Cracks Show in Port Industrial Markets

Despite healthy container volumes, areas such as the Inland Empire and Seattle have their share of uphill battles.

While still strong, industrial real estate markets near major U.S. ports have recently recorded cooling demand, along with rising vacancy rates and sluggish rent growth, or even rent contractions.

In that, the port markets are much like the broader American industrial market in the post-pandemic era, though port markets have extra factors to worry about—wild cards, in some respects—such as the potential for supply-chain disruptions, geopolitical tumult such the attacks on shipping in the Red Sea, and labor challenges.

“A couple of things are going on, especially at the larger port markets,” Jason Price, Cushman & Wakefield’s head of logistics for the Americas and for industrial research, told Commercial Property Executive. “Those markets saw some of the most substantial increasing in prices until early ’23. Now they’re the first to see rental rate declines, especially Southern California, where rents really skyrocketed, and were pretty much among the highest in the nation.”

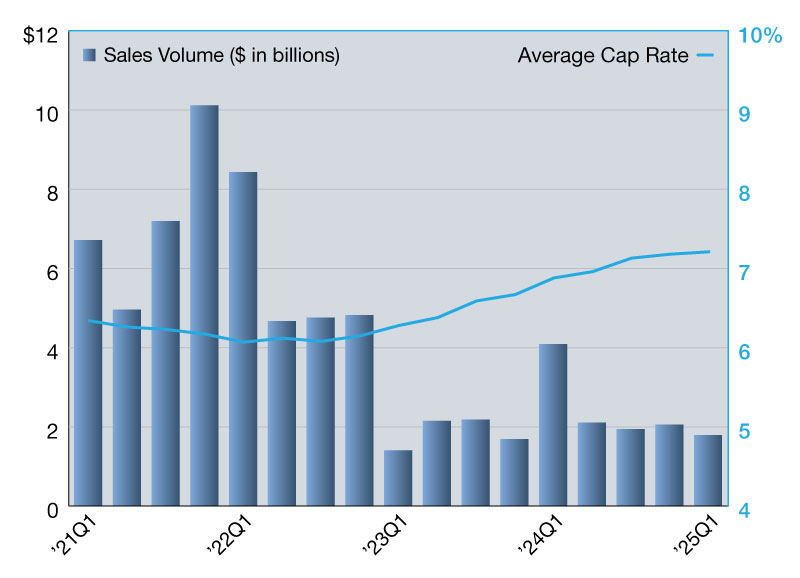

In the wake of a historic industrial boom

As the pandemic waned in 2021 and ’22 and imports boomed, logistics companies and other users ramped up their industrial capacity in hopes of needing that in the future, Price added. That was especially the case in port markets, as healthy consumer demand (“revenge spending”) spurred imports to record levels. In many markets, the pipeline and industrial completions followed.

“But now, with more normalized import totals, we’re finding that some of these occupiers are not needing that space, so they’ve been putting some of it on the market,” Price also said.

During the first quarter of 2024, the largest U.S. port industrial markets recorded 436,000 square feet of negative absorption, compared with 13.3 million square feet of positive absorption the same quarter a year earlier, according to Cushman & Wakefield data. Vacancy rates have been edging up slowly in recent quarters for those markets, coming in at 5.5 percent in this year’s first quarter, or roughly comparable to all U.S. industrial markets, whose first-quarter vacancy average was 5.7 percent.

Goods still flowing through U.S. ports

Though demand for port industrial space is down, that isn’t the case for the volume of goods flowing through U.S. ports. The first-quarter TEU (20-foot equivalent units) volume to U.S. ports was 11.4 million, the highest since the third quarter of 2022, Cushman & Wakefield reported.

That dynamic—higher shipment volume but lower demand for industrial space—seems counterintuitive, but Price pointed out that tenant inventory management is becoming more efficient, which enables doing more with less to cut costs amid today’s high-rent environment.

READ ALSO: Mastering Supply Chain Challenges

Though port-market industrial is still relatively healthy, various exogenous shocks will continue to impact global container shipping even as the worst of the pandemic-era shocks fade, according to Brian Marks, a senior lecturer in the Economics and Business Analytics Department at the University of New Haven, and a logistics expert. One looming possibility later this year is the possibility of a strike impacting East Coast ports.

“You also have issues in the Middle East severely impacting shipping transit time, and a weather issue, a drought, impacting the Panama Canal,” Marks added. “The shocks have increased not only transit time, but also costs.”

One way for shippers to deal with higher costs is to continue their drive to use space more efficiently, which could pose a continued headwind for absorption of port-market industrial space.

Who’s winning next?

Another open question for U.S. port markets is whether East or West Coast ports will have the relative advantage as international shipping and manufacturing patterns change. The ports of Southern California are still by far the largest in terms of volume, Newmark Managing Director, National Industrial Research, Lisa DeNight pointed out, and even as manufacturing shifts from China to other east Asian nations, that part of the country will maintain its connections across the Pacific.

Southern California industrial markets aren’t the only ones that will benefit from the steady flow from east Asia to the U.S., however, DeNight said.

“There has been a clear connection between that hyperinflationary rent growth in Southern California and an ascendancy of these more attractively priced but very easily accessible inland intermodal hubs in the Southwest, such as Salt Lake City, Las Vegas and Phoenix,” DeNight said.

READ ALSO: Extreme Weather and Industrial Resiliency

Even so, East Coast port markets are poised for long-term growth as well for different reasons, she noted. One is the diversification of sources for manufactured goods, and the U.S. ports to which they go. Businesses learned all too well during the pandemic that putting all of one’s logistics eggs in one basket is a recipe for trouble. More goods from south Asia or even Africa will mean more shipments to East Coast ports, especially the Southeast.

Also, the growth of U.S. manufacturing in the Midwest and Southeast will support port growth in those regions, as those operations need imported parts and ports from which to export their goods.

“The ecosystem that’s emerging in the Southeast and Midwest favors both kinds of an import and export emphasis on Southeast ports,” DeNight said. “But I’m also bullish New York and New Jersey as a safe shore for industrial investment in particular, because of the extreme supply constraints there.”

You must be logged in to post a comment.