CRE CLOs Go From Surging to Sluggish

The market was predicted to have another record-breaking year before the pandemic put a stop to it.

The commercial real estate collateralized loan obligations market was headed for another record year with perhaps as much as $25 billion in issuance before the COVID-19 crisis forced business shutdowns. Now, as the commercial real estate financial world slowly comes back to life, CLOs are expected to recover more gradually than other vehicles.

Four CRE CLOs totaling $3.4 billion were issued in the first quarter of 2020, with Blackstone Mortgage pricing the largest one to date at $1.5 billion. Arbor Realty had the second-largest issuance at $800 million, followed by Bridge Investment Group at $550 million and Exantas Capital Corp. which priced its $522.6 million CRE CLO on March 2, according to “Commercial Mortgage Alert.”

CRE CLO issuance for the remainder of the year will depend on how well the overall economy recovers during the COVID-19 period, according to Catherine Liu, associate manager at Trepp.

“It’s especially dependent on when investors are confident enough to give borrowers additional leverage,” Liu said. “CRE CLOs are riskier and typically carry more leverage than CMBS. The expectation is they will recover more slowly than traditional CMBS loans. If issuance is 30 or 40 percent of last year’s total, that would be a high number.”

There were a number of deals in the pipeline before the pandemic forced the market shutdown. The year-to-date CRE CLO issuance of $3.4 billion through the first quarter of 2020 was slightly behind issuance in Q1 2019 and comprises only about 18 percent of last year’s total issuance of $19.2 billion.

“One could imagine those platforms are watching the market very closely,” said Missy Dolski, head of North America capital markets at Värde Partners. “But with new originations at pretty low levels currently, it’s hard to imagine them getting to enough scale for an issuance, not to mention whether the clearing levels would be such that it would be accretive.”

Investors have been watching the corporate bond and CMBS markets for signs of life. “For the securitized market to start ramping up, the corporate bond market has to be healthy,” said Shlomi Ronen, managing principal & founder of Dekel Capital. “If that is healthy, all the CMBS will start first and then we’ll start seeing some CLO issuance.”

But Ronen recalled lessons from the 2008-2009 financial crisis. “The last time we came out of (financial crisis) it didn’t happen overnight. It will take a little bit of time for the markets to get back to what it was pre-pandemic,” Ronen said.

There is always a possibility some CRE CLOs, especially those that were in the pipeline, could be completed this year. “There are loans and transactions that were originated with at least somewhat of an intent to securitize them,” said Nitin Bhasin, senior managing director & co-head of commercial real estate securitizations at Kroll Bond Ratings Agency. “It may be an exit folks are still looking at.”

But, he added, “In terms of post-COVID-19 new loans, new originations might take much longer until the market starts to function again.”

Federal government intervention has helped the agency business, with Fannie Mae, Freddie Mac and high-grade bonds trading almost at pre-coronavirus levels.

“Going forward it’s not clear when the commercial real estate CLO markets will be fully functioning again,” said Joseph Iacono, CEO & managing partner at Crescit Capital Strategies. “One of the biggest issues driving the junior bonds is that people need to get a handle on defaults.”

Default Management

Manager responses to defaults will vary, Dolski noted. Factors include whether or not there’s enough liquidity to buy out a loan and make future fundings and whether or not another loan can be bought with proceeds if it’s a managed deal.

“Given sponsors hold a significant first loss position in all these transactions, the way servicers and sponsors address loan workouts will be important so that the CLO vehicles fully repay the issued bonds,” Dolski added.

There is a lot of incentive for managers to buy out or replace loans before defaults occur, said Deryk Meherik, senior vice president at Moody’s Investors Service, noting managers hold 15-plus transactions on average.

“Given the number of acquisition financings with hard cash equity in the collateral pool, there is an incentive not to walk away. That, along with the managers holding on to a material amount in the transaction, act as incentives to keep defaults as low as possible,” said Meherik.

Moody’s is talking to managers continually about various options, including modifying loans using a portion of future funding originally earmarked for soft costs to cover debt service.

“They’re trying to be creative to avoid defaults in the pool,” said Jocelyn Delifer, Moody’s vice president & senior analyst. “Buying out a loan at risk of default is an option if they have the ability to do it and the liquidity. In normal times, they typically do. I think right now it depends on the liquidity those lenders have.”.

Sectors Hit Hardest

There will likely be issues relating to all property types, although multifamily may be affected least and hotels and retail the most.

