Demand for Lab Space Hits 10-Year Low

Venture capital funding could be the sector's lifeline, according to Avison Young’s latest research.

After 10 consecutive years of positive net absorption, the lab/R&D market is on track to break the streak in 2024, according to Avison Young’s U.S. life sciences report for the first half of 2024.

“Demand for lab space is the lowest it has been in the past 10 years,” Tucker White, Avison Young’s U.S. Life Science lead for Market Intelligence, told Commercial Property Executive.

Driven by speculative construction, sublease market activity and limited leasing velocity in the first half of 2024, the total availability rose to an all-time high of 26.4 percent, representing 47.5 million square feet.

According to the report, after the delivery of 3.3 million square feet during the first half of 2024 and project pauses totaling 1.3 million square feet, active construction now sits at 20.3 million square feet. With the pipeline 40 percent leased and ample availability concentrated across recent building deliveries, the market has time to absorb this new product.

READ ALSO: The Top Alternative Asset Class on Institutional Investors’ Radar

In the first half, construction starts totaled only 512,000 square feet across two buildings.

While some markets like Boston are seeing positive absorption in the first half of the year due to leased building deliveries, a drop in occupancy due to sublease vacancies occurred in other major markets including the Bay Area and Raleigh/Durham, influencing a negative occupancy performance.

“However, increased funding levels in the sector suggest that occupiers will need to put capital to work in the coming years, increasing the demand for lab space and filling up a top-heavy supply pipeline positioned to capture the sector’s growth,” White told CPE.

The report stated that this leasing activity could result from the prospect of more favorable economic conditions influenced by federal monetary policy.

Venture capital seeing a ‘welcome uptick’

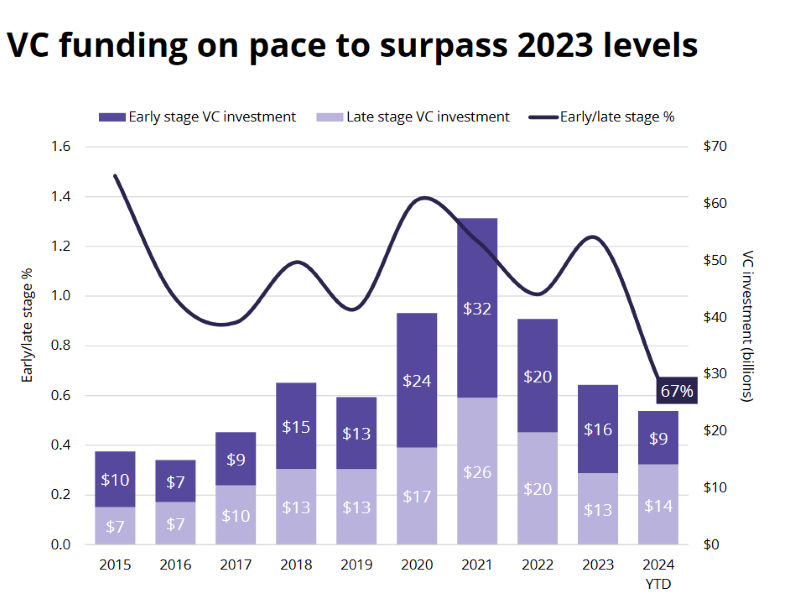

Savills’ second-quarter life science report found that venture capital funding increased nearly 30 percent in the first half of 2024 compared to the same period last year, with numerous companies raising hundreds of millions of dollars.

Substantial amounts of the life science development pipeline are set to be delivered by the end of the year, adding space to an already saturated market.

Smaller leases have been the primary driver of demand nationwide in the first half of the year, as many occupiers remain cost-conscious. Many tenants who previously occupied larger spaces are looking to densify their footprint or are delaying leasing decisions.

Bob Richards, JLL executive managing director, life science, told CPE that venture capital activity has seen a welcome uptick despite headwinds, which drives activity.

“While the supply-demand imbalance continues to be challenging, sophisticated landlords with assets in core markets leverage their experience and insights to outperform the competition,” Richards mentioned. “Additionally, tenants in today’s market have many opportunities and are achieving previously unattainable concessions.”

Life sciences growth starting to normalize

Nick Cassaro, vice president of life science development with BGO, told CPE he is starting to see life sciences, on a macro level, normalize to stable year-over-year growth seen before 2020.

“For companies with strong science backing, we will see large venture capital rounds to continue corporate and real estate growth, along with companies being acquired by larger pharmaceutical companies,” Cassaro said.

“With the current oversupply in major markets, large pharmaceutical companies—and smaller companies that have already fundraised—are beginning to look for additional space in prime developments. These developments will continue steadily growing due to more clarity in the financial markets regarding rate cuts and deployment of venture, BARDA and NIH funding.”

One area where investors are drawn is Gateway of Pacific, a five-phase lab and office development in South San Francisco that is highly sought-after by the biotech industry. More than 200 life science companies operate alongside a wide network of venture capital and a skilled workforce.

Salil Payappilly, senior vice president at BioMed Realty, told CPE that investors and tenants are increasingly demonstrating a preference for sustainable buildings, such as those featured there. BioMed Realty is a portfolio company within Blackstone’s Core+ Life Sciences Real Estate strategy and owns and operates the flagship campus.

No more ‘rocket ship’ years

Ken Richter, executive vice president & national lead for the life sciences sector at Project Management Advisors Inc., told CPE that while far short of the “rocket ship” years of 2020 and 2021, the bump in venture capital funding is welcome and brings the sector close to prepandemic levels.

“We are seeing a slight increase in interest from tenants, and once we get past the election, we expect that to continue to grow,” Richter said. “We are at a seminal moment in life sciences, as more purpose-built life science spaces are currently available than ever—and even more will be online over the next year. There are opportunities for prospective tenants to capitalize on some fantastic properties at rates that will not be available when the market picks back up.”

Daniel Maldonado, managing director of life sciences for the Americas at Unispace, told CPE that if life science venture capital activity continues to surge, “it absolutely has the potential to stimulate leasing activity and chip away at the oversupply of life science real estate. The sector has shown growth and resilience this year, especially in biotechnology and health-care advancements, and investors are noting.”

“After a significant decline in the life sciences industry in 2022, over the last few months we have witnessed a gradual recovery that now appears to be gaining more traction,” Maldonado said. “The life science sector demonstrates promising potential with a strengthening public equity market for biotech companies and substantial reserves held by major pharmaceutical firms and venture capital funds.”

He added that while expectations for 2024 do not anticipate a return to the fervor of 2021, there is optimism for significant improvements in deal activity and value creation compared to 2022 and 2023.

“With more venture capital active in the market, we should expect to see increased activity from newer life science companies looking to secure lab and manufacturing real estate and existing companies looking to renovate, expand or even relocate to address changing needs in the fast-moving research sector,” Maldonado concluded.

You must be logged in to post a comment.