CRE Sentiment Index Hits All-Time High

The Fed's easing of interest rates and the likelihood of an economic soft landing are key drivers behind this optimism, according to CREFC's latest survey.

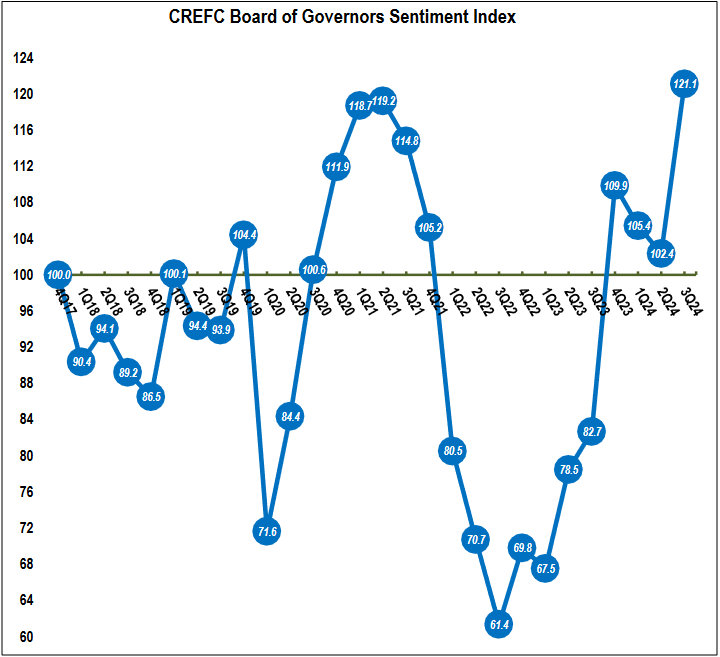

Confidence in the commercial real estate sector has improved significantly in the third quarter of 2024, according to the Board of Governors Sentiment Index survey from the CRE Finance Council.

The index surged to 121.1, an 18 percent increase from 102.4 in the prior quarter. This marks the highest index reading since the metric was launched in 2017.

The Fed’s easing of interest rates, the possibility of an economic soft landing and the impact on commercial real estate asset values and lending market conditions boosted the results.

The survey was conducted between Sept. 4 and Sept. 12, just before the Federal Reserve’s decision on Sept. 18 to cut interest rates by 50 basis points. It focused on six topics:

- Economic outlook: Overall sentiment remains guarded. 32 percent of respondents expect improved performance over the next 12 months, up from 11 percent last quarter. Only 11 percent now anticipate worsening conditions.

- Rate impact: 85 percent of respondents expect lower mortgage and capitalization rates to impact CRE finance and CRE asset values positively. This reading has doubled since last quarter’s 41 percent.

- CRE fundamentals: 40 percent predict better conditions over the next year than 24 percent in the second quarter.

- Transaction activity and financing demand: 81 percent anticipate increased demand, up from 54 percent last quarter. Borrower demand for financing leaped by 20 points to 85 percent.

- Liquidity and CMBS market: Confidence in liquidity improved significantly, from 46 percent in the previous quarter to 77 percent expecting better/more liquid market conditions in the debt capital markets. CMBS and CRE CLO demand increased to 66 percent from 43 percent.

- Optimistic industry sentiment: This metric more than doubled over the second quarter, moving from 22 percent to 57 percent. Negative sentiment plummeted to 2 percent.

Experts’ outlook mirrors survey results

BGO Chief Economist Ryan Severino told Commercial Property Executive that the positive outlook reported in the CREFC survey aligns with BGO’s outlook.

“At this point, it would take something highly idiosyncratic to derail our positive outlook for CRE capital markets,” Severino said.

“CRE returns have swung back into positive territory after the Fed stopped raising rates last year, holding to form. With no permanent change in the CRE economy, there is no reason to expect that the lower rates would not continue to boost the CRE market—liquidity, transaction volume, valuations, appreciation returns and total returns should all improve as the monetary policy environment shifts,” Severino commented.

