Data Center Demand Keeps Surging Despite Challenges

And how the industry is responding to the hurdles, according to JLL’s latest report.

The rapid expansion of the data center sector is expected to continue in 2025 despite power constraints and demand that is outpacing supply, according to JLL’s latest outlook.

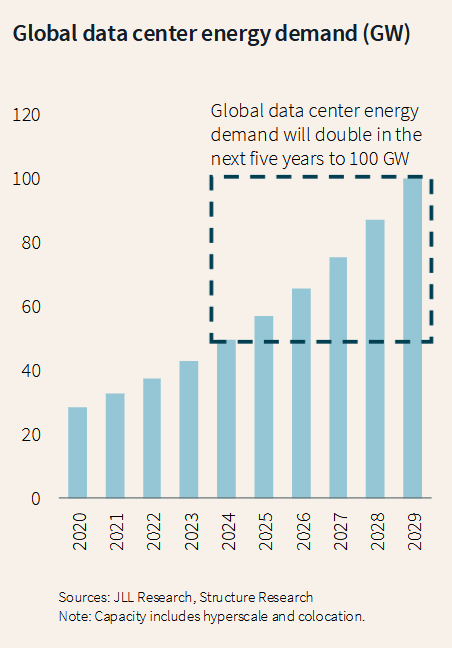

Globally, the data center capacity is likely to expand 15 percent per year through 2027, perhaps more, with capacity in the Americas (led by the U.S.) expanding to roughly 30 gigawatts.

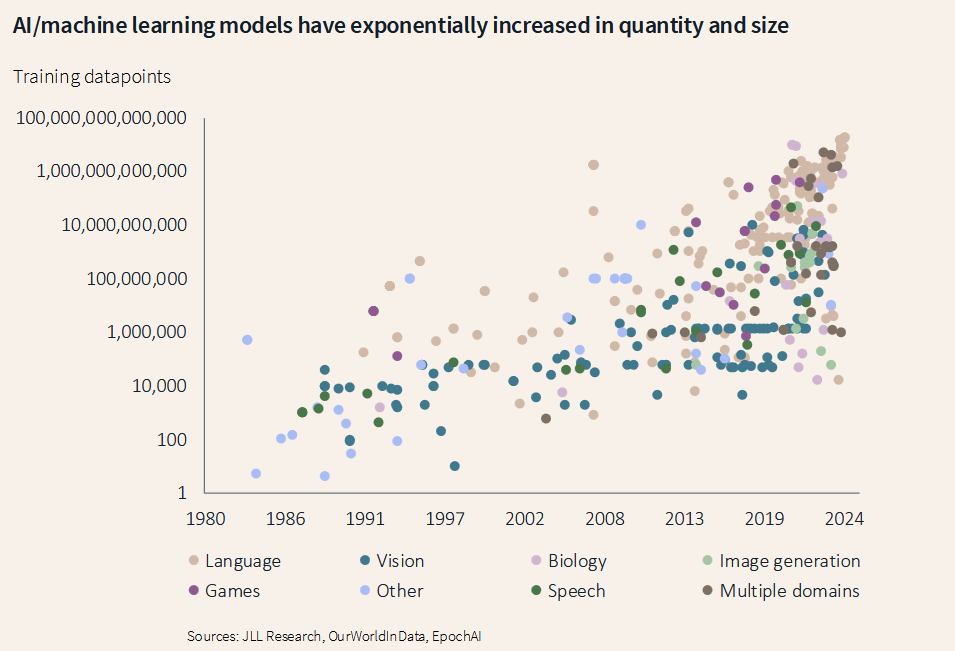

One of the prime spurs of data center growth will be the parallel growth of AI applications, which are expanding rapidly across nearly all U.S. and global industries. Capital expenditures on the technology have risen sharply during this decade, including that by Alphabet, Amazon, Meta and Microsoft, with preliminary estimates putting the total at more than $200 billion in 2025, or more than twice as much as in 2020.

AI demand will mean more than just accelerated power demand, but also a push for further miniaturization in data center design. JLL anticipates that advances in chips will eventually reach 250 kW per rack, an amount the report calls “astounding.”

“The ability to train, iterate and improve AI models at much faster speeds is making the entire AI ecosystem more valuable,” the report noted. “The pace of AI innovation will continue to accelerate with each new generation of GPUs.”

READ ALSO: Are Data Centers Immune to CRE Market Forces?

Though AI will continue to grow, for the data center industry, data storage and cloud-based applications still make up the majority of demand. Optimistic adoption scenarios suggest that AI workloads will still represent less than 50 percent of data center capacity in 2030.

Energy demand

Data centers use a considerable amount of energy, but they will actually represent a relatively small portion of the near-future increase in demand for energy, despite media attention on the subject. Currently, only about 2 percent of electricity worldwide goes toward powering data centers. The increase in electricity demand by data centers through 2030 is projected to be less than a third of that needed for both EVs and air conditioning.

Even so, the fact that data centers tend to cluster in certain places, such as Northern Virginia, tends to put pressure on power grids in those places. In Virginia, data centers represent more than a quarter of power demand. Such concentrations will pose challenges in the further development of data centers, with much of the delay associated with securing easements and regulatory approvals.

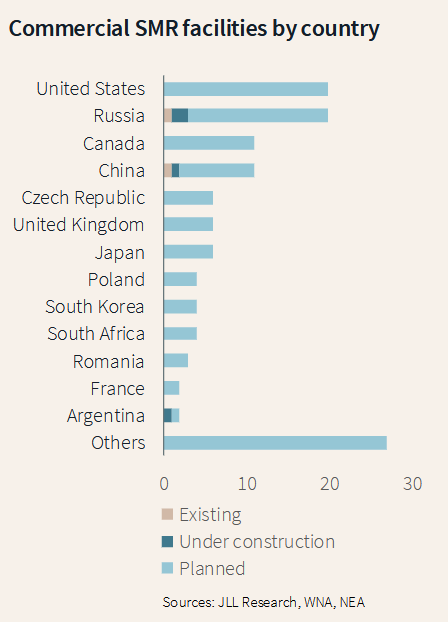

Nuclear power is emerging as a solution to meet the demands of data centers, according to JLL. Some of that demand will be met by conventional reactors, but much might eventually be met by small modular reactors, which can provide a scalable range of power, from 1.5 MW to 300 MW. SMR technology is still being developed, however, and may not make an impact on the data center power industry until the 2030s.

Data center efficiency

Power isn’t the only challenge faced by the data center industry, according to the JLL report. As AI expands, cooling increasingly dense and power-hungry data centers will be increasingly urgent. The development of more energy-efficient chip architectures and advanced liquid cooling systems will be part of the industry’s response.

The need for more immersion cooling will change the design of data centers, the report explains, with liquid cooling more important than ever for high-density racks.

“Immersion cooling introduces new challenges in structural design due to weight consideration,” the report says. “The weight of the largest cooling baths can reach up to four metric tons when filled with equipment and cooling fluid, which requires significantly reinforced flooring.”

Despite the challenges facing data centers, investors will remain interested in the sector, JLL predicted. Different classes of investors generally have different goals in data centers: Institutional investors have been acquiring global operators, while private equity focuses on funding development. Alternative investors buy individual assets when they can.

This year promises to be another record year for data center development, with an estimated 10 GW projected to break ground globally in 2025. On the other hand, a relatively small number of data centers trade each year because they simply don’t come on the market that often.

Global data center investment sales have averaged just $7 billion annually since 2020, JLL reported. That compares to an annual average of $241 billion for office assets over the same period.

You must be logged in to post a comment.