CRE Executives See Glimmers Emerging from Tough Times: RCLCO Report

The semiannual survey of commercial real estate leaders finds a noticeable bifurcation between how they view the market now and what they foresee over the next 12 months.

In a sports car, going from 0 to 60 mph really quickly is terrific. But 65.0 to 9.2, as a measure of how real estate professionals view their sector? Not so terrific.

That’s how much RCLCO’s Real Estate Market Index has plummeted since the CRE advisory firm published their previous survey six months ago. The Mid-Year 2020 Sentiment Survey from RCLCO documents a stunning, yet unsurprising, plunge in optimism about the real estate sector because of the COVID-19 pandemic.

READ ALSO: REITs Ramp Up ESG Campaigns

RCLCO Managing Director Brad Hunter, the report’s lead author, characterized the current situation as “a sudden stop,” or in other words, not something that’s playing out as part of a typical economic cycle.

Yet despite the bottom falling out of the RMI in the past six months, it’s not all gloomy. In fact, opinions of what the market will be like in 12 months are much more moderate.

The Current RMI, based on a semiannual survey of hundreds of real estate executives and other leaders and current conditions, stands at 9.2. To put that figure in context, that’s the lowest it has been since the end of the Great Recession. Any number below 30 indicates “periods of economic and real estate market stress/recession,” according to RCLCO.

“The nearly 56-point drop in so short a period mirrors the speed and depth of the damage that the pandemic has wrought upon the U.S. economy and real estate markets,” the report states.

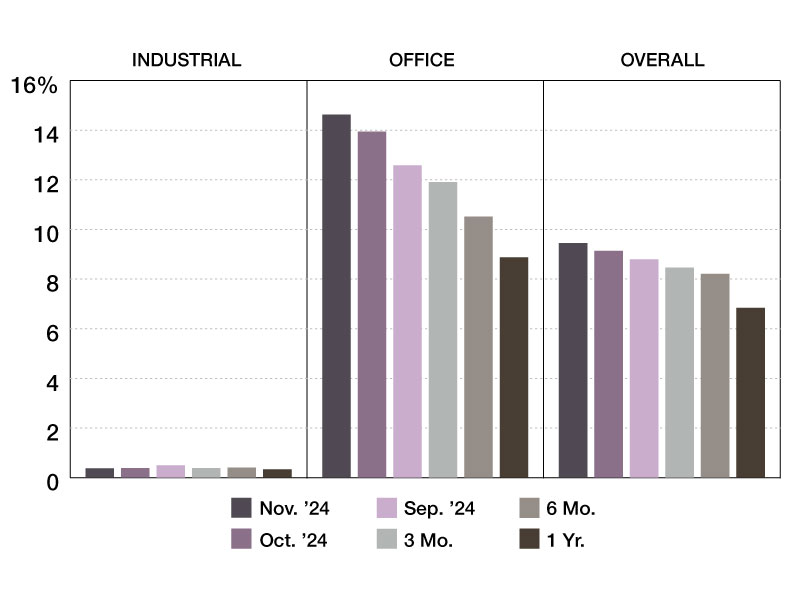

The damage has walloped most but not all commercial real estate sectors. Though respondents believe that nearly every major sector has “jumped from expansion to contraction in the first half of 2020,” industrial is the big exception. Big-box warehouse, logistics, cold storage and last-mile distribution product are seen as having likely benefited from the pandemic, driven by surges in e-commerce and home delivery.

A brighter 2021?

As to whether we’ve hit bottom yet, that varies by product type. The report notes that new data from the National Council of Real Estate Investment Fiduciaries indicates that office rent collections likely improved through mid-June compared to May, to north of 91 percent. On the retail side, however, NCREIF reported that while rent collections increased from May, they still averaged below 60 percent for June.

The RCLCO Future RMI, based on where survey participants see the industry in 12 months, is substantially less negative than the Current RMI. At 37.5, it’s at least above the recession threshold.

Further, survey respondents foresee recovery beginning in the hotel sector within a year, and fewer than 16 percent expect the overall commercial real estate markets to be significantly worse over the next 12 months.

You must be logged in to post a comment.