CRE’s Perceptions of Coworking

More than 550 key executives participated in Cushman & Wakefield’s latest survey on flexible office space.

David Smith, Americas Head of Occupier Research, Cushman & Wakefield. Image courtesy of Cushman & Wakefield

A new Cushman & Wakefield report on flexible workspace and coworking strategies finds nearly two-thirds of companies are using coworking to some degree and many expect to double their commitment over the next five years, citing flexibility and reduced real estate costs as their top reasons.

READ ALSO: Why Are Large Players Entering the Coworking Sector?

The global real estate services firm partnered with CoreNet Global, a worldwide association of corporate real estate executives, to survey more than 550 key CRE executives about their perceptions of the coworking sector. The participants were also asked about the pros and cons of using coworking, expected cost impacts and employee utilization of flexible office spaces.

David Smith, Americas head of occupier research at Cushman & Wakefield, said the responses showed companies increasingly see coworking and flexible space as a growing and broader part of their occupancy strategies. Of those surveyed, 63 percent said their organizations were utilizing coworking somewhere in their portfolio, with the highest use coming in the Americas (66 percent) and the lowest in Asia Pacific (58 percent).

Melanie Gladwell, Executive Managing Director, Americas Head of Flexible Workspace, Cushman & Wakefield. Image courtesy of Cushman & Wakefield

The survey found the average respondent company has 12 percent of its employees using coworking on a regular basis, more than double from two years ago, when it was 5 percent. That number is expected to double again over the next five years, to 24 percent. Growth is expected to be highest over the next five years in APAC, with expected utilization reaching 25.2 percent in 2024. The Americas is expected to reach a 23.3 percent utilization rate, while EMEA is anticipated to reach 21.7 percent. What’s particularly striking is that more than half of the organizations surveyed had no employees utilizing coworking two years ago. Today, only about one-fourth of those companies have no employees regularly using coworking locations.

Melanie Gladwell, executive managing director, Americas head of flexible workspace at Cushman & Wakefield, said those numbers do not surprise her at all. “While flexible workspace had been dominating recent headlines, this industry got its start more than 40 years ago with the pioneering providers originating in Australia and the UK. Even 20 years ago, the client mix of national and global flexible workspace providers was 51 percent multinational corporations. However, usage of flexible workplace was not viewed as a real estate decision nor was that decision being made by traditional buyers of real estate. These decisions were made by functional business leaders,” Gladwell told Commercial Property Executive. “Over the past decade, new technology, economic shifts and the dynamic needs of a multi-generational workforce have changed enterprise operating models, leading to a variable workforce, and ultimately creating new office requirements.”

Gladwell said tenants now expect “amenitized, variable, functional, serviced and flexible workplace options from investors to help them win the war for talent, support transformational initiatives, drive employee engagement and improve business performance.”

Pros and cons

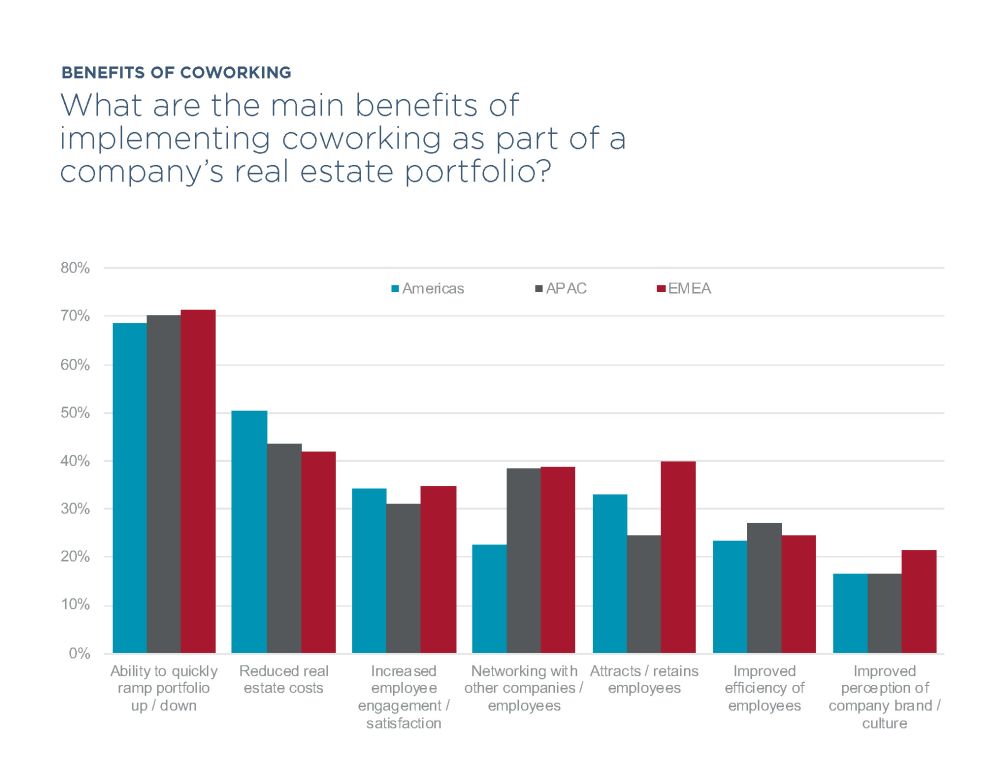

While the ability to attract and retain employees and increased employee engagement and satisfaction were among the top five benefits of implementing coworking as a part of a company’s real estate portfolio, the top two responses were the ability to ramp up or down their portfolios, followed by the ability to reduce costs. The survey found one-third of the companies using flexible space reported occupancy cost savings of more than 5 percent. It also found that a company’s perception of coworking improved for those that have been able to lower their CRE spending through coworking. Among those whose costs decreased by 6 percent or more, 71 percent have a positive or very positive view of coworking. For those organizations where CRE costs increased by 6 percent or more, that number dropped to 55 percent.

Despite an overall positive view of coworking, the survey respondents were realistic about challenges going forward. About half (48 percent) said they see an increased difficulty in maintaining company culture and cohesion when workers are operating out of coworking locations. But the top concern among respondents across the globe was digital security, with about 70 percent of the EMEA respondents being the most worried. That number dropped to about 55 percent for the Americas and 50 percent for APAC company respondents. Other concerns were decreased personal privacy, decreased employee engagement/satisfaction, increased real estate costs and decreased efficiency of employees.

You must be logged in to post a comment.