CRE Improves Slowly but Steadily in SIOR Update

The Society of Industrial and Office Realtors’ latest survey indicates confidence in the market’s prospects among the organization’s members.

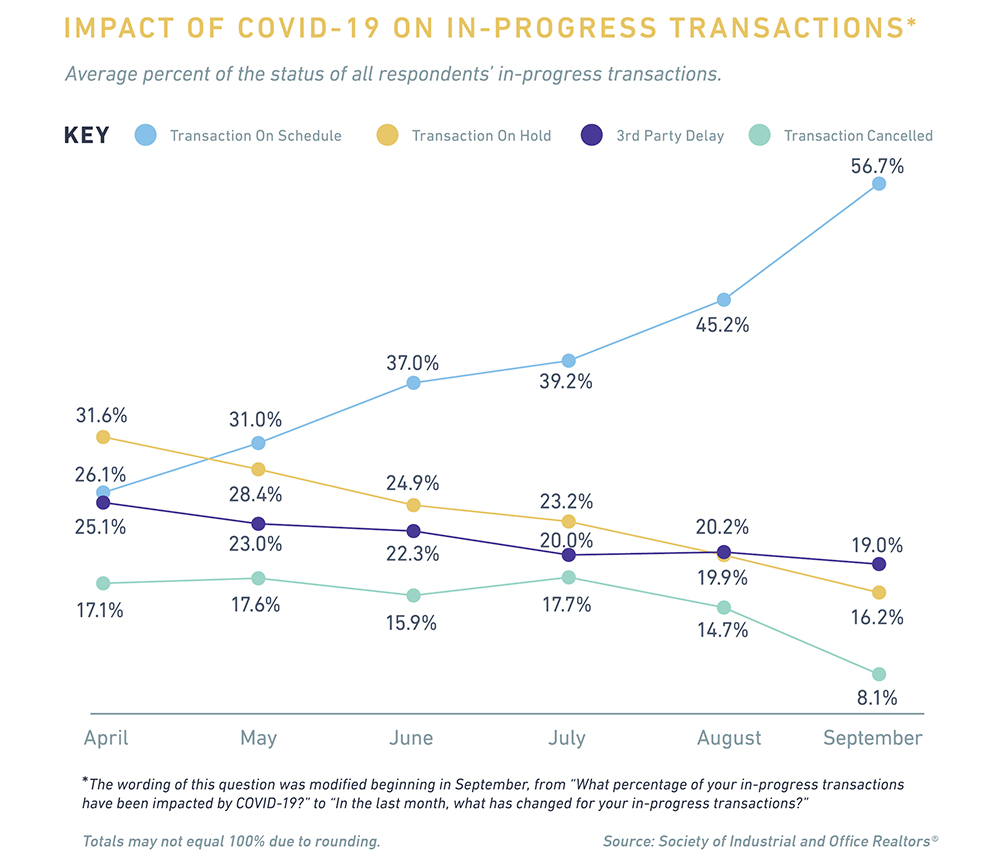

On-time transactions for the industrial and office sectors have more doubled since the onset of the pandemic while confidence in the market has held steady, according to The Society of Industrial and Office Realtors’ September survey.

READ ALSO: SIOR: More CRE Transactions Stay on Schedule

SIOR continues to monitor the impact of COVID-19 on the commercial real estate market through its monthly Snapshot Sentiment Survey, and the association’s September study indicates that the market is clearly on a trajectory toward improvement.

The numbers tell the story. On-time office transactions in September increased to 46.4 percent of all deals in the sector from 36 percent in August and just 22 percent in April. In the industrial sector, on-schedule transactions jumped to 61.1 percent from 49.7 percent in August and 28.9 percent in April. Additionally, canceled transactions in the office and industrial sectors dropped month-over-month from a respective 18.8 and 13.2 percent, to 11.5 and 6.7 percent, which also bodes well for the commercial real estate’s future.

SIOR launched the Snapshot Sentiment Survey in April 2020, the first full month of the pandemic in the U.S. The September report is based on the views of the 8.2 percent of SIOR’s approximately 3,400 designees and member associates who responded to queries regarding transactions and confidence in the market. With a full six months of observations on which to reflect, SIOR has surmised that the market is on a slow but steady upswing.

“The news cycle is not every day anymore; rather than minutes and hours, it’s stretched out to weeks and months so there’s a little bit more information out there for brokers to be able to react to,” Mark Duclos, global president of SIOR & co-founder of Sentry Commercial, told Commercial Property Executive.

