How CRE Boosts the Economy: NAIOP

Industrial construction spending surged by more than 140 percent in 2022, NAIOP reports.

The latest report from the NAIOP Research Foundation shows the impact of new commercial real estate development on the U.S. economy continues to grow, with the industrial sector’s new construction spending surging by more than 140 percent from 2021 to 2022.

The combined economic contributions of new commercial building development and operations of existing commercial buildings last year was $826.9 billion.

The annual Economic Impacts of Commercial Real Estate research study found CRE development and operations from the office, industrial, warehouse and retail/entertainment sectors also contributed $2.3 trillion to the U.S. gross domestic product, generated $831.8 billion in personal earnings and supported 15.1 million jobs. Altogether, commercial, residential, institutional and infrastructure development and operations of existing commercial buildings contributed $6.5 trillion to the U.S. economy and supported 37.7 million jobs in 2022.

READ ALSO: Top 10 Commercial Real Estate Trends for 2023

Marc Selvitelli, president & CEO of NAIOP, said in a prepared statement the data points in the report are strong economic indicators of commercial real estate development, job growth and subsequential contributions to the U.S. economy. However, Selvitelli did note the success could be met with headwinds this year as inflation, workforce constraints and higher interest rates create uncertainty. He added the organization’s Research Foundation, legislative team and education will continue to keep members and industry professionals informed on the issues and offer resources as the industry navigates potentially choppy waters.

There was much to laud from the 2022 numbers and Richard Branch, chief economist with Dodge Construction Network, which provides the commercial construction data cited in the report, stated the construction sector ended 2022 with positive momentum. Looking ahead to this year, he said they expect growth in sectors such as life sciences, data centers and manufacturing will be important for seeing potential amid the economic slowdown in 2023.

In particular, the report notes slow growth in real (inflation-adjusted) GDP (0.2 percent is expected) as well as in nonresidential fixed business investment (0.6 percent). Both figures are evidence of potential declines in demand for construction and real estate, according to the report. Despite the expected economic growth slowdowns, the NAIOP Research Foundation anticipates total value of construction to increase modestly in 2023.

Conducted annually since 2008 by NAIOP, the study is used by real estate professionals and municipal, state and federal officials and employees to understand and quantify the key economic benefits of commercial real estate on the U.S. economy. The report was authored by Brian Lewandowski, Adam Illig, Michael Kercheval and Richard Wobbekind at the University of Colorado Boulder Leeds School of Business.

