COVID-19 Impact Still Tough on Self Storage Rents

The self storage sector continued to see negative effects caused by the pandemic, as street-rate performance declined in all the top markets tracked by Yardi Matrix.

As the nation grappled with fallout from the novel coronavirus outbreak, self storage rents continued to decline in May. On a year-over-year basis, street rates slid 4.3 percent for the average 10×10 non-climate-controlled and 6.7 percent for climate-controlled units of similar size. Over the past 12 months, street rate performance was negative in all the top markets tracked by Yardi Matrix.

On a month-over-month basis, street rates fell 0.9 percent for the standard 10×10 non-climate-controlled and 0.8 percent for climate-controlled units of similar size. Chicago saw a 1.1 percent increase in street rates month-over-month for non-climate-controlled units, while street rates for climate-controlled units remained unchanged.

Despite the heavy decline in street rates, demand for storage space appeared to be stable, with move-ins and move-outs slightly recovering over the past few weeks. Overall, the pandemic seems to be both fueling and diminishing demand for self storage: While people who need to downsize are driving the need for storage units, growing unemployment might lead to a decrease in demand.

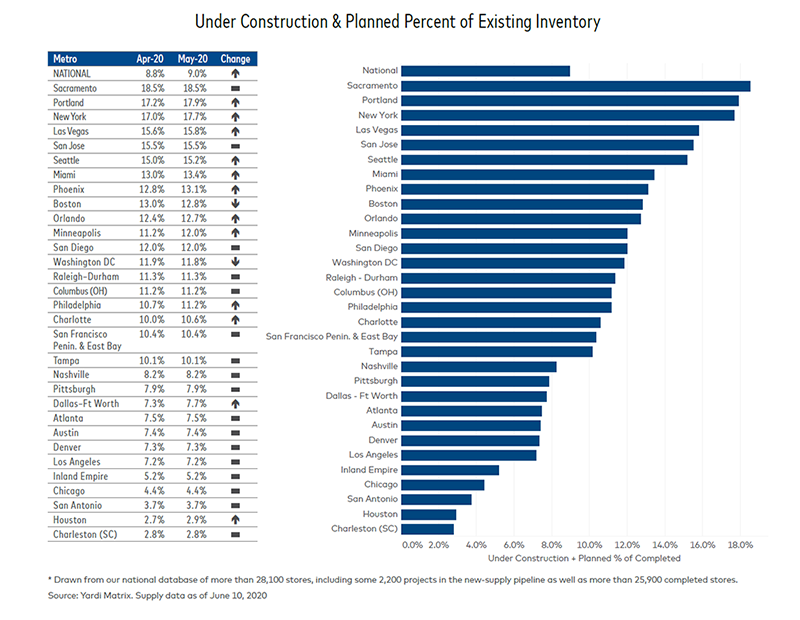

The new-supply pipeline seems to be less affected by the COVID-19 outbreak, as developers continued to push through with new projects. Nationally, projects under construction or in the planning stages accounted for 9 percent of existing stock, a 20-basis-point increase month-over-month. New York saw a notable uptick in development activity—the metro’s new-supply pipeline represented 17.7 percent of total inventory, a 70-basis-point growth over the previous month. Despite the positive signs, the coronavirus outbreak is expected to slow down deliveries and cause delays in development throughout 2020.

You must be logged in to post a comment.