Debt Has the Potential to Outperform Core Equity in 2020

Core plus debt offers returns approximately 300 bps higher than implied senior loan pricing, notes CenterSquare's Scott Crowe.

Investors’ response to the continued deceleration in core private equity real estate performance has been to seek alternative real estate exposures, including the emerging asset class of private real estate debt. One of the latest strategies here is “core-plus” debt investing as a market opportunity has emerged because of the retreat by traditional lenders in response to increased regulation and risk aversion. We view core-plus debt as a mispriced asset class and expect it to outperform core equity and broader fixed income returns, with lower risk. Importantly, we believe today represents a timely moment to explore this investment opportunity given risks from a slowing growth environment entering 2020.

Core-plus Real Estate Debt

The core-plus real estate debt asset class is relatively nascent, consisting of newly originated loans primarily secured by institutionally owned, fully-stabilized office and multifamily properties in economically diverse markets. The stabilized collateral with contractual cash flows that underpins core-plus debt investment distinguishes it from other forms of real estate debt that lend against highly transitional assets that rely heavily on the success of value-add business plans and speculative new construction. This higher quality collateral base of core-plus debt drives its lower risk profile.

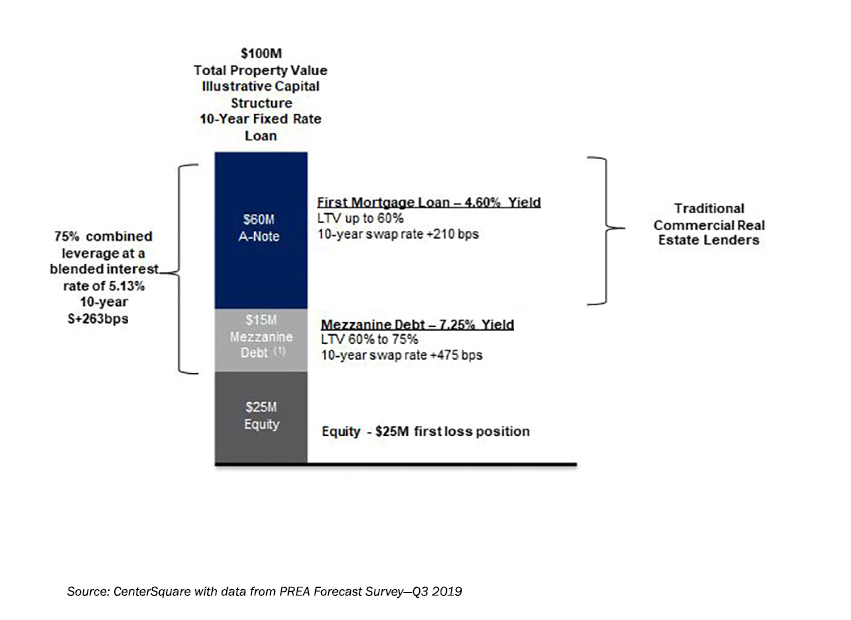

While increased regulation and heightened risk aversion have forced traditional lenders to cap senior loans at around 60 percent loan-to-value (LTV), many borrowers still demand higher LTV solutions to implement their real estate investment strategies. To remain competitive and meet this market-driven need, senior lenders partner with non-traditional real estate lenders to provide the 60-75 percent LTV component of the capital stack for high-quality assets. Low interest rates and high competition for senior loan origination have driven down interest rates for first mortgages. Hence, the mezzanine lender enjoys a 265bps premium over the senior lender rate while the incremental leverage only adds 50-60bps to the overall borrowing rate.

