COVID-19 Impact on Self Storage Rents Eases

In a sign that the sector may have seen the worst of the fallout from the pandemic, the downward trend of street-rate performance is starting to slow.

Although the coronavirus outbreak continued to put pressure on the self storage industry, rents did not fall as drastically in June compared to previous months. On a year-over-year basis, street rates declined 4.3 percent for the average 10×10 non-climate-controlled and 6.7 percent for climate-controlled units of similar size. Over the past 12 months, street rate performance was negative in all top markets tracked by Yardi Matrix, whereas month-over-month, only 19 percent of the markets saw negative street rate performance.

Despite being one of the worst-performing markets in the recent months, Pittsburgh was the only top market with growth in street rates year-over-year in June, with rates increasing 1.5 percent for the standard 10×10 climate-controlled units. Similar-sized non-climate-controlled units also experienced the smallest decline in the metro, down only 0.9 percent.

Historically oversupplied Charleston also saw positive rent performance. On a month-over-month basis, street rates grew 1.2 percent for the average 10×10 non-climate-controlled units. Despite having a completed inventory of 11.4 net rentable square feet per capita, almost double the national average, the metro’s new-supply pipeline grew by a considerable 60 basis points in June, potentially hindering the further improvement of street rate performance.

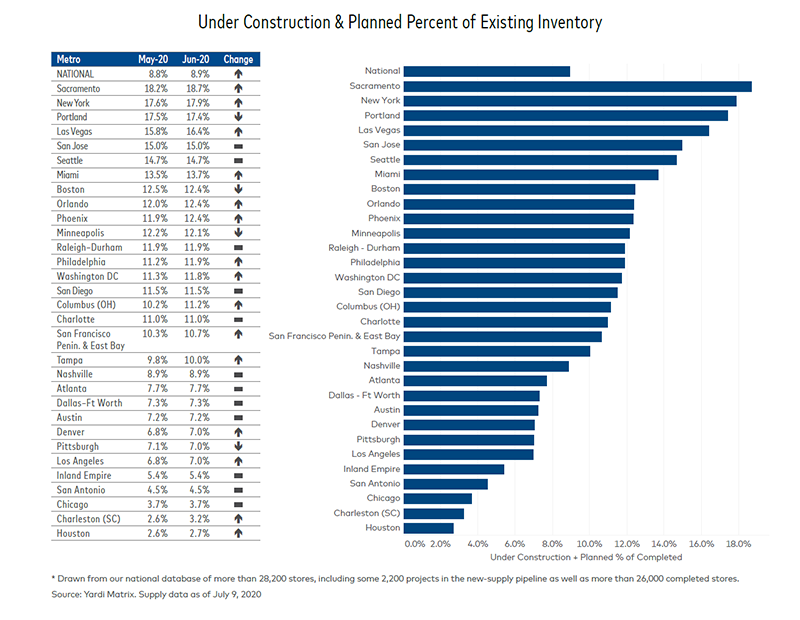

Nationwide, projects under construction or in the planning stages accounted for 8.9 percent of total inventory, up 10 basis points over the previous month. However, development activity is still expected to slow down in the short term. In June the number of abandoned projects increased by 2 percent, or 17 facilities across the nation, indicating a potential decline in construction activity. The largest uptick in new projects was registered in Columbus, Ohio. The metro’s new-supply pipeline represented 11.2 percent of the existing stock, a 100-basis-point increase month-over-month.

Read the full Yardi Matrix report

You must be logged in to post a comment.