CRE Seeks Financing Alternatives as Lenders Hit the Brakes

In a tough situation, borrowers are responding with increasing creativity.

In order to keep capital flowing into commercial real estate deals and projects, investors and developers are increasingly turning to alternative funding sources.

The pool of commercial real estate lenders was already shrinking in 2022, according to data from MSCI, and recent events have accelerated the pace. “The upheaval highlights a fluid situation as lenders come to grips with an environment of higher interest rates,” Jim Costello, executive director, MSCI Research, wrote earlier this year. “Borrowers in the commercial (real estate) market themselves have faced challenges, with higher mortgage costs repressing some investment activity.”

Higher mortgage rates are “partly a yield curve story” but “also one about competition, as there were fewer lenders originating new loans,” according to Costello.

While both the commercial and multifamily sectors have been rattled by recent events and by the threat of defaults, the commercial space is expected to suffer more acutely. In a June research brief, CenterSquare Investment Management noted that the rental residential sector is best positioned for private lending opportunities, as well as for a potential rebound.

“The needs-based demand for multifamily has resulted in the asset class experiencing resilient occupancy levels throughout historical downturns” as far back as the 1980s, the firm said in its report. Commercial assets, meanwhile, are likelier to become vacant in an economic downswing, rather than simply seeing their rents flatten or decrease, according to CenterSquare.

“As regional banks and other institutional lenders tighten their lending requirements, multifamily property owners definitely have had to work harder to refinance their existing debt and obtain new financing for acquisitions,” said Anthony Kang, a partner at Saul Ewing. “Some have turned to non-traditional sources, such as private funds, preferred equity sources, and other alternative lenders who typically charge higher interest rates.”

Those lenders have their own issues, however, as they navigate the same economic tumult as everyone else. “Even some of the more established private debt investors are also slowing down as they work to address issues on their existing balance sheet caused by recent disruptions,” said Margaret Grossman, managing partner & president of T30 Capital, a middle-market real estate debt and equity investor. “That said, we are also seeing new entrants into the market looking to capitalize on increasing rates.”

Meanwhile, short-term loans, always a feature of commercial real estate financing, have become increasingly important. T30 Capital is seeing its share of the action. “We are seeing well capitalized borrowers look to refinance from bridge to bridge where they might formerly have exited a bridge loan by refinancing into a traditional term loan,” said Grossman. “We are also seeing some credit market participants looking to offer ‘stretch senior’ options to cover the gap between available debt financing and less available equity capital.”

A plea to Uncle Sam

Spurred on by looming maturity dates and the impacts of remote work, the Real Estate Roundtable has requested federal bank regulators reestablish a troubled debt restructuring program for the commercial real estate sector. The proposed program would grant financial institutions increased flexibility to refinance loans, mirroring similar programs that were established by federal agencies in 2009, 2010, 2020 and 2022.