Has the Potential to Outperform Real Estate Equity

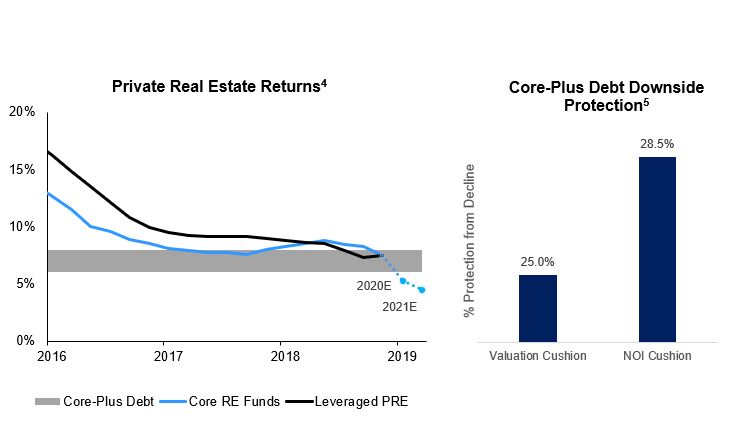

The end of cap rate compression, coupled with a catch-up in supply that is diminishing NOI growth, has driven a significant deceleration in private real estate returns. With forecasts for commercial real estate equity to deliver total net returns of 5.3 percent in 2020 and 4.5 percent in 2021 , expected core-plus debt unlevered net returns of 6-8 percent have the potential to outperform with lower levels of risk. In fact, on an LTV basis (given a loan cut-off of 75 percent) or net income basis (1.4x DSCR), declines of approximately 25 percent in values or approximately 30 percent in income would be required before risking impairment.

A Mispriced Asset Class

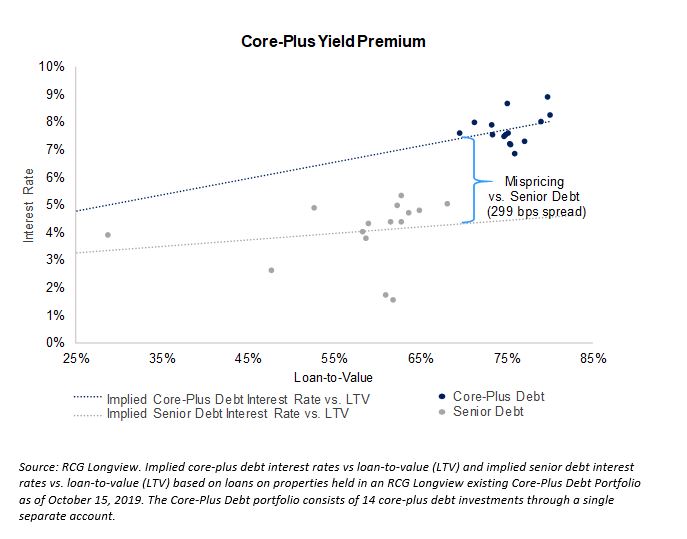

We believe core-plus debt is a mispriced asset class, offering returns approximately 300bps higher than implied senior loan pricing. This core-plus yield premium is being driven by three primary reasons. First, when skilled lenders originate private loans, the imperfect information created and captured is unavailable to others to arbitrage, creating a return premium. Second, as the mezzanine lender forecloses on the equity in the case of a default, the ability of the mezzanine lender to operate the real estate and protect the senior lender’s investment is a consideration that can create a return premium. And lastly, senior lenders do not always want to warehouse mezzanine loans in advance of a securitization and will pay a premium to shift some of the risk at closing of the loan.

Given decelerating core private equity real estate returns, core-plus debt is an especially attractive real estate strategy as there is an excess return premium available for sophisticated core-plus debt investors in the 60-75 percent LTV component of the capital stack. This mispriced asset class, with expected unlevered net returns likely to outperform core equity and broader fixed income, provides an interesting investment opportunity today.

Scott Crowe is the Chief Investment Strategist of CenterSquare. The statements and conclusions made in this article are not guarantees and are merely the opinion of CenterSquare and its employees. Any statements and opinions expressed are as of the date of this article, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of CenterSquare. Material in this article is for general information and is not intended to provide specific advice or recommendations for any purchase or sale of any specific security or commodity. Benchmarks used in this article are broad-based indices which are used for illustrative purposes only. Comparisons to benchmarks have limitations as benchmarks have volatility and other material characteristics that may differ from actual investment portfolios. Because of these limitations, benchmarks may not be an accurate measure of comparison.

You must be logged in to post a comment.