Coworking Grows in San Diego as Biotech VC Stumbles

The shared office sector is booming in the Southern California city, a new report by CBRE suggests, while venture investment in life sciences retreated during the first quarter.

San Diego is one of the country’s premier biotech hubs, but a single co-working deal exceeded the city’s total VC investment in life sciences during the first quarter, according to a new report by CBRE.

Shared office startup CommonGrounds Workspace landed $100 million in Series A funding in January to fuel its aggressive growth plans, as Southern California’s flexible office sector continues to heat up. By contrast, life science investment in San Diego totaled just $76.2 million in the first quarter, the lowest level in more than four years.

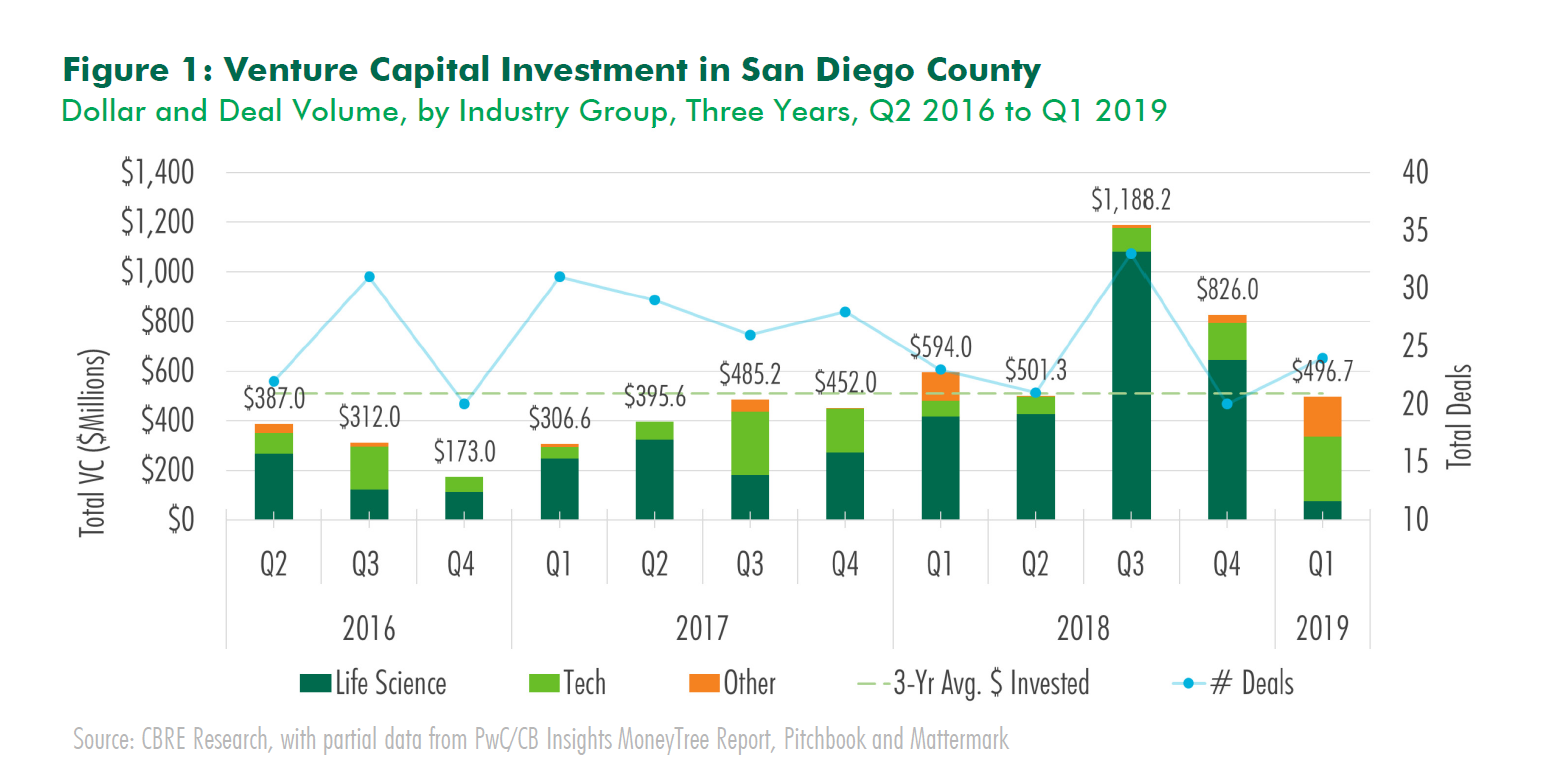

CBRE’s Capital Recap report finds that San Diego companies attracted $496.7 million of total VC investment in the first quarter. Investment in technology firms—including software, web, hardware and services—hit a record high of $259.5 million, which was $115.7 million more than the trailing fourth-quarter average. Other sectors including water purification and transportation also drew significant VC funding.

Still a tech haven

With just under 19 million square feet of lab inventory, San Diego County ranks as the nation’s third-largest biotech center, behind Cambridge, Mass. and the San Francisco Bay Area, according to Cushman & Wakefield. Illumina, TSRI, Pfizer and Celgene are among the top life science employers in the county.

Several venture-backed life science firms recently went public or announced plans to do so later in the year, which may account for the steep drop in VC funding to the sector in the first quarter, CBRE noted.

Quarterly funding fluctuations aside, San Diego remains an attractive place for startups to do business, in part because it’s cheaper than Silicon Valley. San Francisco-based self-driving startup Comma.ai announced that it will be moving south to San Diego, citing a 42 percent lower cost of living compared to the city’s Bay Area rival. San Francisco office rents were also making it hard for the company to expand.

Shared office boom

San Diego’s thriving tech scene has driven a surge in coworking spaces, catering both to startups and to larger companies looking for more flexible, affordable real estate. The city is one of America’s top 20 coworking markets, with 50 shared office locations totaling more than 965,000 square feet of space, according to a December 2018 report by Yardi Matrix.

WeWork, Spaces and BioLabs are among the big players in the growing sector. BioLabs, which specializes in hosting life science startups, last October opened its second San Diego location, a 27,000-square-foot expansion space in the University Towne Centre area.

In January, Cross Campus built on its network of five coworking centers in the Los Angeles area by snapping up DeskHub, which has one shared office location in San Diego’s Little Italy neighborhood and another in Arizona.

Founded in 2016, CommonGrounds currently has five spaces open across three states, one in its home base of Carlsbad, a San Diego suburb. The startup plans to use its fresh financing to open between 20 and 30 new locations, as part of a 2-million-square-foot, 50-site buildout over the next 24 months.

You must be logged in to post a comment.