CRE Foreign Investment Update

Cross-border commercial real estate investors in the U.S. are getting more selective amid a decline in commercial real estate deal activity.

Foreign investment in U.S. commercial real estate has taken a hit amid the COVID-19 crisis, but deals continue at a slower pace, as selective and experienced investors bank on promising assets from industrial facilities to life sciences properties.

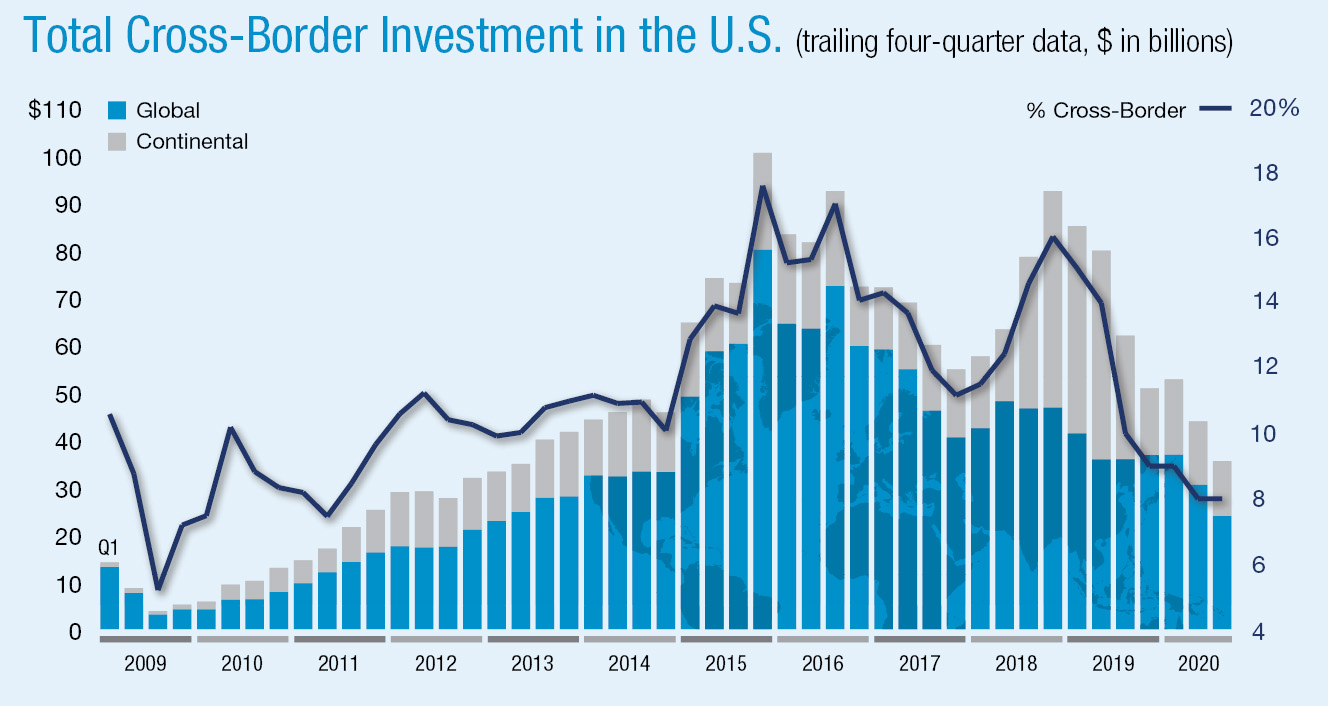

Cross-border acquisitions reached $3.5 billion in the third quarter of 2020, down 71 percent year-on-year, according to figures from Real Capital Analytics. Overseas investors sold slightly more than they bought—just $53 million, as the pace of dispositions dropped sharply from the same period in 2019.

READ ALSO: CRE Investment Posts Stronger Q3: CBRE

Saudi Arabia-based Sidra Capital ramped up its pursuit of life sciences assets, such as Arborcrest Corporate Campus near Philadelphia, due to demographic changes and the challenges created by the COVID-19 pandemic, according to a statement by company Chairman Hani Baothman. Image courtesy of Spear Street

Despite the annual plunge, acquisitions were still far above the low watermark of $501 million seen in the second quarter of 2009, amid the global financial crisis. “This recession is different in that it’s a demand shock,” explained Jim Costello, senior vice president at RCA. “You don’t have that same kind of collapse that happened when good properties just couldn’t get financed.”

Liquidity for the market is lowest in the category of deals priced at $50 million and over, he added, which happens to be the space where cross-border players are most active. “If I’m an owner of a high-quality office tower in Manhattan, I don’t want to take a loss on that investment,” even if it’s currently sitting empty, he said. “But if I’m a buyer, I look at the building and say, ‘Nobody’s coming into the building, those leases are in place, but I want a huge discount to cover my risk that maybe nobody comes back.’”

