CRE Execs Weigh In on Smart Contracts

A new survey by Savoy Stewart of more than 500 commercial real estate professionals outlines both proptech’s advantages and barriers to its wider adoption.

Commercial real estate professionals see various advantages to the use of smart contracts in this industry, including greater speed and efficiency of executing transactions, according to a new survey by Savoy Stewart, of London. On the other hand, several barriers are seen as impeding the adoption of smart contracts, such as a lack of knowledge and concerns over regulation and taxation of smart contract transactions.

Enabled by blockchain technology, a smart contract is essentially computer code that can both self-execute and self-enforce the terms and conditions of a legal agreement. And because of blockchain’s decentralized nature, a smart contract can bypass expensive middlemen, such as financial institutions and lawyers.

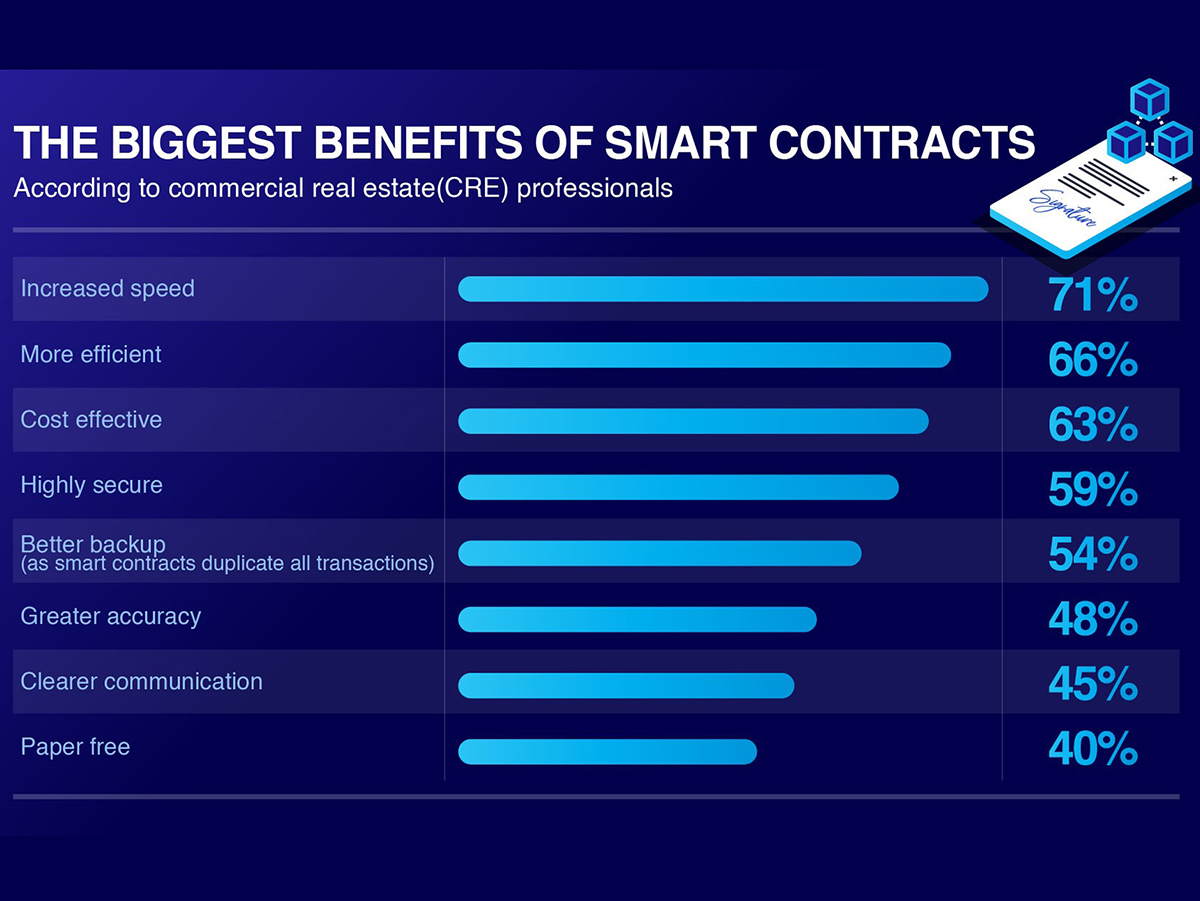

In CRE transactions involving multiple intermediaries such as brokers, banks and lawyers, a smart contract can take over some or all these functions. As a result, 66 percent of survey participants believe this will enable a transaction to be more efficient. And with a decreased role—or none—for middlemen, 63 percent of respondents said they expect that both buyer and seller could save substantial money. Savoy Stewart surveyed 544 commercial real estate professionals—238 in the U.S. and 306 in the U.K. The inquiry found that 71 percent of the respondents view increased speed as the biggest benefit of using smart contracts because they run as software, so they don’t require documents to be processed manually.

