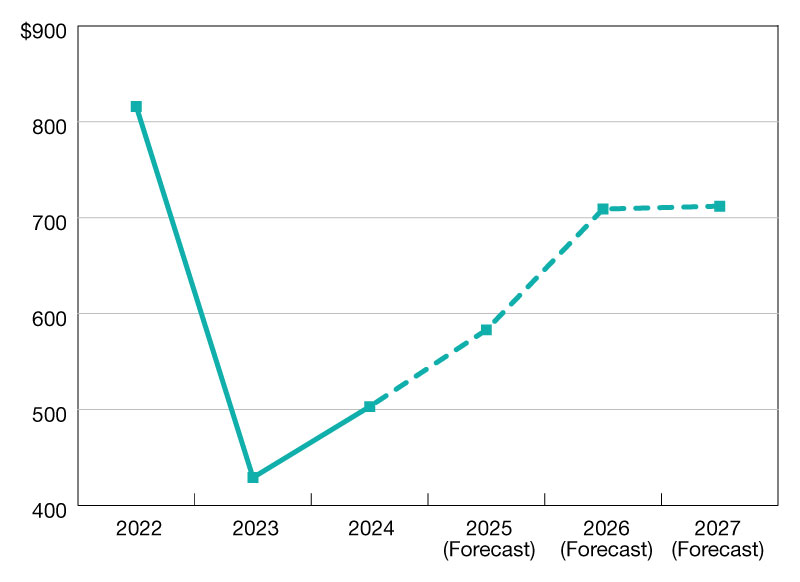

Lending Expected to Reach $583B in 2025

The Mortgage Bankers Association forecasts a 16 percent year-over-year increase.

Total commercial and multifamily mortgage borrowing and lending is expected to rise to $583 billion in 2025, which is a 16 percent increase from 2024’s estimated total of $503 billion. This is according to an updated baseline forecast released by the Mortgage Bankers Association at its 2025 Commercial/Multifamily Finance Convention and Expo in February.

Multifamily lending alone (which is included in the total figures) is expected to rise to $361 billion in 2025—also a 16 percent increase from last year’s estimate of $312 billion. MBA anticipates originations in 2026 will increase to $709 billion in total commercial real estate lending, with $419 billion of that total in multifamily lending.

READ ALSO: MBA-CREF Special Report: Lending Grows Amid ‘Complexities’

There are still plenty of challenges in commercial real estate, but there are also signs of stabilization. Given the strong pickup in origination activity at the end of 2024, it appears that at least some borrowers and lenders are ready to move. MBA is forecasting that interest rates are going to stay within a trading range for the next few years. With abundant capital ready to be deployed, and if rates decline as they did at the end of 2024, we fully expect that borrowers and lenders will jump on any opportunities.

MBA forecasts somewhat slower economic growth and a marginally weaker job market in the years ahead. Given our forecast for interest rates and the broader economy, MBA anticipates growth in commercial mortgage originations in the next two years. We expect an increase in originations across property types and capital sources, but certainly recognize the additional challenges posed by the large number of loans scheduled to mature in 2025.

—Posted on March 24, 2025

You must be logged in to post a comment.