Pandemic-related travel restrictions are also jamming up the mechanics of the market, preventing many executives from visiting properties or clients in a timely manner. One New York-based capital markets broker said that investors from South Korea and Japan remain hungry for commercial real estate in the U.S., but quarantine requirements for international travelers are keeping many of them at home. The executive added that for many of these firms, the president, CEO or chairman needs to visit the asset in person before the deal can be done.

Singapore’s CapitaLand, which reported high occupancy at its existing multifamily portfolio in the U.S., launched a new venture in December to build apartments with an Austin, Texas-based partner, starting with a 341-unit suburban project. Rendering courtesy of CapitaLand

Asia remains active

The COVID-19 outbreak, however, didn’t stop the National Pension Service of Korea—the world’s third largest pension fund—from joining Hines to purchase a 49.5 percent stake in SL Green’s One Madison Avenue office development in Manhattan for $492 million this past April. As is often the case, the deal was facilitated by an existing partnership; the pension giant had previously teamed up with Hines to take equity stakes in SL Green’s One Vanderbilt skyscraper, which opened in September.

The National Pension Service of Korea teamed up with Hines Interest LP again in May to purchase a nearly 50 percent stake in One Madison Avenue, a $2.3 billion adaptive reuse office project that will span 1.4 million rentable square feet in Midtown Manhattan. Rendering courtesy of SL Green

Singapore-based CapitaLand, the largest developer in Southeast Asia, is also widening its U.S. footprint. In December, the company formed a $300 million joint venture with an Austin, Texas-based real estate firm to acquire and develop multifamily assets in the Southeast and Southwest U.S., starting with a future apartment project in Austin. The deal built upon CapitaLand’s landmark acquisition of a suburban apartment portfolio from Starwood Capital Group in 2018.

The real estate behemoth is also raising its profile in the U.S. office sector through Ascendas Real Estate Investment Trust, which picked up two San Francisco office buildings leased to Stripe and Pinterest for a total of $560.2 million in November. All told, Asia accounted for some $800 million in U.S. acquisitions in the third quarter, behind only Canada, which invested $1.2 billion, according to RCA.

Selective players

The Middle East remains an important source of capital for the U.S. market, although according to RCA data, acquisitions totaled just $258 million in the third quarter, dropping 75 percent year-on-year. Bahrain-headquartered Investcorp has been the leading buyer from the region over the past three quarters, notching deals such as the acquisition of a 3.5 million-square-foot industrial portfolio across four markets for $280 million in October.

Saudi Arabia-based Sidra Capital provided another demonstration of the region’s strength by acquiring a 90 percent stake in Arborcrest Corporate Campus, a five-building suburban office campus with major life sciences and biotech tenancy in suburban Philadelphia. Through the $225 million recapitalization deal, which closed in early December, Speer Street Capital retained a 10 percent ownership in the 855,600-square-foot asset.

Based on independent reports of properties and portfolios $2.5 million and greater. Data believed to be accurate but not guaranteed. All data and statistics are the sole intellectual property of Real Capital Analytics Inc., and no sale, transfer, sub-license, distribution or commercial exploitation of the data is permitted without the express permission of RCA. Source: Real Capital Analytics Inc.

JLL Managing Director Claudio Sgobba, who led the transaction, noted that investors from the Gulf Cooperation Council—a group of oil- and gas-producing states in the Persian Gulf—prefer local partnerships in the U.S., including recapitalization deals.

“They like boots on the ground that will co-invest in their deal,” he said, meaning a partner with a track record of managing the asset class. Lenders typically require GCC investors to have a U.S. carve-out guarantor on financing requests above a 50 percent loan-to-value ratio. “It’s a lender requirement to have a U.S. entity or partner to be liable if acts of fraud are committed,” he said. “And that needs to be an entity that has a specific net worth and liquidity assigned to it.”

Beyond life sciences properties, Gulf investors are highly attracted to logistics and industrial real estate anchored by longstanding middle-market tenants, as well as office buildings. But there are two major caveats. For many buyers from Saudi Arabia, investments need to be Sharia-compliant or in accordance with Islamic law. “It’s what they call ethical investments,” Sgobba said. “So they can’t invest in an asset where a tenant is in banking or in the insurance business.”

Properties associated with gambling or with the manufacture or distribution of pork are also off-limits, he added. Another issue is that almost all Gulf syndicators need to achieve a leveraged return north of 7 percent in the U.S. to exceed typical returns achieved back home. That high-yield requirement essentially rules out shiny core assets like trophy office buildings.

You must be logged in to post a comment.