By the numbers

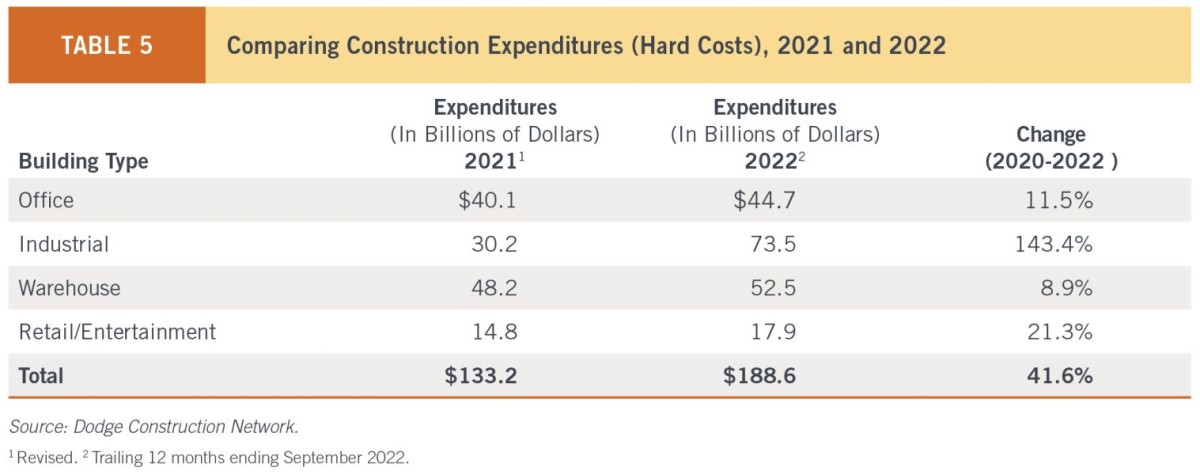

Non-warehouse industrial building construction (manufacturing) saw a 143.4 percent jump last year going from $30.2 billion in 2021 to $73.5 billion in 2022 in hard costs for construction spending. Warehouse construction increased by 8.9 percent, from $48.2 billion in 2021 construction spending to $52.5 billion in 2022. The office sector saw construction spending rise by 11.5 percent from $40.1 billion in 2021 to $44.7 billion. NAIOP notes the office segment has been impacted by continued remote work as some firms are defensively putting space on the sublease market, a trend exacerbated by downsizing and layoffs, particularly in the tech sector.

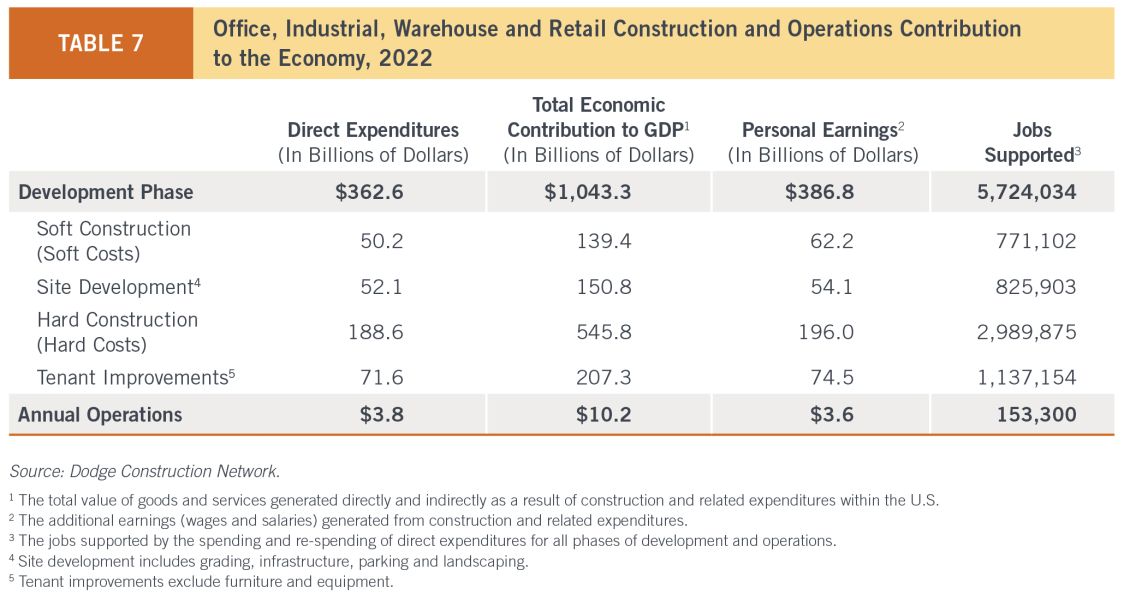

Office, Industrial, Warehouse and Retail Construction and Operations Contribution to the Economy, 2022. Chart courtesy of NAIOP

While there are challenges of office-linked retail in urban-core markets, NAIOP states demand for traditional retail space has rebounded with overall occupancy rates recovering to pre-pandemic levels. That enthusiasm translated into a 21.3 percent increase in construction spending for the retail/entertainment sectors last year, rising from $14.8 billion in 2021 to $17.9 billion last year.

The report also tracked the four phases of development—soft costs, site development costs, hard costs and tenant improvements—to determine the total impact on the economy. The study found direct construction expenditures in the development phases totaled $362.6 billion in 2022, which resulted in a contribution of just over $1 trillion to the GDP and generated $386.8 billion in personal earnings.

It also supported 5.7 million jobs last year. However, the report noted construction firms were still having trouble hiring workers to handle the demand. As of October 2022, there were approximately 10.3 million job openings, up from 6.8 million in October 2020 during the height of COVID-19 pandemic. But NAIOP notes recent data suggests the total job openings, while still elevated, are declining.

You must be logged in to post a comment.