COVID-19 Is Remaking the Workplace, CFOs Say

In a PwC survey, corporate executives weigh in on the future of the workplace, capital investment plans and potential layoffs.

Image by Shridhar Gupta on Unsplash

As companies lay plans for a return to the workplace, a new study from PwC indicates that the coronavirus pandemic is bringing about far-reaching change.

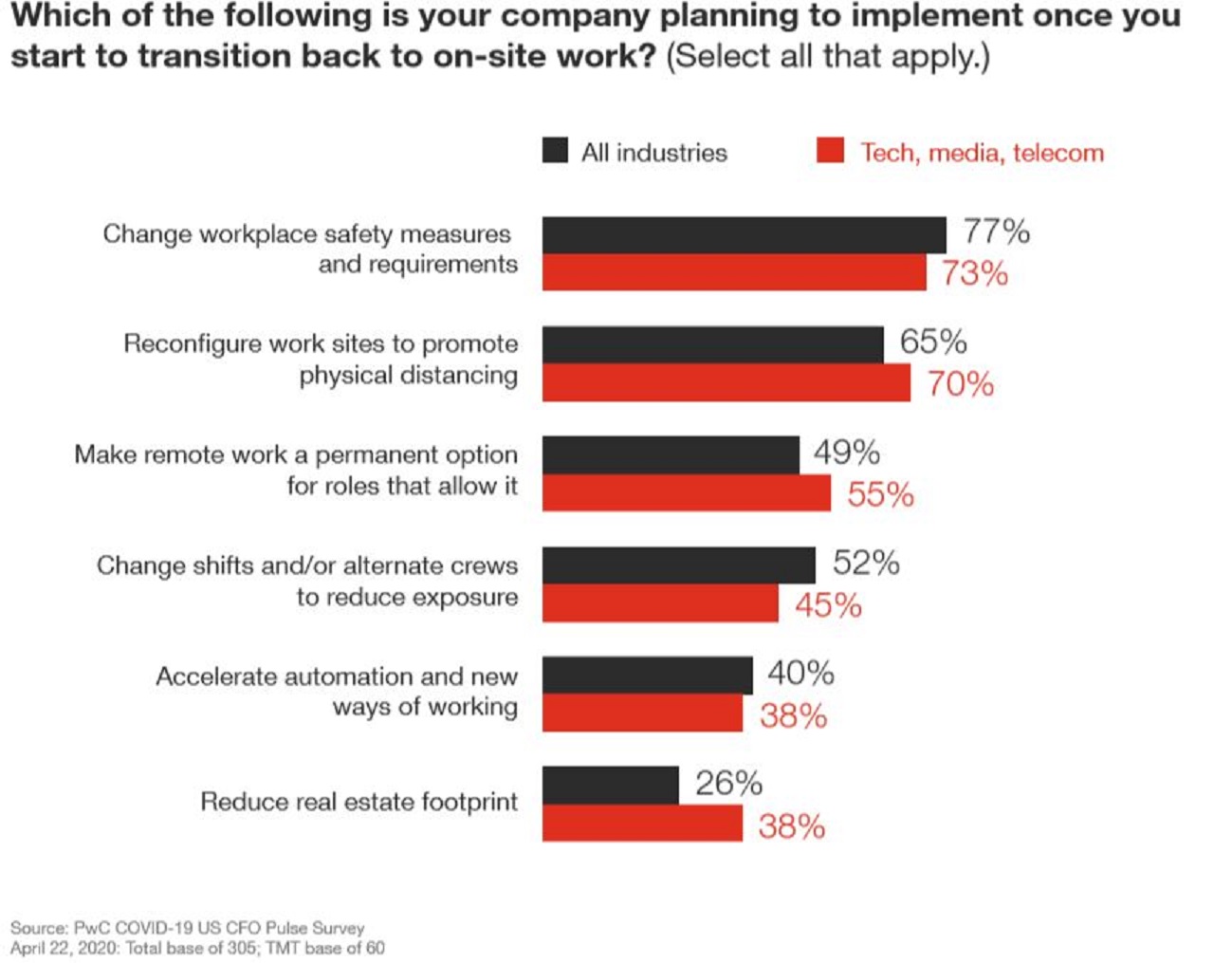

Employee health and safety is top of mind. The nationwide survey of CFOs found that 77 percent anticipate changes to workplace safety measures and requirements. Additionally, 65 percent plan to reconfigure worksites, and more than half will change shifts and/or alternate crews to reduce potential exposure.

The findings are highlights of PwC’s fourth COVID-19 Pulse Survey, which was conducted on April 20, 21 and 22. Of the survey’s 300-plus respondents, 89 percent represent companies in five sectors: industrial products (23 percent); technology, media and telecommunications (20 percent); financial services (20 percent); consumer markets (14 percent); and health-care (12 percent).

