CRE Transaction Activity Picks Up, NAIOP Reports

Deals and rent collections are seeing month-over-month improvements, though the tough times are not over, according to the latest results of the association's coronavirus impact survey.

Investment sales volume continues to improve across multiple property sectors, according to NAIOP’s monthly Coronavirus Impact Survey.

All is far from rosy in the commercial real estate industry, however, as the office sector faces an increased challenge in rent collections.

READ ALSO: Industrial Real Estate Faces Short-Term Decline in NAIOP Report

The September study marks the sixth in a series of NAIOP Coronavirus Impact Surveys. “Different property types have performed so differently over the last six months,” Shawn Moura, research director with NAIOP, told Commercial Property Executive.

NAIOP queried 203 members for its September Coronavirus Impact Survey, securing the opinions of a range of industry professionals, including building owners and managers, developers, brokers, lenders and investors. On the transactions front, survey participants reported an increase in industrial, office and multifamily deals in September, with industrial leading the way with the greatest month-over-month rise in acquisitions.

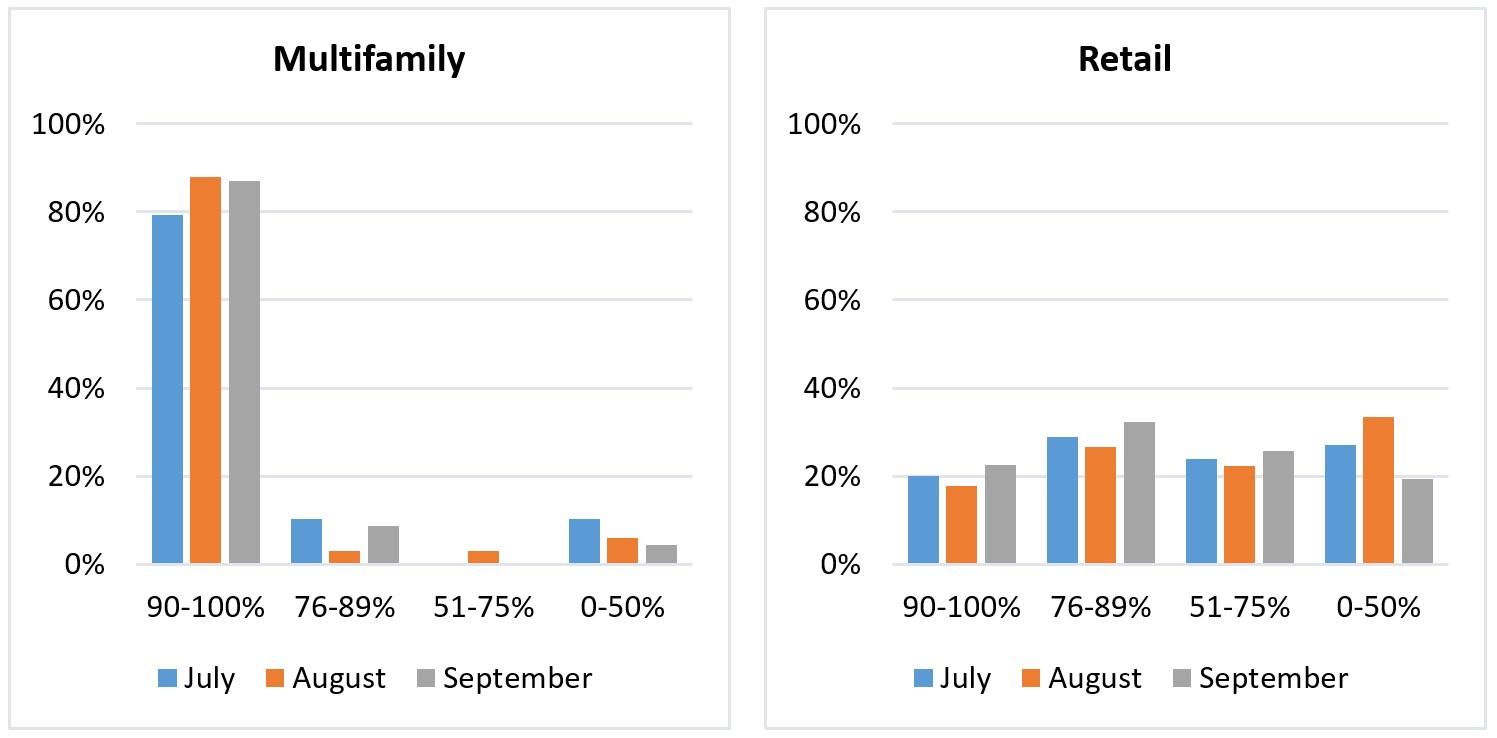

Retail, however, continued to struggle the most in attracting investor interest. A total of 79.8 percent of respondents reported no retail deal activity at all in September, compared to the office, multifamily and industrial sectors, where a respective 42, 22 and 15 percent of respondents reported no deal activity.

