What Do Office Tenants Want?

New strategies for winning & keeping office tenants.

By Nancy Crotti

One day not long ago, a young adult showed up for an interview at a prospective workplace: a dark brick, 1980s-era building with an imposing lobby. The job candidate took one look, turned around and left without having the interview.

One day not long ago, a young adult showed up for an interview at a prospective workplace: a dark brick, 1980s-era building with an imposing lobby. The job candidate took one look, turned around and left without having the interview.

Other potential employees—all Millennials—did the same. Finally, the human resources warned the real estate department that the company would lose more talented recruits unless it upgraded the property, recalled Bernice Boucher, managing director of workplace strategy at JLL.

The company invested millions to make the lobby more welcoming and renovate a basement cafeteria. It did not, however, jettison cubicles in favor of a more open work environment. The company ended up moving.

Boucher’s anecdote gets to the heart of a vital and complex question: What do office tenants want?

In some respects, the answers are becoming clearer. Today’s standards call for large open spaces with a side-core layout and plenty of natural light. Preferred amenities include a rooftop park or patio, a fitness center, car-charging stations, bicycle lockers and showers. On the high-tech wish list: Smart elevators, HVAC designed for flexibility, and data systems suited to a mobile workforce.

In some respects, the answers are becoming clearer. Today’s standards call for large open spaces with a side-core layout and plenty of natural light. Preferred amenities include a rooftop park or patio, a fitness center, car-charging stations, bicycle lockers and showers. On the high-tech wish list: Smart elevators, HVAC designed for flexibility, and data systems suited to a mobile workforce.

One example that may embody the future is The Edge, a 430,000-square-foot Class A building developed by OVG Real Estate in its hometown of Amsterdam. Dubbed “The Smartest Building in the World” by Bloomberg News, The Edge “knows” each worker’s schedule, and uses a smartphone app to locate a desk for everyone daily.

“The building can know who you are by your license plate on your car, and welcome you and direct you to a parking space,” Boucher explained. “I know there’s a creepy aspect to it, but if you want the ultimate tenant experience, there’s an app on your phone.”

Yet buildings need not be as high-tech as The Edge to compete. According to Kingsley Associates’ second-quarter survey, more than 88 percent of office occupants reported being generally happy with their space, a higher share than in 2013, noted John Falco, a Kingsley principal. Nearly 70 percent said they received value for the money.

“This indicates that landlords are realizing the importance of keeping their tenants happy, and that is giving landlords the power in most major markets,” Falco explained. “If a landlord focuses on delivering high levels of customer service, they tilt the balance of power in their direction due to the cost and time associated with a tenant moving.”

For office tenants who described themselves as likely to renew their leases, location was overwhelmingly the most important factor, cited by 81 percent of respondents. Rounding out the top five factors were building quality (cited by 51 percent), the company’s space requirements (44 percent), property management (42 percent) and price (37 percent). Even if their rent goes up, these tenants recognize that moving is usually more costly and painful than renewing, Falco noted.

It doesn’t always have to be, however, as many smaller companies have discovered, observed Steve Purpura, managing partner & Northeast market leader for Transwestern. For example, tech startups that spent their infancies in co-working spaces, such as WeWork, want prebuilt suites that they can occupy awhile, then move on, Purpura said.

These tenants also want shorter, more flexible leases. If landlords can get tenants to agree to a termination option, tenants must pay for unamortized expenses if they leave early. “It’s a penalty, but not a huge penalty,” said Phil Utigard, executive vice president of Transwestern in Chicago.

