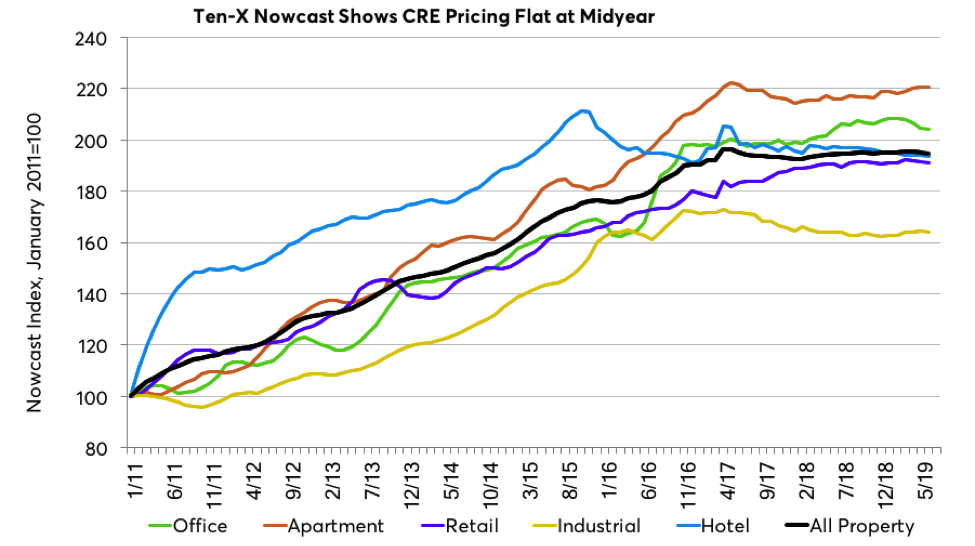

CRE Pricing Stays Flat at Midyear

According to the Ten-X Commercial Real Estate Nowcast, the All-Property Index dropped 0.2 percent month-over-month in June, leaving it flat compared to one year ago.

Commercial real estate prices ended a weak first half of 2019 on a down note. According to the Ten-X Commercial Real Estate Nowcast, the All-Property Index dropped 0.2 percent month-over-month in June, leaving it flat with its level one year ago. Pricing was down or flat on a monthly basis in all five major property segments.

The apartment segment was the only one to tread water in June, with the Ten-X Apartment Nowcast flat from May and up 2.1 percent from last year. The regional picture was generally weak, with the Midwest being the standout showing some strength, increasing 1 percent in the month, placing it a solid 5.3 percent up over the past year.

The other four major property segments all posted 0.2 percent monthly declines in June. This also left the office, retail and industrial segments essentially flat from the midpoint of last year. Hotel pricing is down 2 percent year-over-year, according to the Ten-X Hotel Nowcast. Hotel pricing was flat-to-down regionally with the exception of the Southeast, which increased 0.3 percent in June.

Four consecutive monthly declines left office pricing flat on an annual basis in June, according to the Ten-X Office Nowcast. However, there was significant regional variation in the month, with a 0.8 percent increase in the West and a 0.4 percent increase in the Midwest counterbalanced by declines in the other regions. Annually, only the Southwest shows office pricing momentum, up 0.7 percent year-over-year, though this is a significant slowing from previous months following June’s 1.3 percent decline. Office vacancies are already above their lows for this cycle and high for late in the business cycle, prompting concern on how they would do in the event of a recession.

The Ten-X Industrial Nowcast has been erratic all year, declining 0.2 percent in June after a rocky start to the year and then three consecutive monthly gains. Industrial pricing stands essentially flat from last year, up 0.1 percent. Like the office segment, the industrial Nowcast showed some strength in the West and Midwest and weakness elsewhere.

The Ten-X Retail Nowcast posted its third consecutive monthly drop in June, falling 0.2 percent. This left it flat on the year, just 0.1 percent ahead of last June. Retail pricing was strongest in the Midwest, up 1.6 percent and weakest in the Southwest, down 2.3 percent, though on an annual basis the Southwest has shown the best gain over the past year of 5.2 percent.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.