CRE Sentiment Index Soars to New High: CREFC

The survey reveals broad optimism about several factors, including market fundamentals and the federal policy.

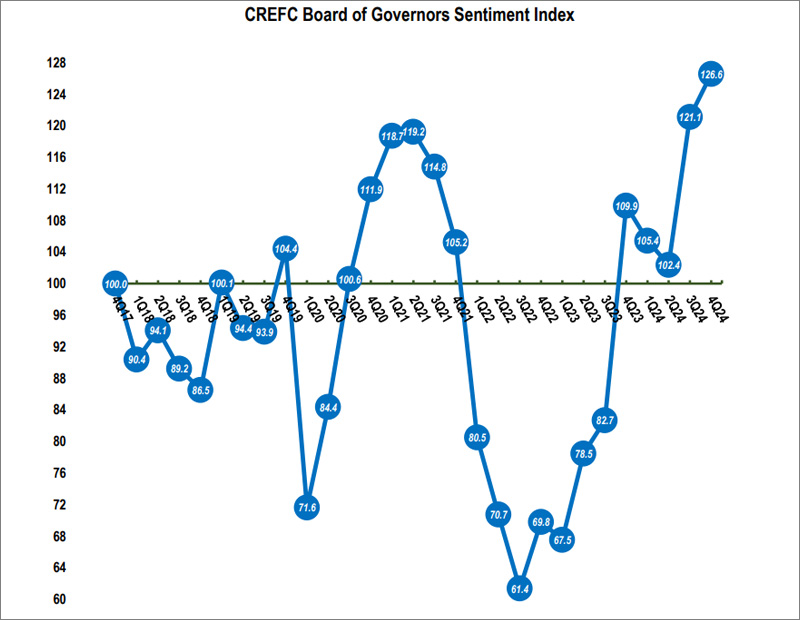

Optimism among key commercial real estate investors continues to rise, reaching an all-time high, according to CREFC’s Board of Governors sentiment index for the fourth quarter of 2024, conducted from Dec. 19 to Jan. 6.

The index rose 5 percent to 126.6 from its all-time high reading of 121.1 in the third quarter of 2024.

The BOG comprises more than 50 senior executives in commercial real estate finance. They represent all lending and mortgage-related debt investing sectors, including balance sheet and securitized lenders, loan and bond investors, mortgage bankers, private equity firms, loan servicers, rating agencies, attorneys, accountants and others.

Some 95 percent of respondents expect transaction volume to increase by at least 10 percent in 2025, with multifamily (30 percent) and office (23 percent) offering the best risk-adjusted opportunities. A majority (51 percent) said the “higher-for-longer” forecast for interest rates is a concern.

The index measures seven key categories, as follows.

Economic outlook

CREFC found that optimism continues to grow, with 42 percent of respondents expecting improved economic performance over the next 12 months, compared to 32 percent in the third quarter.

“Optimism in the commercial real estate market continues to grow, reflecting increasing confidence in economic stability and future growth,” Mario Saldana, vice president of investments at Tricera Capital, told Commercial Property Executive.

Investors and industry participants anticipate stronger market performance driven by resilient demand, steady employment levels and easing inflation concerns, he added.

“While economic uncertainties persist, sentiment suggests a positive trajectory for investment, leasing activity and overall market expansion. There could be heightened transaction volumes and capital deployment if this momentum continues, reinforcing long-term confidence in the sector.”

READ ALSO: How Geopolitics Will Shape CRE Investment in 2025

However, the economy isn’t healthy, and the overall cost of capital will continue to be high throughout the year, warns Dave Sobelman, founder & CEO of publicly traded REIT Generation Income Properties.

“Despite a 10 percent increase in optimism, roughly 60 percent of real estate professionals still do not see material improvement,” he said. “CRE professionals are somewhat resigned to another year of uncertainty.”

Federal policy

CREFC showed that 74 percent expect a positive impact on CRE finance-related businesses, up from 17 percent last quarter.

“One can see the trend that started in November and includes a more considerable sentiment around economic growth in the U.S., given the new administration,” Jeff Holzmann, COO of RREAF Holdings, told CPE. “Regardless of political preferences, the stock market has indicated more substantial stock prices due to the expected changes indicated by the incoming administration.”

Reduced spending, added pressure on the Fed to lower rates, more favorable tax cuts and lax regulations should lead to stronger economic activity, he added.

Rate impact

CREFC found that 58 percent are now neutral on rates, and those having positive expectations sank.

“As we exited the third quarter, we saw the first rate cut in years [by 50 basis points],” said Robert Martinek, director at EisnerAmper. “Inflation had moderated, and another two cuts totaling 75 basis points soon followed. Consumers were anticipating an additional four to five cuts in 2025. After the election, most people considered Trump to be pro-business. However, many view his policies as inflationary, and the 10-year treasury rate surged. Market participants are now hoping, not expecting additional rate cuts.”

READ ALSO: Fed Leaves Interest Rates Alone

Saldana added that uncertainty about interest rates continues to shape industry sentiment, with market participants adjusting expectations for borrowing costs and capital markets activity. “While higher rates initially slowed transaction volumes, the market has stabilized as investors and borrowers adapt.”

CRE fundamentals

CREFC found that 65 percent expect improvement, and 12 percent expect worsening.

Melanie French, CEO of RR Living, told CPE that multifamily owners, investors and managers are seeing a recent resurgence of distressed assets in the market.

“While it is not good for the former owners, these units returning to trading spur job growth through increased value-add renovations,” French said. “I love seeing this influx returning as it freshens the look and longevity of those communities.”

Transaction activity and financing demand

CREFC found that 86 percent of investors and 91 percent of financiers see higher activity.

“Activity started to recover in 2024, with a notable acceleration in the latter half of the year, particularly in lending markets,” said Trey Morsbach, executive managing director & co-lead of JLL Capital Market’s Debt Advisory & Corporate Finance.

“We’re observing a marked increase in the number of investors going on offense, with aggregate bidding activity on transactions rising by more than 40 percent in the fourth quarter of 2024 on a year-over-year basis.”

Institutional capital is increasingly prominent in acquisitions and transactions of +$100 million. ODCE redemption queues are easing, and valuation marks are nearing parity with market values, allowing more core capital to return, Morsbach added.

Market liquidity

CREFC found that 81 percent expect improved conditions, slightly higher than the previous quarter.

Sobelman told CPE he equates 2025 to 2011.

“Cap rates have stabilized to a realistic and higher level, and lenders are seemingly more comfortable re-entering the market due to proper valuations congruent with the debt rates and terms available,” he said.

Overall sentiment

CREFC found that 77 percent express positive sentiment, up from 57 percent last quarter.

“I just left an industry conference, and sentiment amongst everyone was higher than it’s been for years,” said Pierre Debbas, Romer Debbas LLP.

He added that moving past the election, optimism is growing with President Trump’s economic agenda, the inevitable reduction in interest rates, and the reduction in government spending and inflation, which should bring down the 10-year U.S. Treasury and, subsequently, interest rates.

“Multifamily is still strong as demand for rents has been consistent given the inability of most people to afford a home, and investors are still targeting this asset class.”

You must be logged in to post a comment.