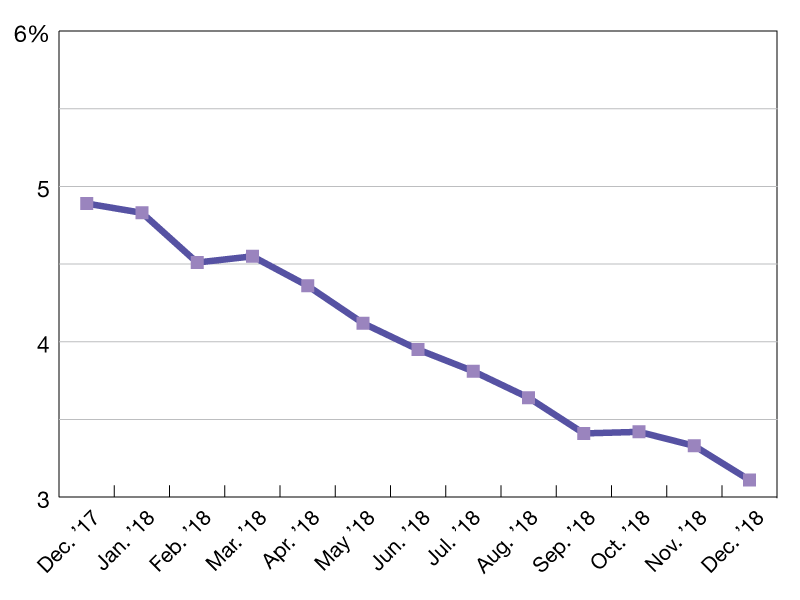

2018 CMBS Delinquency Rates

The delinquency reading dropped in 10 of the 12 months of 2018. In total, the rate shed 178 basis points during 2018.

The Trepp CMBS Delinquency Rate concluded 2018 on a positive note as the reading dropped sharply in December and reached another post-crisis low. The rate fell 22 basis points from 3.3 percent in November to 3.1 percent in December. The delinquency reading dropped in 10 of the 12 months of 2018. In total, the rate shed 178 basis points during 2018.

Several months ago, we posited that the delinquency rate could have cracked 3 percent by the end of the year. Although it didn’t quite drop that low, it certainly came close. Looking ahead to 2019, we expect the delinquency rate to continue to compress during, at least, the first half of the year. By then, most of the legacy loans which are currently distressed should be resolved and removed from the calculation.

The industrial delinquency rate fell 61 basis points to 2.4 percent. The industrial reading compressed 328 basis points in 2018, representing the largest year-over-year improvement among major property types.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Jan. 11, 2019

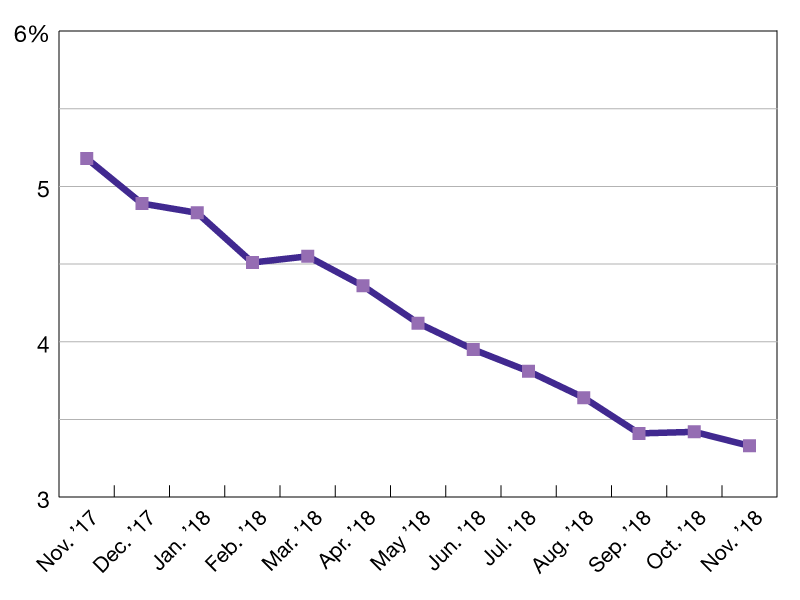

The Trepp Delinquency rate resumed its year-long downward trajectory in November, after its one-time uptick in October. The overall delinquency rate for US commercial real estate loans in CMBS is now 3.3 percent, a decrease of nine basis points from the October level.

The delinquency rate began to fall with consistency after June 2017 when its reading clocked in at 5.6 percent. Fortunately, the fabled Wall of Maturities entered its final stages around that time. The rate has now dropped in 15 of the 17 months from July 2017 to November 2018.

The November 2018 delinquency reading is 185 basis points lower than the year-ago level. Year-to-date, the rate has fallen 156 basis points. The November rate also represents a new post-financial crisis low for the reading. The delinquency rate’s peak of 10.3 percent was measured in July 2012.

The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or non-performing balloons) is now 3.3 percent, down 10 basis points for the month. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 3.5 percent, down eight basis points from October.

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Dec. 14, 2018

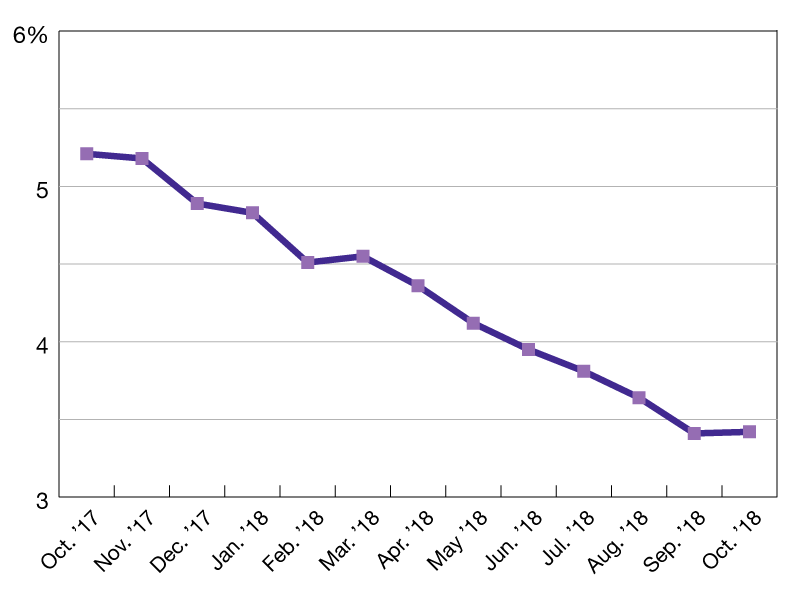

The Trepp CMBS Delinquency Rate took a timeout from its consistent improvement in October. The overall rate inched higher after falling in six straight months and 14 of the last 15 months prior to October. The overall delinquency rate for US commercial real estate loans in CMBS is now 3.4 percent, an increase of one basis point from the September reading.

The October 2018 rate is 179 basis points lower than the year-ago level. Year-to-date, the reading has fallen 147 basis points. The post-crisis low of 3.4 percent was set last month. The all-time high of 10.3 percent was registered in July 2012.

The percentage of loans that are seriously delinquent (60 or more days delinquent, in foreclosure, REO, or non-performing balloons) is now 3.4 percent, up three basis points from September. If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 3.5 percent, two basis points higher month over month. One year ago, the US CMBS delinquency rate was 5.2 percent (down 179 basis points since then).

Manus Clancy is Senior Managing Director of Applied Data & Research.

—Posted on Nov. 9, 2018

You must be logged in to post a comment.