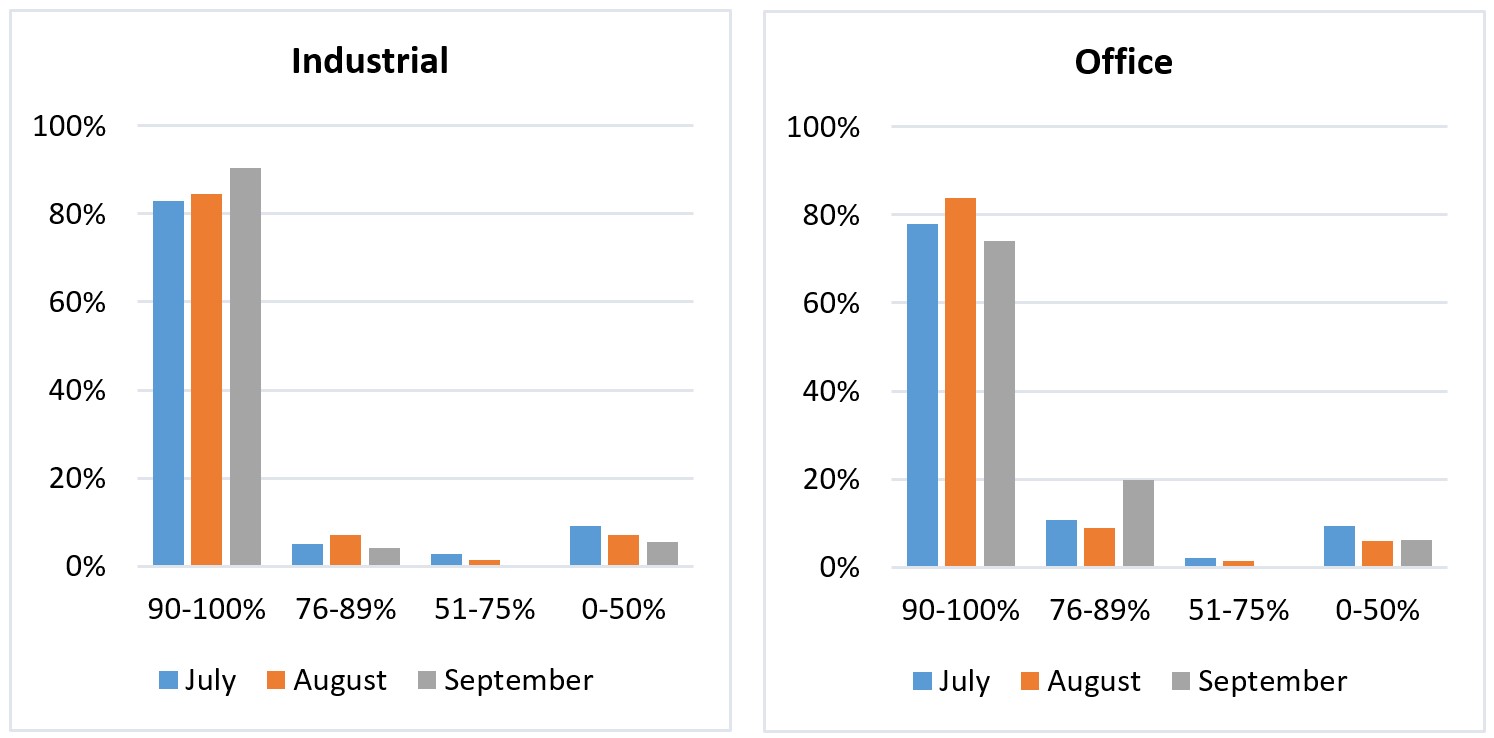

NAIOP September Survey percentage of tenants that have paid their rent in full and on time for Industrial & Office. Chart courtesy of NAIOP

With the exception of office assets, all sectors saw strong or improving rent collections. The industrial sector was at the forefront of the sectors once again, as the percentage of respondents reporting on-time collection rates of 90 percent or more increased to 90.4 percent month-over-month. Multifamily rent collections remained robust, holding steady at approximately 85 percent and retail rent collections improved, with more than 20 percent reporting on-time collection rates of 90 percent or more.

Conversely, collections in the office sector went on the downswing, with the segment of respondents reporting collection rates exceeding 90 percent dropping from 83.4 percent in August to 74.1 percent in September.

NAIOP September Survey percentage of tenants that have paid their rent in full and on time for Multifamily & Retail. Chart courtesy of NAIOP

“The uptick in the number of respondents who reported that fewer than 90 percent of their office tenants had paid rent on time and in full was a bit surprising, as it reversed a trend toward more on-time rent collections,” said Moura. “There has been some concern among office building owners that more tenants would face financial headwinds the longer the recession lasts, but it is still too early to know whether this will be a notable trend in rent collections, or just a blip in the data.”

One (relatively) sure thing

The fact that the coronavirus is a completely unknown quantity hinders industry experts’ ability to anticipate the commercial real estate market’s path; however, there are a few likely trajectories.

“Industrial real estate will probably continue to outperform other asset classes as e-commerce sales continue to grow,” Moura said.

In terms of development activity, he noted that both industrial and multifamily have already rebounded, buoyed by strong pre-pandemic performances. But the future is less certain for office and retail development. “We likely won’t see a return to pre-pandemic levels of new office development until after the pandemic is no longer a major public health concern, and it is likely that retail will be the last sector to recover, given the challenges the sector faced before the pandemic,” Moura concluded.

Read the full report by NAIOP.

You must be logged in to post a comment.