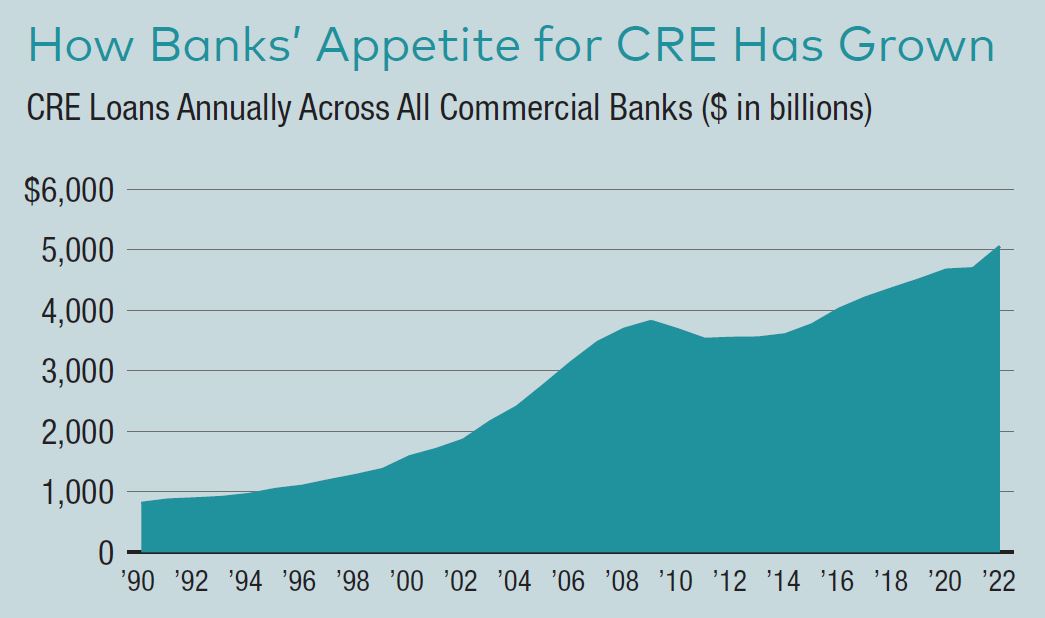

In an open letter to regulators, the group noted that the U.S. commercial and multifamily sectors represent a combined $20 trillion, financed with $5.5 trillion of debt. Of that $5.5 trillion, 50.3 percent is provided by commercial banks. In turn, $936 billion of that $5.5 trillion matures in 2023 and 2024. In addition to holding a majority of the country’s combined commercial and multifamily debt, commercial banks hold the majority of debt in each individual sector.

The specter of mass defaults has hung over the commercial real estate space for months. Commercial real estate titan Brookfield Corp. rattled the sector with its default on a mortgage for several Washington, D.C.-area office properties this spring. Coming in April, on the heels of repeated bank collapses, the news forced investors to confront the thought of a potential wave of delinquencies. The loan for the Brookfield properties was transferred to a special servicer. The following month, Brookfield defaulted on $275 million in CMBS financing for EY Plaza, a 41-story office tower in downtown Los Angeles. The financing was placed in receivership. The firm also defaulted on $755 million in loans for the Gas Company Tower and the 777 Tower in Los Angeles early this year.

CRE lending gets creative

Seller financing is currently one of the more popular alternative options for borrowers, said William Kramer, a partner at Brinkley Morgan. This is partly because, due to generally large value or price increases, “many sellers have enough equity to pay off any existing mortgages and still have enough to finance a large portion of the price for buyers,” Morgan said.

Traditional institutional lenders are increasingly cautious when underwriting loans in this high-interest rate environment. “The higher rates and, thus, higher borrowing costs make it more difficult for borrowers to meet the financial covenants such as debt yield and debt service coverage ratio,” Kramer observed, noting that while rents have increased significantly, interest rates have more than doubled in many cases in recent years.

While the Fed’s recent pause was assuredly just that, some developers are looking around the corner to a potentially lower-rate environment. “There is some sentiment among borrowers that interest rates will come back down in the next few years,” said Kramer, “so they are willing to risk paying a higher rate than an institutional rate to a seller for a short-term loan, then refinancing.”

Another alternative gaining attention is EB-5 financing. Administered by U.S. Citizenship and Immigration Services, an agency of the U.S. Department of Homeland Security, the EB-5 visa program is an investment-based immigration program that allows immigrant investors to obtain permanent residency in the U.S. in exchange for investing in a domestic business.

“The renewed interest in the EB-5 program is, due in large part, to Congress passing legislation to revamp the program more than a year ago,” said Ronald Fieldstone, a partner at Saul Ewing. “The flexibility of EB-5 financing enables developers to secure funds with a reduced reliance on senior loans and at a below-market rate, compared to traditional junior mezzanine financing.”

Under the terms of the EB‐5 Reform and Integrity Act of 2022, the program requires a minimum investment of $1.05 million.

Weathering storms

While there is no guarantee when lending will ramp up, Kramer predicted that, as underwriting criteria adjusts to a higher-interest rate environment, lenders will eventually accept lower rates and less conservative financial covenants.

“I am seeing from both my borrower clients and lender clients that borrowers with very strong financial statements are able to close loans much quicker and easier, even where the financials of the property may not be as strong,” said Kramer.

T30’s lending arm, Fort Amsterdam Capital, expects to see activity continue and possibly increase in the second half of this year, according to Grossman. “The biggest factor in determining how much activity will pick up will likely be borrowers’ ability to raise equity behind their debt.”

But it is not only the macroeconomic situation and the particulars of commercial real estate that will have an impact. Extreme weather is a factor, too, since one of the largest impediments to real estate mortgage loans has been obtaining property insurance.

Regardless, despite stormfronts both figurative and literal, Kramer speculated that capital will, in some form, always be available. “Lenders need to make money, which they do by making loans. Historically, lenders will always find a way to make loans even in less-than-ideal lending environments.”

You must be logged in to post a comment.