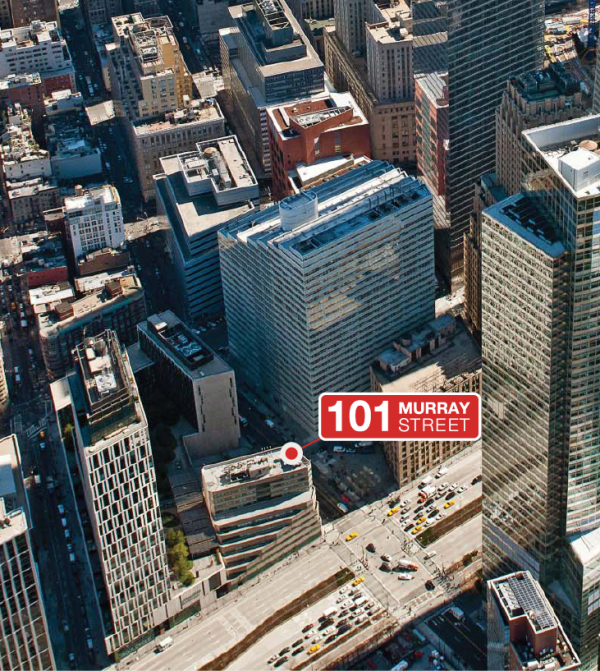

C&W Reps St. John’s University in Sale of 101 Murray St. in Lower Manhattan

St. John’s University “had their pick of offers” after it put its prime Lower Manhattan campus at 101 Murray St. up for sale and the result was a record-setting $223 million deal between the university and The Witkoff Group, Fisher Brothers and Vector Group.

By Gail Kalinoski, Contributing Editor

St. John’s University “had their pick of offers” after it put its prime Lower Manhattan campus at 101 Murray St. up for sale and the result was a record-setting $223 million deal between the university and The Witkoff Group, Fisher Brothers and Vector Group Ltd. The partnership plans a mixed-use residential building ranging from 310,028 to 373,336 square feet in the highly sought-after Tribeca neighborhood.

When St. John’s hired Cushman & Wakefield’s Capital Markets team to market the property in March, the university reportedly hoped to sell the 10-story, 145,525 square-foot-building at Murray and West streets for $150 million to $200 million. The sale, which closed last week and was announced this week, became the largest residential site sale in Lower Manhattan and set a record price for the area, according to a Cushman & Wakefield news release.

“The feedback from the market was overwhelmingly positive from the outset and we received widespread interest from the most likely candidates, as well as those you would not immediately think of. It was clear very early on that there were many more-than-qualified buyers who recognized just how unique and exciting a project at 101 Murray St. will be,” Helen Hwang, Cushman & Wakefield executive vice president, told Commercial Property Executive. “In the end, we are thrilled that St. John’s had their pick of offers from many world-class developers, including The Witkoff Group and Fisher Brothers.”

Nat Rockett, Karen Wiedenmann, Steve Kohn and Michael Rotchford, also from the Cushman & Wakefield New York Capital Markets team, assisted in the transaction.

“Cushman & Wakefield has done an extraordinary job, with a first-rate team, representing us in the sale of our current Manhattan campus,” Martha Hirst, executive vice president, chief operating officer and treasurer at St. John’s University, said in the release. “The University takes great pride in our presence in New York City, and the overwhelming success of this transaction allows us to ensure the strength of that presence for generations of St. John’s students to come.”

The site provides a 31,028 square-foot footprint that will allow for maximum design flexibilities. There is no height restriction, allowing the developer to maximize ceiling heights and enhance the views from the residences. The partnership said it would demolish the current building and construct a mixed-use building with residential and commercial spaces. Design plans have not been announced.

“Lower Manhattan continues to evolve at a record-setting pace and we are proud to be a part of it, along with The Witkoff Group,” Winston Fisher, partner at Fisher Brothers, a developer of commercial and residential properties in New York City and Washington, D.C., said in a separate release from the partnership.

Steven Witkoff, chairman and CEO of The Witkoff Group, a real estate investment firm that owns a diverse portfolio of office, industrial, residential properties and land and hotel interests in select U.S. markets, said the partnership was helping to define Lower Manhattan, which he called one of the fastest growing areas in New York City.

“We believe 101 Murray will be another highly sought-after destination,” he said in the partnership release.

Hwang also pointed to the ongoing transformation in Lower Manhattan as playing a role in the bidding war for 101 Murray St., citing $30 billion in public and private investment in the area. She also noted that development parcels in Tribeca are difficult to acquire.

“We are in a market where high-class, scalable development sites are extremely rare, and in a neighborhood, Tribeca, that is not only the most desirable from a residential point-of-view, but where land parcels for new construction are almost non-existent,” she told CPE. “At the same time, we are witnessing unprecedented demand for residential space citywide, particularly for luxury residences that offer modern amenities and finishes, a market that is underserved.”

St. John’s, a Catholic university with campuses in Queens, Staten Island and Rome, Italy, has owned the Murray Street property since 2001, when it merged with the School of Risk Management, which is now part of The Peter J. Tobin College of Business at St. John’s. The “vertical campus” also houses the Global Studies language and other programs. St. John’s, which will remain at 101 Murray St. until mid-2014, will look for a new Manhattan location for the start of the 2014-2015 academic year.

Proceeds from the sale will be used to enhance the university’s academic offerings, improve facilities and boost the endowment, which will enable it to offer more financial aid for students. Hirst along with university General Counsel Joseph Oliva led the in-house team on the transaction. Thomas Henry, a partner at Willkie Farr & Gallagher L.L.P., headed the team from the law firm that served as outside real estate counsel to the university.

You must be logged in to post a comment.