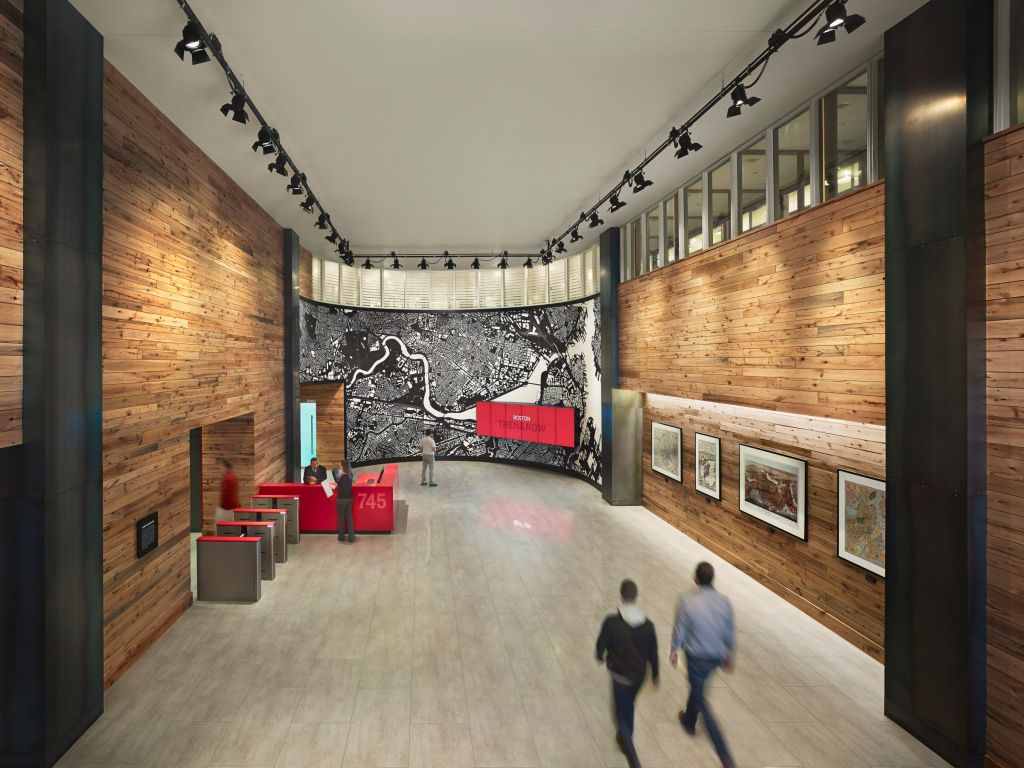

Most companies, however, want more than a cookie-cutter setting. They value lobbies that double as common spaces for work and socialization. Toward that end, winning lobbies feature soft seating, blond wood, white stone and contemporary art, plus a retail or food component, Purpura said.

Also desirable are locations near mass transit and elements that evoke a feeling of wellness, such as abundant natural light and high-quality indoor air. “It’s the new sustainability,” Utigard explained.

Price Pacesetters

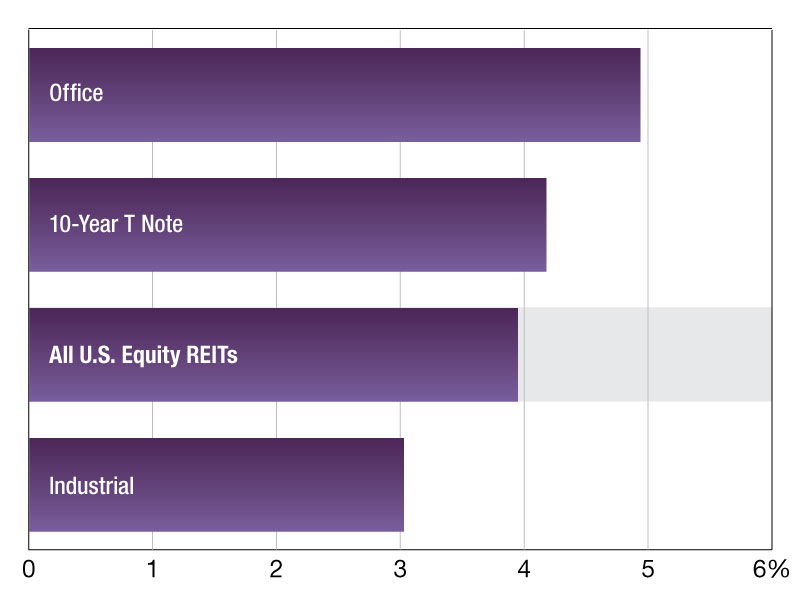

Landlords who provide this type of environment in new construction or in renovated space are setting the pace. Rents for Midtown Manhattan trophy towers have reached $140 per square foot, Purpura noted. Elsewhere, trophy space under construction commands $55 per square foot on average, JLL notes in a third-quarter report. Class A space in the pipeline can fetch nearly $43 per square foot.

Landlords who provide this type of environment in new construction or in renovated space are setting the pace. Rents for Midtown Manhattan trophy towers have reached $140 per square foot, Purpura noted. Elsewhere, trophy space under construction commands $55 per square foot on average, JLL notes in a third-quarter report. Class A space in the pipeline can fetch nearly $43 per square foot.

“Those are very, very strong rents,” Purpura said. “I think in the short term, they’re probably pretty stable.”

