Why CREFC Survey Says Things Are Looking Up

Optimism takes a record jump in the organization’s latest poll, but sector-specific concerns remain.

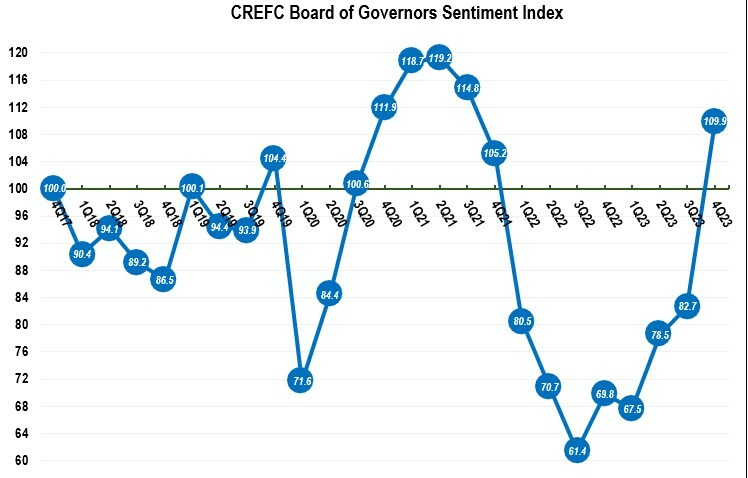

The latest Board of Governors Sentiment Index from the CRE Finance Council indicates a notable shift in industry sentiment, while marking the largest quarterly increase since the survey’s inception.

In terms of the exact survey numbers, the jump was from 82.7 in the third quarter to 109.9 in the fourth, or a 33 percent increase in the Sentiment Index.

This significant rise underscores a cautiously optimistic outlook in the CRE finance industry, according to Lisa Pendergast, executive director of CREFC. She added in a prepared statement that the overall sentiment reflects confidence in the resilience and adaptability of the market as we are navigating through a landscape of economic uncertainties and sector-specific challenges, demonstrating the industry’s robustness in the face of evolving macroeconomic conditions.

READ ALSO: Financial Outlook for CRE

The survey was administered between Dec. 18, 2023, and Jan. 3, 2024. According to CREFC, the index serves as a reliable barometer of market conditions and outlook as perceived by senior members of the industry.

The survey’s highlights cover a wide range of issues facing the CRE financing community.

• There was a sharp increase in positive outlook for the U.S. economy over the coming 12 months, with 54 percent of respondents anticipating better performance, versus only 7 percent in the previous quarter.

• Views on the effects of federal government actions and mortgage/cap rates on CRE finance–related businesses tilted toward neutral or more positive perceptions.

• Expectations improved markedly for CRE fundamentals, transaction activity and investor demand for CRE assets, including multifamily.

• Survey participants expect a significant increase in borrower demand for financing and liquidity in the CRE debt capital markets.

• The survey found a significant increase in positive sentiment toward CMBS and CRE CLO demand/spreads.

• In the third quarter, 58 percent of the BoG held a negative overall sentiment for all CRE finance businesses over the next 12 months, but only 19 percent felt the same in this most recent survey.

Specific concerns

CREFC cautioned that while these core questions from the survey elicit a broadly positive outlook, additional, open-ended responses did reveal some concerns.

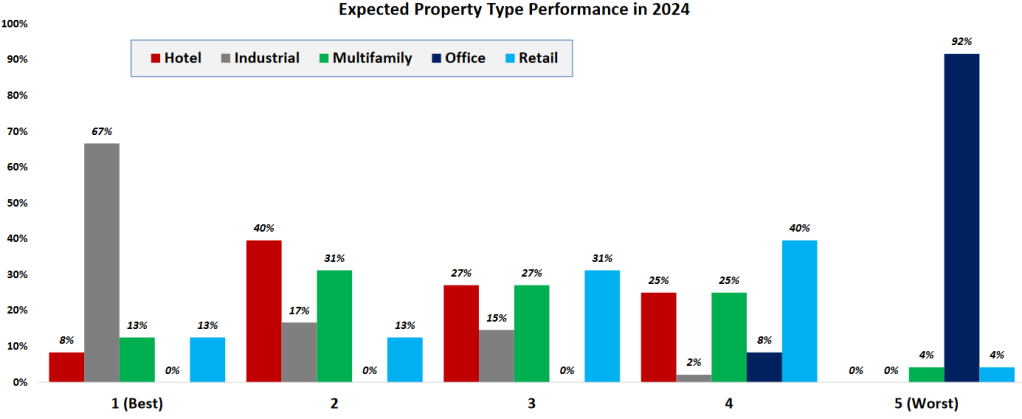

For example, the office sector is expected by a whopping 92 percent of survey respondents to be the worst-performing property class in 2024. There’s also concern that issues in this sector could tarnish the overall CRE market.

Other, more specific concerns include oversupply of multifamily, followed by growing defaults; “shadow delinquencies” at regional banks; and worries about rate cuts during a slowing economy.

You must be logged in to post a comment.