Trust in the market

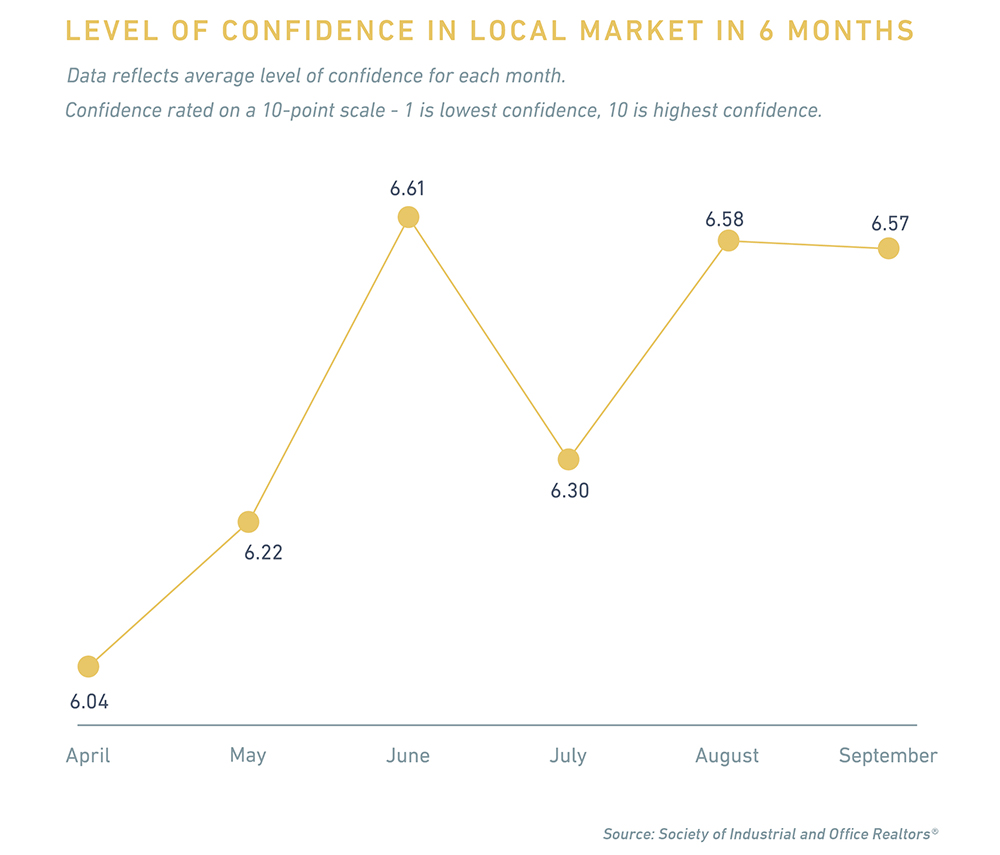

Despite swirling uncertainties due to the pandemic, SIOR members continue to have high hopes for commercial real estate’s performance in the upcoming quarters. According to the results of the September survey, brokers’ level of confidence in the local market held steady for the most part, declining ever-so-slightly on the 10-point scale from 6.58 in August to 6.57 in September.

“What we find to be interesting is the last three months of the overall sentiment survey rating essentially shows that there is a stability in the brokerages, and they’re learning how to navigate this world and are finding a little bit more stability in the way they approach it,” said Duclos.

At the sector level, overall broker confidence was 6.9 for industrial and 6.0 for office. “While office sentiment is still below the industrial sentiment—and that’s understandable—it has held up in the last few months and we’re surprised and pleased to see that,” Duclos noted.

Mark Duclos, Global President of SIOR & Co-founder of Sentry Commercial. Image courtesy of The Society of Industrial and Office Realtors

Regionally, the survey yielded less desirable news for the office sector in the Northeast region, where brokers reported the lowest confidence—a mere 4.8 on the 10-point scale. SIOR speculates that New York City’s particularly arduous challenges with COVID-19 could have had a negative impact on the overall sentiment in the Northeast. However, other factors can play a role in regional discrepancies as well.

“The regions’ sentiment is sometimes driven by the industries within those regions,” Duclos added. “All regions have different industries and that may affect your sentiment positively or negatively.”

Read the full SIOR report.

You must be logged in to post a comment.