earnings reported in February 2020. The universe of stocks used to aggregate the data presented is based on CenterSquare’s coverage universe of approximately 200 U.S. listed real estate companies. Sector cap rates are market cap weighted. Sectors and market classifications are defined by the following:

Apartment: REITs that own and manage multifamily residential rental properties; Industrial: REITs that own and manage industrial facilities (i.e. warehouses, distribution centers); Office – REITs that own and manage commercial office properties; Retail – REITs that own and manage retail properties (i.e. malls, shopping centers); Hotel – REITs that own and manage lodging properties; Healthcare – REITs that own properties used by healthcare service tenants (i.e. hospitals, medical office buildings); Gateway – REITs with portfolios primarily in the Boston, Chicago, LA, NYC, SF, and DC markets; Non-Gateway – REITs without a presence in the gateway markets.

Private Market Cap Rates represent the cap rate achievable in the private market for the property portfolio owned by each company, and are based on estimates produced by CenterSquare’s investment team informed by various market sources including broker estimates.

You must be logged in to post a comment.