CRE Prices Are Stabilizing

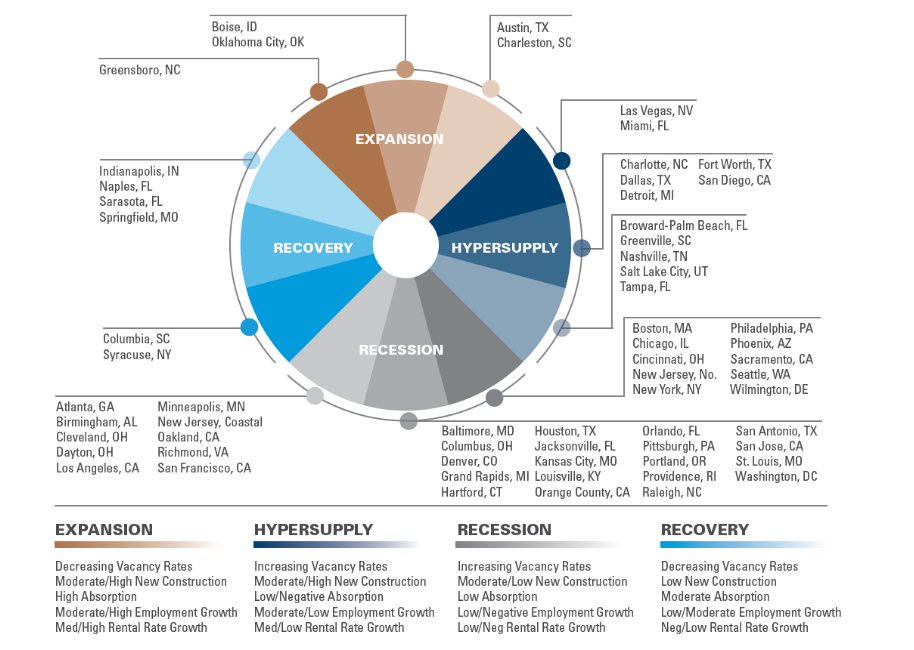

A modest-but-broad increase in property values is also emerging, according to Integra Realty Resources’ latest report.

The commercial real estate sector remains for the most part resilient and adaptable, as evidenced by a growing stability in property prices, according to Integra Realty Resources’ 2024 midyear report.

Office market trends

While the office sector continues to see elevated vacancy levels and negative absorption driven by remote work, bright spots can be seen in medical office and biotech, which in most regions are seeing stability, simply because these product types are less vulnerable to economic volatility and the work-from-home trend.

Meanwhile, however, IRR reports that “limited capital availability and significant value declines in large urban markets are driving down office property prices, sometimes nearing land value.”

According to IRR, institutional investors are divesting from long-term office assets, with a limited pool of buyers—primarily private equity firms—scooping up downtown buildings at significant discounts. However, new Class A buildings are leasing well, given the limited supply pipeline.

“The return to work has been much slower than many analysts initially predicted,” Integra CEO Anthony Graziano told Commercial Property Executive. “This has also coincided with occupiers upgrading space to attract people back to work.”

Overall, he added, he hasn’t seen any evidence that the “flight-to-quality” trend in the office market has done a lot to drive increased office attendance.

READ ALSO: Investors Find Office Bargains

“Employees remain in a strong negotiating position to demand flexibility,” Graziano explained. “As employment growth slows, and the labor market slacks under the weight of fiscal policy, we will see employers negotiate new packages which include a requirement to work from the office 3-5 days per week.”

According to Graziano, some businesses may never fully come back, and others with high customer-facing requirements (banks, attorneys, architects) or team training requirements will continue to re-populate offices with new hires. “The balance is that overall demand for office will remain down, which means the highest-quality buildings will become more attractive to occupiers with plenty of options from which to choose,” Graziano also told CPE.

The bad and good of e-commerce

On the retail side, demand is mixed, with ongoing low vacancy levels overall, despite challenges in high-supply markets for big-box and junior-box stores. On the other hand, IRR reports, “newer urban centers, upscale mixed-use developments, and community shopping centers are thriving.” Markets such as Chicago, Columbus and Indianapolis are experiencing low vacancy rates and positive retail absorption, although challenges to consumer spending could affect the retail landscape.

Driven by population growth, increases in population density and in-migration of high earners, select metros in the South (Atlanta and Miami) and West (San Diego and Phoenix) are seeing rising retail rents. In the South especially, demographic shifts are driving retail expansions.

“E-commerce continues to influence smaller in-store footprints but hasn’t diminished overall retail demand,” IRR stated.

While e-commerce has been at best a substantial distraction for the retail sector, it continues to be a main driver of demand and rental growth in the industrial space market.

Markets where supply chain needs have pushed rents higher include Charlotte, N.C.; Miami; Boise, Idaho, and Phoenix, even though speculative construction and leasing velocity slowed in most markets by the first quarter.

Metros in which previous spec development has led to increased vacancies include Chicago, Indianapolis, Dallas and Los Angeles. In contrast, cities where there has been limited new construction, such as Cleveland and Detroit, have maintained low vacancies and limited price volatility. And as always, good locations and infrastructure improvements are crucial, as seen in Chicago; Kansas City; Raleigh, N.C., and Northern New Jersey.

Finally, the adaptive reuse of older industrial buildings and underutilized properties as modern industrial facilities is gaining momentum, based on a shortage of industrial land in multiple cities. “This trend is helping to support market prices for remaining inventory,” IRR remarked.

You must be logged in to post a comment.