Delinquency Rates for Commercial Property Loans Declined Slightly in Q2 2024

The delinquency rate for most property types declined, with the exception of loans backed by office properties.

Delinquency rates for mortgages backed by commercial properties declined slightly during the second quarter of 2024. This is according to the Mortgage Bankers Association’s (MBA) latest commercial real estate finance (CREF) Loan Performance Survey, released in July.

The delinquency rate for most property types declined last quarter, with the exception of loans backed by office properties, which experienced an increase. Even so, the pace of increase in the delinquency rate for office property loans appears to have slowed in recent quarters.

Commercial properties are working through changes in interest rates, property values and the fundamentals of some properties. Each property and loan faces a unique mix of conditions depending on that property’s type and subtype, market and submarket, owner, vintage, deal terms and more. As more loans mature throughout the year, more properties will be adjusting to these new conditions.

The balance of commercial mortgages that are not current decreased slightly in the second quarter of 2024.

- 97.0 percent of outstanding loan balances were current or less than 30 days late at the end of the quarter, up from 96.8 percent in the first quarter of 2024.

- 2.5 percent were 90+ days delinquent or in REO, unchanged from the previous quarter.

- 0.2 percent were 60-90 days delinquent, down from 0.3 percent the previous quarter.

- 0.4 percent were 30-60 days delinquent, unchanged from the previous quarter.

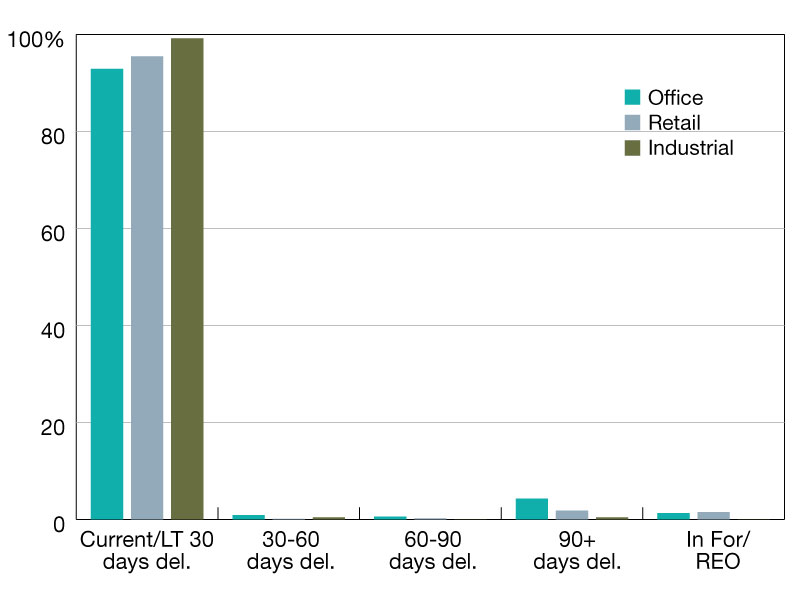

The share of loans that were delinquent increased for office properties and decreased for other property types.

- 7.1 percent of the balance of office property loan balances were 30 days or more days delinquent, up from 6.8 percent at the end of last quarter.

- 5.8 percent of the balance of lodging loans were delinquent, down from 6.3 percent the previous quarter.

- 4.5 percent of retail balances were delinquent, down from 4.7 percent.

- 1.1 percent of multifamily balances were delinquent, down from 1.2 percent.

- 0.8 percent of the balance of industrial property loans were delinquent, down from 1.2 percent.

Among capital sources, CMBS loan delinquency rates saw the highest levels despite seeing a decrease during the quarter.

- 4.8 percent of CMBS loan balances were 30 days or more delinquent, down from 5.2 percent last quarter.

- Non-current rates for other capital sources remained more moderate.

- 0.9 percent of FHA multifamily and health care loan balances were 30 days or more delinquent, up from 0.8 percent.

- 1.1 percent of life company loan balances were delinquent, down from 1.2 percent.

- 0.4 percent of GSE loan balances were delinquent, unchanged from the previous quarter.

Click here for more information on MBA’s CREF Loan Performance Survey.

You must be logged in to post a comment.