Is There a CRE Labor Crisis? Insights From the CPE 100

Our quarterly survey also sheds light on what the next six months hold for the industry and the economy.

The much-discussed labor shortage extends to the commercial real estate industry.

The much-discussed labor shortage extends to the commercial real estate industry.

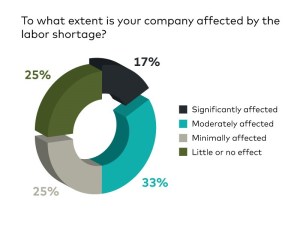

Fully 50 percent of respondents to the latest CPE 100 Sentiment Survey report that a labor shortage has affected their company moderately or significantly. A similar number say that the shortage has had a minimal effect on them or none at all.

The results reflect the views of the CPE 100, an invited group of industry leaders. Participants are surveyed quarterly on their views of key issues facing the industry.

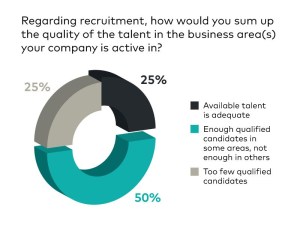

Those trends are also reflected in the mixed success that the CPE 100 are having in filling positions. Half of respondents said that available talent is adequate for some kinds of jobs but inadequate for others.

Those trends are also reflected in the mixed success that the CPE 100 are having in filling positions. Half of respondents said that available talent is adequate for some kinds of jobs but inadequate for others.

According to one quarter of participants, too few qualified candidates are available. Only 25 percent say that the talent at their disposal is satisfactory.

The most recent results are not entirely dissimilar from the previous time the CPE 100 were asked about recruitment. In 2019, slightly fewer respondents than today—36 percent—reported a mixed bag: enough talent in some areas but not in others.

Two years ago, 29 percent found too few qualified candidates, and the same number, 29 percent, said that the number of qualified candidates was adequate.

Two years ago, 29 percent found too few qualified candidates, and the same number, 29 percent, said that the number of qualified candidates was adequate.

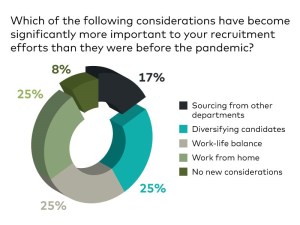

Survey results confirmed that commercial real estate companies have likewise shifted their recruitment policies over the past 18 months. Building a more diversified pool of candidates, the flexibility to work at home and work-life balance have all taken a priority. Only 17 percent mentioned a greater focus on sourcing team members from other departments at their company.

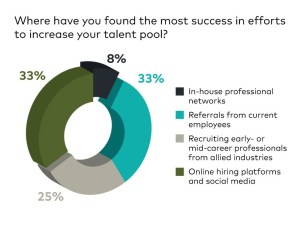

Along those lines, the CPE 100 cited two strategies as the most effective in building the talent pool: referrals from current employees, and online platforms and social media. Both approaches were cited by one third of those surveyed.

Along those lines, the CPE 100 cited two strategies as the most effective in building the talent pool: referrals from current employees, and online platforms and social media. Both approaches were cited by one third of those surveyed.

In addition to questions about labor-related challenges, the CPE 100 were also asked the Sentiment Survey’s standard questions about prospects for the industry and the economy as a whole. These issues were raised at a time when several new concerns have emerged or intensified since the previous survey: inflation, a national labor shortage and shipping bottlenecks at coastal ports lead the list, as well as the persistence of the pandemic.

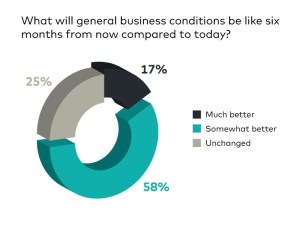

Nevertheless, the views of the CPE 100 on the economic outlook have remained remarkably consistent this year. In the most recent survey, 58 percent of participants predicted that the economy would be better in six months.

Nevertheless, the views of the CPE 100 on the economic outlook have remained remarkably consistent this year. In the most recent survey, 58 percent of participants predicted that the economy would be better in six months.

That result varies only slightly from the 53 percent who held that view in the previous survey and 56 percent in the first quarter.

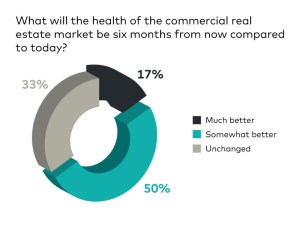

Concerns about the economy’s performance may be taking at least a moderate toll on the CPE 100’s outlook on the industry’s prospects.

According to the latest survey, only 67 percent of the CPE 100 now expect the industry’s performance to be better in six months. That has slipped noticeably from 86 percent during the second quarter and 81 percent during the first quarter.

According to the latest survey, only 67 percent of the CPE 100 now expect the industry’s performance to be better in six months. That has slipped noticeably from 86 percent during the second quarter and 81 percent during the first quarter.

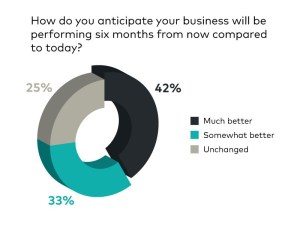

Respondents likewise seem somewhat less upbeat about the prospects for their own firms than they were earlier this year.

The latest survey shows that 77 percent of the CPE 100 expect company performance to improve six months from now. That has slipped from 94 percent in the second quarter’s survey and 88 percent during the first quarter.

That said, however, these results should probably be viewed in the context of a slow and fluctuating recovery from a difficult downturn. Two years ago, during the third quarter of 2019, 61 percent of the CPE 100 believed that their firms would be performing somewhat better or much better in six months.

That said, however, these results should probably be viewed in the context of a slow and fluctuating recovery from a difficult downturn. Two years ago, during the third quarter of 2019, 61 percent of the CPE 100 believed that their firms would be performing somewhat better or much better in six months.

And in 2019, only 38 percent expected the commercial real estate market as a whole to be performing better six months in the future—30 percent less than hold that view in the latest survey.

You must be logged in to post a comment.