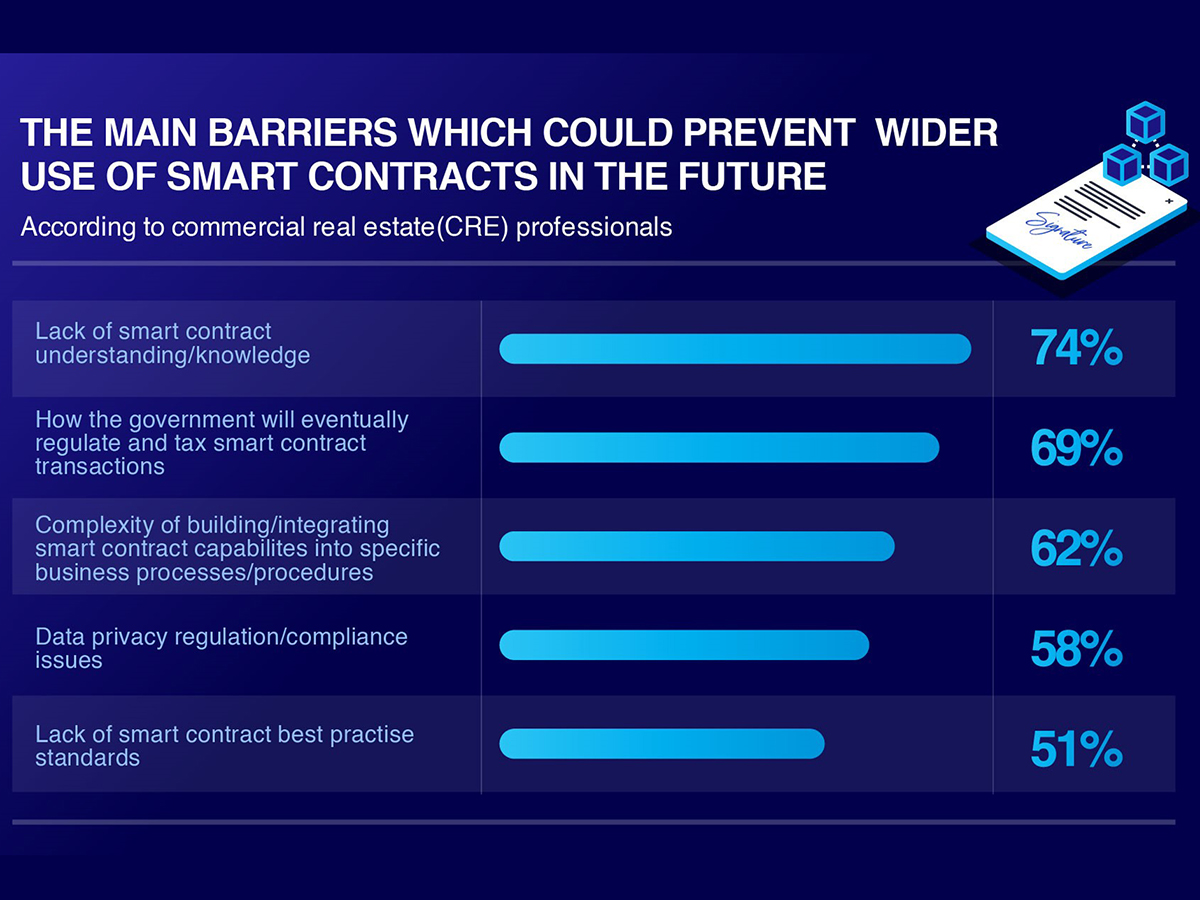

As to the main perceived barriers preventing much wider use of smart contracts, 74 percent of those surveyed cited a lack of knowledge about such contracts. Interestingly, 58 percent believe that data privacy compliance might be a challenging issue. Because details stored on a smart contract stay forever, this could breach certain data privacy regulations.

An evolving technology

“Smart contracts are only in their infancy, but they have huge potential to make a real game-changing impact in the commercial real estate industry,” Savoy Stewart Managing Director Darren Best commented in the survey. “As the understanding of their functionality as well as applications to different commercial real estate processes/procedures improves, they could over time gradually phase out standard paper-based contracts.”

Kris Ferranti and Christiana Modesti of Shearman & Sterling explained that CRE equity tokenization is a potential way of enhancing CRE’s liquidity vis-a-vis other asset classes. They cautioned, however, that certain covenants and obligations typically found in the governing documents of the issuing entity cannot with any practical effect be encoded on a blockchain and enforced through smart contract technology. The reason, Ferranti and Modesti disclosed, is that while the technology can monitor compliance of objective conditions constituting a breach of covenants and obligations, it can’t yet do so with respect to subjective conditions.

You must be logged in to post a comment.