He also stressed that It’s important to remember this is not a panacea to the entirety of the market, especially struggling mortgages that are backing poor-quality collateral. “Rate cuts have already spurred the market, and further loosening should continue to do so, but they will not save every deal,” he added.

Jim Costello, chief economist at MSCI Real Assets, told CPE that investors who had been anticipating as many as five rate cuts in 2024 have been sorely disappointed. This disappointment has weighed on investor expectations for commercial property.

“The Fed began its rate-cutting cycle in September, while the timing and number of subsequent cuts remain to be seen. What does appear clear is that barring an unforeseen shock, the era of free money that has existed since 2009 is over.”

According to Costello, this is proving to be a tough adjustment, considering the long run for cheap capital. “We have a whole generation of people who weren’t in the market before 2009, and their expectations were formed in an environment where central banks around the world were injecting liquidity into the system,” he observed.

Costello also said that without question, that higher costs are making it more difficult to assess market value and negotiate deals.

“On a positive note, the sharp drop in transaction volume last year shows some signs of stabilizing,” he added.

According to MSCI Real Assets, the slide in deal volume and pricing that started in 2022 ended in the second quarter of 2024, with a minor 2 percent dip in year-over-year volume.

Just wait ‘til the next Fed rate cut

Lauro Ferroni, head of capital markets research for the Americas at JLL, said that the Fed’s first rate cut in September is expected to solidify the market’s year-to-date improvements further.

“This should lead to a more normalization in the transactions market by catalyzing more deal activity and leading to a further increase in the number of lenders actively quoting on CRE loans across property sectors,” Ferroni mentioned.

Crexi COO Eli Randel noted that, as evidenced by the CREFC survey and underscored by increased buyer activity across asset classes on Crexi’s platform, commercial real estate optimism among participants is generally up.

“Many believe a market bottom was reached in ’24 and that ’25 will bring increased values, higher transactional velocity, more accessible debt, and ultimately the beginning of a new cycle,” Randel said.

“The Fed’s recent, more aggressive rate cuts are expected to unlock transaction activity by encouraging those waiting for more favorable conditions to re-enter the market, he added. “While some challenges remain, the industry is cautiously optimistic about entering a new growth phase, which will be driven by new technology to enhance due diligence, connect disparate parties, and promote healthy deal flow.”

Many CRE loans coming due

Ed Del Beccaro, executive vice president & San Francisco Bay Area manager of TRI Commercial/CORFAC International, said the lower interest rates would help the real estate market but questions by how much.

“Many CRE loans with five-year and 10-year terms coming due in 2025 were taken on at much lower interest rates offered today,” Del Beccaro noted.

“Banks will require those real estate entities to inject capital with lower loan-to-value ratios to refinance. Many CRE owners, rather than do that, will give back the keys in 2025, as has been the case in 2024. For this reason, the Federal Reserve is asking banks to increase reserves, which again limits real estate lending.”

He added this will be especially true in the office sector, with many markets still experiencing negative absorption and low velocity of leasing transactions.

“There are hope signs of reaching the bottom but not for a couple more years,” according to Del Beccaro.

He also noted that employment is slowing nationally, which is causing concerns. Shipping costs have increased because of the dockworkers’ strike and the shutdown of the Red Sea shipping routes, causing supply chain issues.

According to Beccaro, remote work trends still impact the market even if in-person office attendance is slowly increasing.

“Annual inflation is coming down but not far enough, with construction costs still too high to start construction in the commercial sector unless preleased. Medical is the exception and a bright spot,” Del Beccaro continued.

Major retailers such as Home Depot and others who increased their warehouse footprint during COVID now have significant excess warehouse capacity and are shutting down some warehouses, he pointed out.

“The good news is that unless the world economy is hit hard by possible wars, many economists do not forecast a recession for next year,” he concluded.

You must be logged in to post a comment.