Source: PwC COVID-19 US CFO Pulse Survey April 22, 2020. Total base of 305; TMT base of 60

Consumer market companies are particularly likely to modify their workplaces. In the latest PwC survey, 86 percent of CFOs representing the sector said that their firms plan safety measures, compared to 77 percent for all business categories. To promote physical distancing, worksite makeovers are a top priority, as well; 77 percent of consumer-market CFOs are planning such steps, 12 percent above the average for all business sectors. And nearly three quarters (73 percent) report that they are considering deferring or canceling capital investment plans.

Long-Term Change

The results of the survey indicate that executives believe long-term change is ahead in the wake of the coronavirus crisis. “The debate is not simply getting back to the way it was done, but also what does it look like going forward,” said Tim Ryan, PwC U.S chair & senior partner, during a call with the media this week.

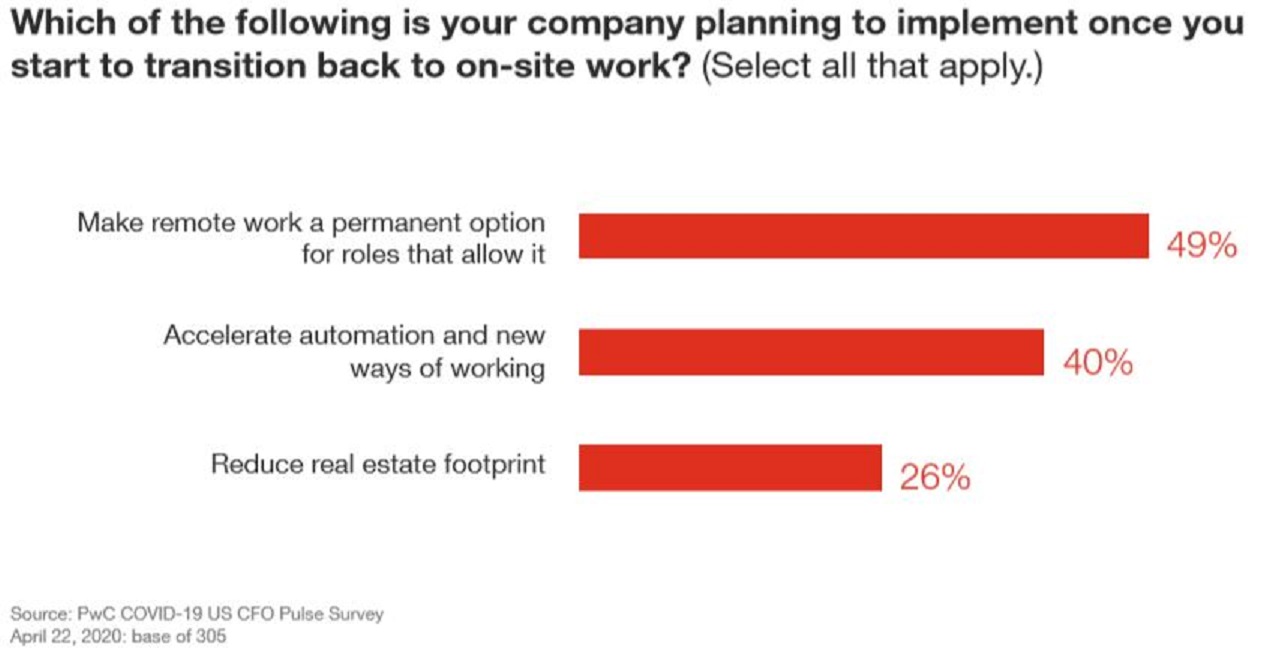

Source: PwC COVID-19 US CFO Pulse Survey April 22, 2020; base of 305

One major theme of the survey is the rapid acceleration of digital transformation across all sectors. From pharmaceutical companies to insurance firms, “The sense of urgency around rapidly accelerating digital change is happening across companies we’re working with, and it is also happening at a level and a pace that we have never seen before,” Ryan noted. And the strategy of working remotely, widely adopted in response to the crisis, may be here to stay. According to the survey, 49 percent of companies are planning to make remote work a permanent option for roles that allow it.

Performance at Risk

Declining revenues and/or profits for 2020 is overwhelmingly expected among respondents (80%), which is comparable to the previous survey conducted two weeks ago. However, the degree of decline varies significantly. CFOs of consumer market companies are projecting a much steeper drop compared to the technology, media, and telecommunications sector and the financial services sector.