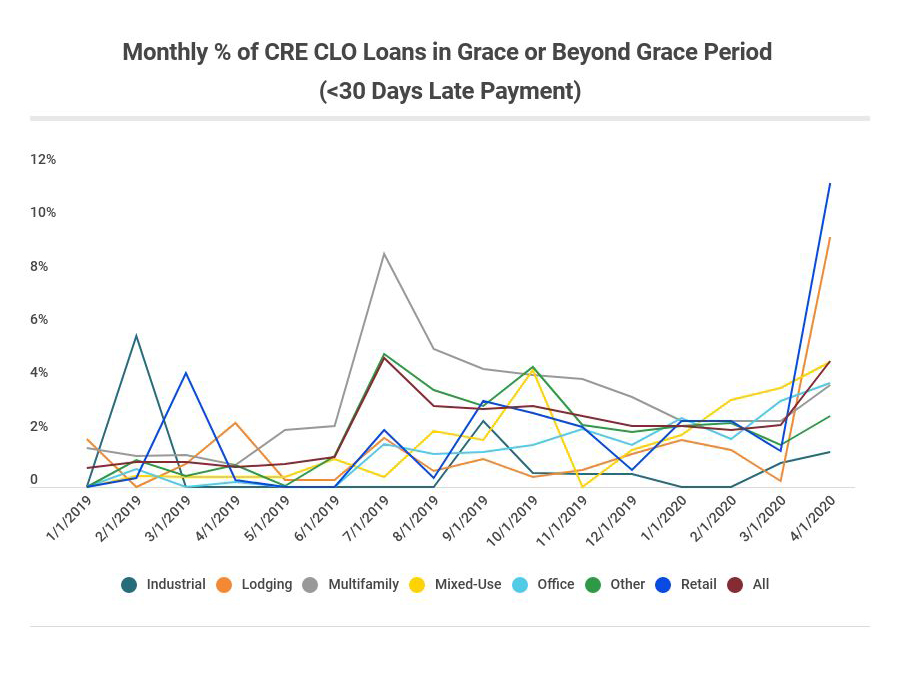

Trepp started seeing spikes in missed April payments for lodging and retail sector loans contained in CRE CLOs, putting them in the grace period or beyond the grace period. The April monthly payment for about 9.4 percent of lodging loans and 11.4 percent for retail loans were not made on time, which puts them in the grace or beyond-grace category, she said.

“In the coming months, we will start seeing the stress being reflected in the actual delinquency rate,” Liu said.

The office sector may lag a bit as tenants reevaluate space needs, some companies go out of business and many keep employees working at home until they establish social distancing protocols for in-office work.

No matter the sector, however, CRE CLOs are transitional assets that have loans based on successful executions of business plans, such as renovations, which lead to higher rents.

“Those business plans, many of them are based on market dynamics, trends and occupancies that were achievable before COVID hit. Those dynamics have changed,” Bhasin said.

Multifamily loans, on the other hand, are considered by many to be least likely to default. In September 2019, Greystone closed on its third CRE CLO, a $600 million CLO backed by bridge loans on primarily multifamily properties. The initial collateral pool consisted of 24 loans totaling $492.1 million that Greystone originated, secured by mortgages on 24 properties in nine states.

“Over our 30-year history as a multifamily lender, we have seen that monthly apartment rents and mortgage payments are typically prioritized by individual (along with food and utilities),” said Jeffrey Baevsky, executive managing director of corporate finance and capital market finance. “The government’s (first) $3 trillion stimulus package and generous unemployment benefits will further help support workforce housing rent payments over the short term. The outlook for recovery in this sector is also more assured.”

If there are any issues with multifamily CRE CLO defaults, Meherik noted, they likely wouldn’t surface before the end of summer, given the current forecast of government support.

While multifamily is seen as the least volatile of the core CRE assets, hotels are among the non-core assets with the most volatility. But hospitality assets are typically a much smaller percentage of CRE CLO loan pools, and some deals have no hotels. Mall retail is not typically found in CRE CLOs, and, if they are contained in an asset pool, they would be mostly strip centers and grocery-anchored neighborhood centers.

But requests for relief on loans, including forbearance and lease modifications are coming from all over commercial real estate. “There are increasingly requests from other property types as well, implying this environment is impacting every property type,” said Dolski.

Värde Partners, a global alternative investment firm, closed a $627.5 million CRE CLO in October—it’s third and largest to date. The asset pool consisted of 24 floating-rate mortgages secured by 47 properties and comprised 59.5 percent office, 21.5 percent multifamily, 6.5 percent hospitality, 6.4 percent mixed use and 6.1 percent retail.

Static vs. Managed

The Greystone CRE CLO issued in September has a three-year active management period, while the Värde Partners CRE CLO is static. Static structures provide no means to reinvest principal proceeds, so when a loan prepays or pays off at maturity, those proceeds go to pay down the bond and there is no ability to acquire new assets.

Managed CRE CLOs typically have a reinvestment period of two to three years, during which the collateral manager can use principal proceeds to acquire previously unidentified loans. A lightly managed structure allows principal proceeds to be used only to acquire companion participations of loans already existing within the transactions.

Does a managed structure for the CRE CLO have an advantage over a static structure during a crisis? “It will allow more flexibility for the issue to put in collateral in the transactions or take collateral out of the transactions as needed to manage the CLO versus static,” he said.

Future of CRE CLO Deals

The sizes of CLOs in 2019 and in early 2020 have been increasing. In fact, deal size has risen rapidly in recent years. Average deal size in 2016 was about $351 million. In 2017, there was one $1 billion transaction, and in 2018 three deals totaled $1 billion or more. Last year, there were at least three $1 billion-plus deals and five sponsors had two issuances each in 2019 that brought their totals for the year to over $1 billion each.

Bhasin calls it a natural progression as the market established itself and investors got more comfortable with the product and had a greater appetite for the structure.

“More issuers entered the market because it was a more efficient market and larger market as a result of the larger deals,” he said.

The future of CLOs, however, is cloudy. “The primary short-term challenge is how CRE CLO issuers handle loans in distress and requests for modifications within the structure of the CRE CLO,” Baevsky said. “In the long term, the challenge will be to see how the deals perform for issuers/bondholders and whether the structural protections were too tight or not tight enough.”

You must be logged in to post a comment.