It’s easier to attract tenants to an older building that’s been remodeled to suit their tastes. “What’s great about those buildings is they often have operable windows, so you not only get the natural light but also the fresh air,” Boucher said, adding, “They have a much more creative vibe to them when they’re renovated and done well.”

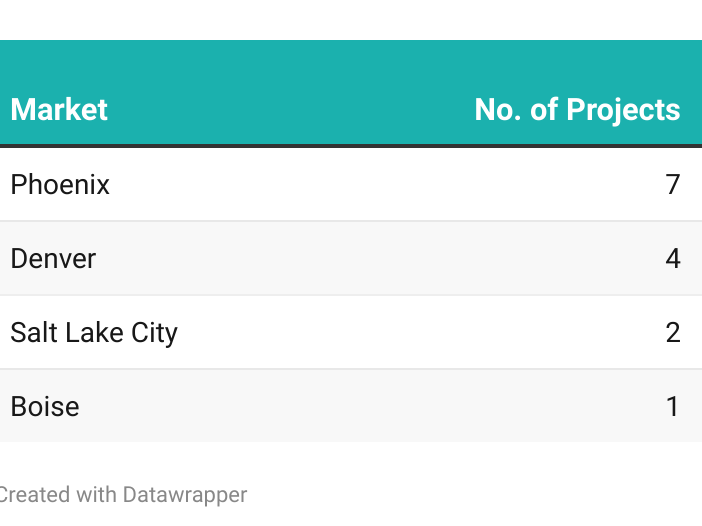

In cities like Chicago, Seattle, San Francisco and Dallas, many tenants are gravitating toward warehouse and manufacturing districts. The Dallas Arts District, to name one, is “the hip, new, live-work-play place (with) lots of residential development where Millennials are living,” Utigard said. “It’s perceived as being the place to be to attract talent.”

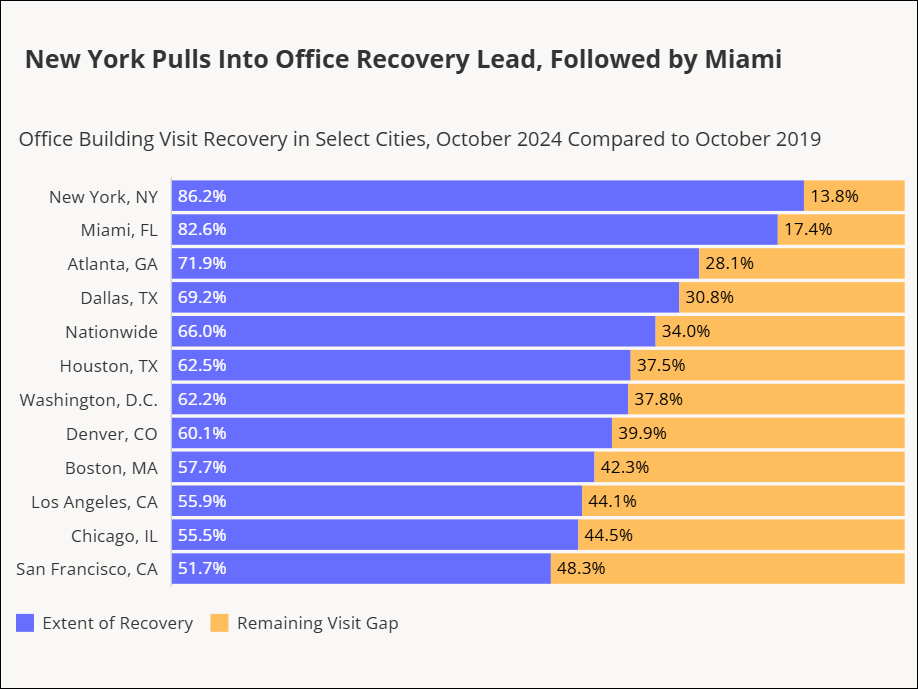

In the aftermath of the Great Recession, a dearth of construction financing led to ramped-up renovation of older buildings. Renewed tenant demand is now yielding a solid return that investment, Boucher said.

What about the future? Tenants who signed leases at bargain rates during the recession likely face rent hikes, Boucher said. Some may shift from Class A properties to Class B buildings as more space in the latter opens up. Those feeling the pinch of low vacancy will likely benefit as new product comes on line next year, she added.

And Utigard urged tenants in strong markets to start talking to their landlords when lease expiration is three years out.

“Get on it,” he said.

You must be logged in to post a comment.