Calculating the Debt Service Coverage Ratio and Why It Matters

The DSCR is one of the most important concepts for lenders and, therefore, borrowers, according to Stephen A. Sobin of Select Commercial Funding LLC.

Stephen A. Sobin

Many new commercial real estate investors have a hard time wrapping their heads around all the different metrics and terms used in the industry. In fact, there are even many experienced professionals who don’t have a clear understanding of what these metrics actually mean. Debt service coverage ratio is one of the most important concepts in the commercial real estate.

Every commercial lender will heavily scrutinize this metric when evaluating whether your property qualifies for a commercial mortgage or not. It therefore behooves you as an investor to really understand what this ratio is all about. If you don’t feel completely comfortable with this concept, then keep reading. This article is for you.

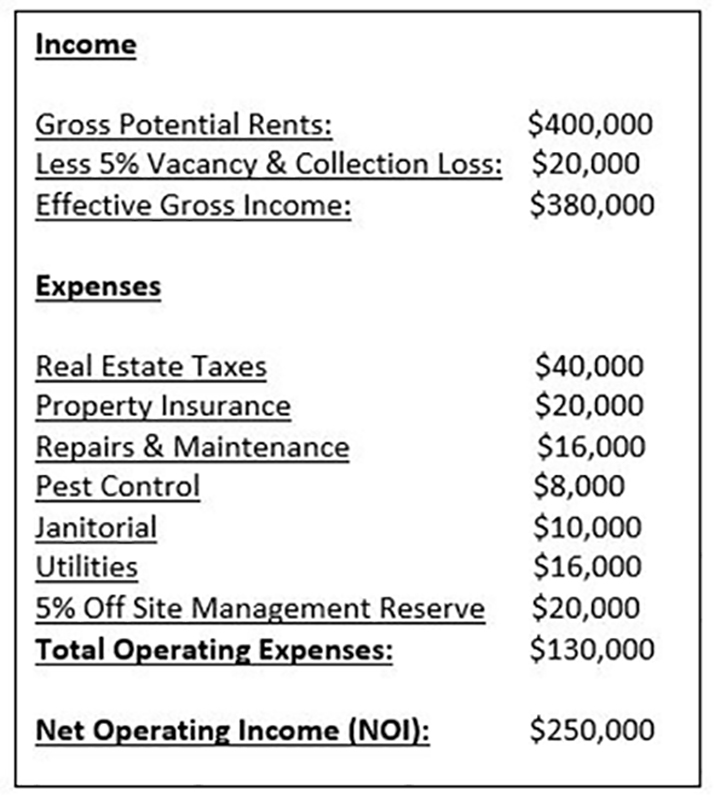

The debt service coverage ratio is the relationship between a property’s net operating income and its annual principal and interest mortgage payments or debt service. Consider the following example. An apartment building in Chicago generates $250,000 in net operating income. The owner of this property pays annual principal and interest payments of $200,030. The debt service ratio of this property is a tad under 1.25 (1.249). Let’s dive a little deeper into this example to really flesh out how to calculate the debt service coverage ratio. The following profit and loss statement details the annual income and expenses of the above apartment building:

After calculating the total gross income and deducting the operating expenses, we see that the property generates $125,000 in net operating income. Now let’s talk about the mortgage payment on the property.

After calculating the total gross income and deducting the operating expenses, we see that the property generates $125,000 in net operating income. Now let’s talk about the mortgage payment on the property.

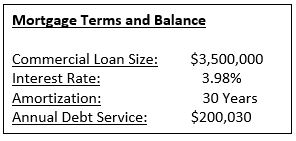

Assume the following loan terms: With these numbers in mind we can now calculate the debt service coverage ratio of this apartment building. Remember that this property generates $250,000 of net operating income and the borrower must pay $200,030 in debt service annually. In order to figure out the debt service ratio, you simply divide the NOI ($250,000) by the debt service ($200,030). As mentioned above, this equals about 1.249. But why does this metric matter?

Well, it’s actually quite simple. If you break down this concept even further, you’ll realize that this property’s DSCR really tells us that the building generates about $1.25 in income for every $1 you owe to the lender. If, for example, the DSCR of a property would be at 1, that would indicate that the property generates just enough money to cover the mortgage payments, and if the DSCR is under 1, that means that the property income can’t cover the proposed loan terms.

Since commercial mortgage loans are mostly based on the cash flow of the property in question, lenders will always want to ensure that the property generates enough net operating income to cover the debt service. This is in contrast to residential mortgages where the debt-to-income metric is used. In the commercial space, lenders typically want to make sure the property income itself covers the mortgage (aside from any outside income the borrower may have). In case any unforeseen incidents occur during the loan term such as vacancies or extra expenses, lenders want to make sure that the property actually generates more annual income than the annual mortgage payments. It’s standard in the commercial mortgage industry to look for a DSCR of at least 1.25 when underwriting a commercial loan. If a proposed loan amount does not reach the lender’s minimum debt service coverage ratio requirement, the loan is said to be debt service constrained and the lender will reduce the loan amount.

Since commercial mortgage loans are mostly based on the cash flow of the property in question, lenders will always want to ensure that the property generates enough net operating income to cover the debt service. This is in contrast to residential mortgages where the debt-to-income metric is used. In the commercial space, lenders typically want to make sure the property income itself covers the mortgage (aside from any outside income the borrower may have). In case any unforeseen incidents occur during the loan term such as vacancies or extra expenses, lenders want to make sure that the property actually generates more annual income than the annual mortgage payments. It’s standard in the commercial mortgage industry to look for a DSCR of at least 1.25 when underwriting a commercial loan. If a proposed loan amount does not reach the lender’s minimum debt service coverage ratio requirement, the loan is said to be debt service constrained and the lender will reduce the loan amount.

While most lenders only look at the property income when calculating DSCR, there are some lenders that make commercial real estate loans based on “global DSCR.” These lenders will take both personal and property income and expenses into account when calculating the debt service coverage ratio. Thus, if a property has a weak cash flow but the borrower has other supplemental income that brings his overall income above the lender’s debt service coverage ratio threshold, the loan will still be doable. For example, if the property in the case above only generated $200,030 (at a 1 DSCR) but the borrower has a part-time job that generates $50,000 of income, the global debt service coverage ratio would meet the 1.25 DSCR requirement.

One last thing to consider when calculating the debt service ratio is how lenders calculate expenses. Many borrowers only include the actual expenses of the property in their calculations. While this may sound intuitive, lenders don’t typically limit themselves to the actual expenses when evaluating the debt service ratio. Even if a property is 100 percent occupied, lenders will typically assume a vacancy factor of about 5 percent to safeguard against any potential future vacancies. Furthermore, lenders typically assume a management fee of about 5 percent of the effective gross income (even if the property is self-managed). Lenders do this because they need to underwrite loans based on the potential that they will need to foreclose on the property and hire a management company to manage the property. They need to make sure that the property will still generate enough income in such a situation. Lastly, lenders will often assume an annual repair and maintenance fee of about $750-$1,000 per unit (even if the actual repair expense is much less). It’s really important to remember to calculate the debt service ratio based on how the lender will look at it. After all, they are on the ones lending the money!

Stephen A. Sobin is the president & founder of Select Commercial Funding LLC, a nationwide mortgage brokerage company specializing in commercial mortgages and apartment loans.

You must be logged in to post a comment.