Cushman & Wakefield Research Head Offers Forecast for 2020

What’s in store for commercial real estate—slowdown, recession or neither? Revathi Greenwood presents the outlook at NAREE’s national conference in Las Vegas.

The now nearly nine-year-long cycle may come to an end two years from now—or the economy may just slow down. Cushman & Wakefield is betting on a slowdown, according to Revathi Greenwood, the real estate service firm’s Americas head of research. She presented the commercial real estate outlook at the recent National Association of Real Estate Editors annual real estate journalism conference in Las Vegas.

With the current cycle just over a year shy of the longest expansion in the past 60 years, following only the 1991-2001 period, Greenwood pointed to three key elements impacting commercial real estate performance: investor interest, real estate fundamentals and long-term structural drivers. Since geopolitical events impact CRE more indirectly by driving the economic cycle, current red flags include stock market performance, wage growth and debt levels, she noted, while issues that could push the U.S. over the edge include national policies, NAFTA/trade wars, an inverted yield curve and immigration issues.

City growth is critical to real estate performance, and preferences among major demographic groups are shaping its future: Overall, the Sunbelt dominates growth potential, with empty nesters migrating to the Southwest and Millennials to the Southeast. A little-discussed but important point, though, is that Millennials have relatively lower incomes than their parents did at their age, while student loans are up significantly. Totaling more than $1.3 trillion, they account for 10.5 percent of household debt.

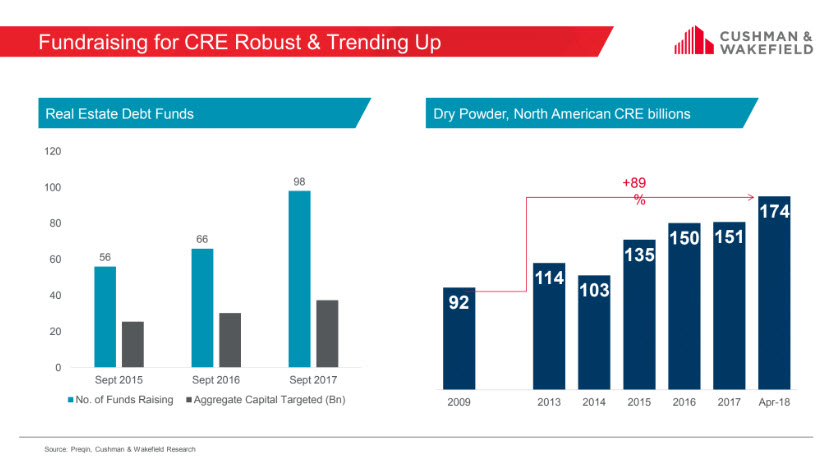

Capital in the wings

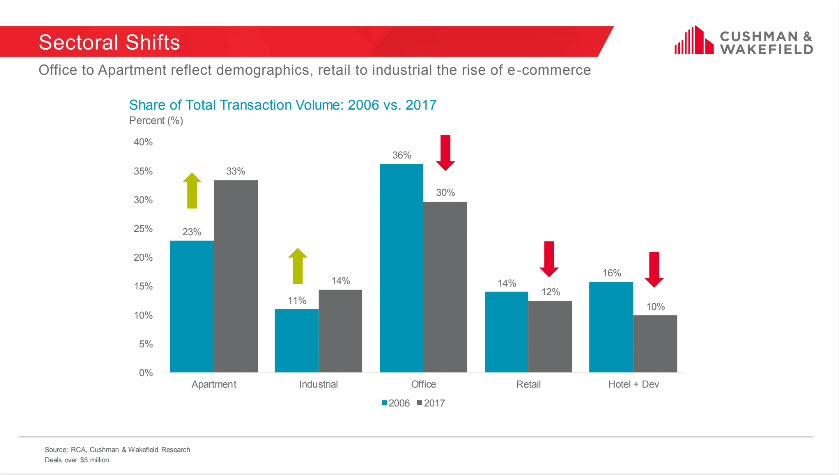

Plenty of capital is sitting on the sidelines, waiting for prices to drop. As of April 2018, it totaled $174 billion, up 89 percent over 2009, with an annual increase in each but one of the past five years. The number of real estate debt funds has also increased. Investors are favoring multifamily and industrial over office, retail and hotel properties. Prices continue to rise across property sectors, but CBD office, multifamily and industrial are seeing the greatest increases.

Plenty of capital is sitting on the sidelines, waiting for prices to drop. As of April 2018, it totaled $174 billion, up 89 percent over 2009, with an annual increase in each but one of the past five years. The number of real estate debt funds has also increased. Investors are favoring multifamily and industrial over office, retail and hotel properties. Prices continue to rise across property sectors, but CBD office, multifamily and industrial are seeing the greatest increases.

Disruptors impacting the industry include technology, the rise of which Greenwood equated to the financial industry in the 1980s and ‘90s, driving jobs; riding hailing, which is largely done to avoid parking difficulties (not just for convenience); the war for talent; and e-commerce. Online shopping, in fact, is projected to rise from 15 percent of sales today to 18 percent.

Office is all about location, with demand led by the high-tech, financial services and business services sectors. Completions have continued to rise, while net absorption has been falling, leading to an increase in vacancy since 2017.

Office is all about location, with demand led by the high-tech, financial services and business services sectors. Completions have continued to rise, while net absorption has been falling, leading to an increase in vacancy since 2017.

Multifamily is challenged by rising rents that are decreasing affordability, although the suburbs are seeing growth. Greenwood forecast that vacancies will remain near their historical lows as demand outpaces supply.

Meanwhile, retail performance is dependent on class, with Class A doing well, B dependent on location, and C impacted by in-store performance. Industrial, on the other hand, is “the absolute darling of the commercial real estate market today,” she said, with both absorption and rents at all-time highs. Absorption will decrease over the next couple of years, stabilizing vacancies, but rents will continue to rise.

You must be logged in to post a comment.