CRE Lending Markets Continue Recovery: CBRE

A strong volume for commercial loan closings in the second quarter was fueled by alternative lenders, banks and life companies.

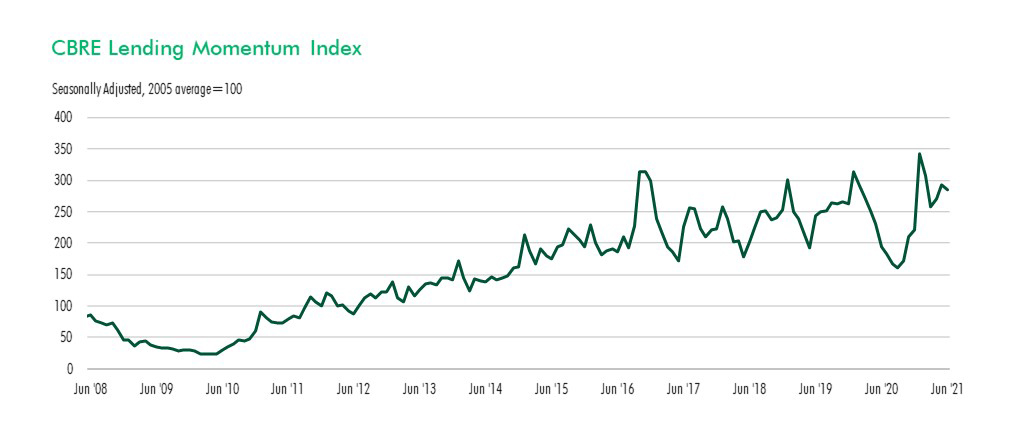

Commercial real estate lending increased 10.8 percent in the second quarter from the first quarter and neared the February 2020 pre-pandemic close, according to the latest CBRE Lending Momentum Index.

READ ALSO: Opportunities, Risks in Today’s Commercial Mortgage Financing

The CBRE Lending Momentum Index tracks loans originated or brokered by CBRE Capital Markets. The index has a base value of 100, which represents average activity for 2005.

The report states the lending markets figures, which remained strong at the midyear point, mirror the wider economic recovery in the U.S. Compared with a year ago, when lending activity fell sharply due to the COVID-19 pandemic, the index is up by 47.3 percent. The index reached 286 in June, compared to a pandemic-era low of 160 in September 2020.

Lending Momentum Continues to Improve. Chart courtesy of CBRE Capital Markets and CBRE Research, Q2 2021

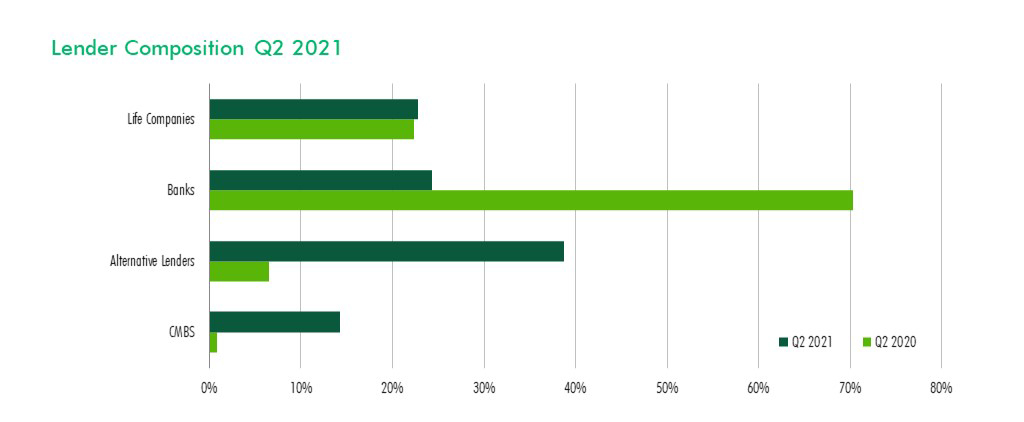

The report notes growing risk appetite by borrowers has fueled demand for transitional financing, such as bridge loans, leading to increased lending by alternative lenders including debt funds, pension funds and credit companies. The alternative lenders led the second-quarter non-agency commercial mortgage origination activity accounting for almost 39 percent of all loan closings. That’s compared to 30.6 percent in the first quarter and 6.5 percent in the second quarter of 2020 during the height of the pandemic lockdown. Bridge financing to help borrowers stabilize properties accounted for 80 percent of the alternative lender closings in the second quarter.

Brian Stoffers, global president of debt & structured finance for capital markets at CBRE, said in a prepared statement that regional banks and life companies also provided competitive quotes, while CMBS loan origination activity improved.

Banks accounted for 24.3 percent of total loan volume in the second quarter, dropping from their leading rank in the first quarter of the year. Regional and community banks were the most active and construction loans accounted for 46 percent of bank volume lending for the quarter, driven mostly by increases in industrial and multifamily development.

Life companies accounted for 22.7 percent of the commercial mortgage originations in the second quarter, up from 19.2 percent in the first quarter of 2021. The life companies issued competitive quotes on fixed and selective floating-rate multifamily mortgages. Despite some concerns about mortgage allocations for the second half of the year, CBRE notes life company loans under application have been strong in recent weeks.

Alternative Lenders Top Q2 Closings. Chart courtesy of CBRE Capital Markets and CBRE Research, Q2 2021. Reflects non-agency commercial/multifamily loans

CMBS lenders originated 14.3 percent of commercial mortgages in the second quarter of 2021, up from 11 percent from the first quarter. CMBS issuance totaled $45.7 billion year-to-date through June, up from $30 billion for the same period in 2020. CBRE notes the single-asset, single-borrower market has been particularly active in recent months, offering efficient financing for larger deals and portfolios.

Underwriting and terms

CBRE stated loan underwriting for the second quarter was generally consistent with the first quarter but did note the percentage of loans carrying full or partial interest-only terms fell for the second-consecutive quarter, which reflected a higher share of amortizing non-agency loans. The second quarter percentage fell to 54.2 percent from 60.6 percent in the first quarter. The average for the past two years is 63 percent. The percentage of full-term interest-only loans increased to 19.8 percent in the second quarter from 17.4 percent in the first quarter. The average for the past two years is 22.4 percent.

The spread on commercial mortgage loans averaged 218 basis points in the second quarter, down from 244 basis points in the first quarter. Compared to last year at the same time, the spreads are 26 basis points tighter. CBRE reported commercial spreads peaked at 290 basis points in the third quarter of 2020. Since that time, spreads on seven- to 10-year, 55 percent to 65 percent loan-to-value permanent loans have continued to tighten.

Commercial LTVs averaged 58.6 percent in the second quarter, down 70 basis points from the first quarter and 2.3 percentage points higher than a year ago.

Read the full report by CBRE.

You must be logged in to post a comment.