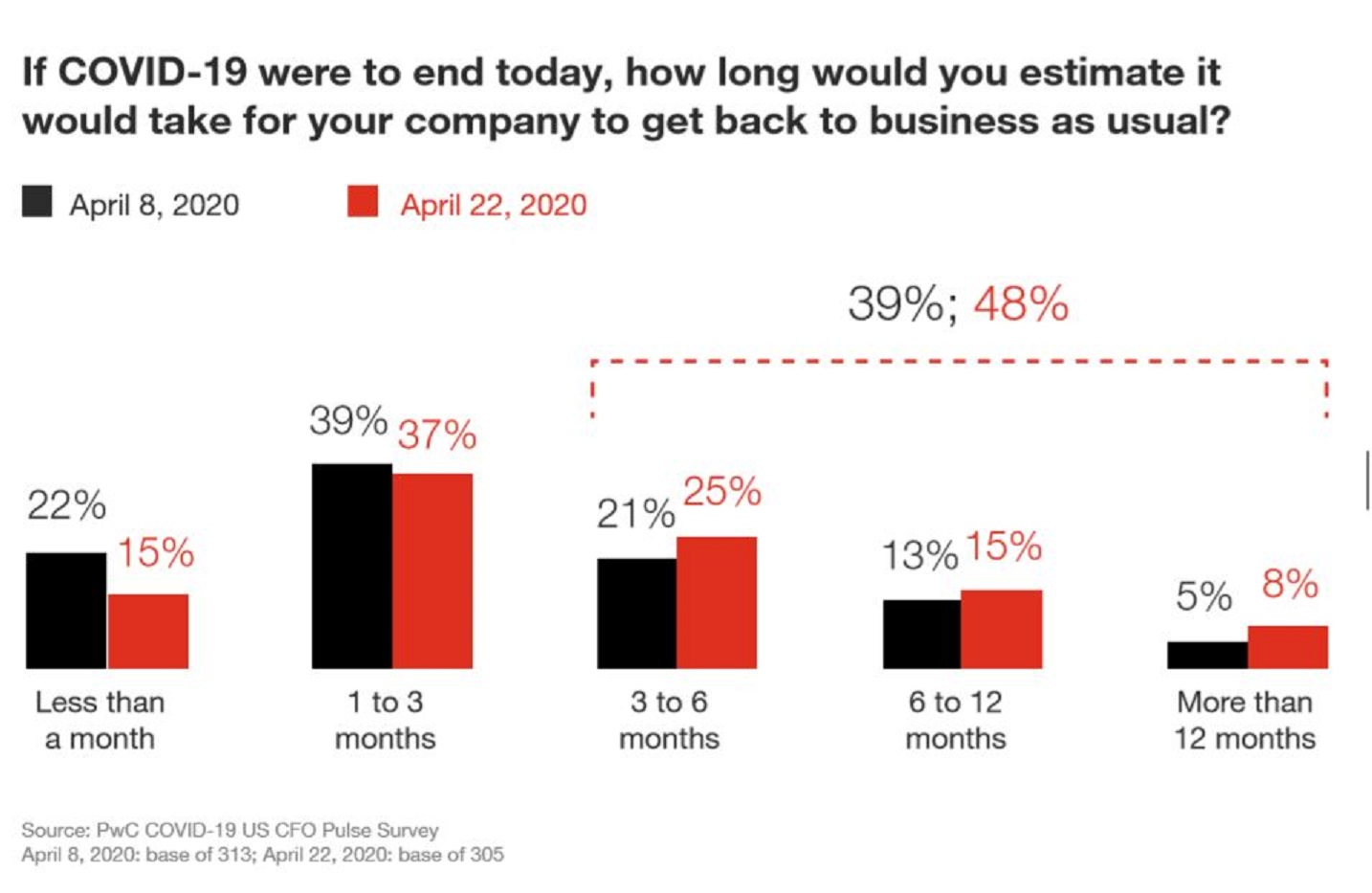

Source: PwC COVID-19 US CFO Pulse Survey April 22, 2020; base of 305

But even with higher confidence among some sectors, the expected lead time for returning to normal after the crisis continues to lengthen. If the COVID crisis were to end today, 52 percent of CFOs said it would take less than three months to come back; that declined from 61 percent in the previous survey. Another 48 percent expect that a return will take at least three months, and within that group, 23 percent expect it will take up to six months to come back.

“This sort of extension of the time to come back (reflects) companies increasingly realizing the significant impact that it will have, in particular, (on) 2020,” said Amity Millhiser, PwC’s vice chair & chief clients officer.

Companies are continuing to adopt cost-cutting measures, but those tactics differ significantly by sector. Overall, 32 percent of CFOs are projecting layoffs to occur in the next month, up 6 percent from two weeks ago. But only 15 percent of financial service company CFOs are projecting layoffs in the next month.

You must be logged in to post a comment.