Demand for Renewable Energy Fuels Investment

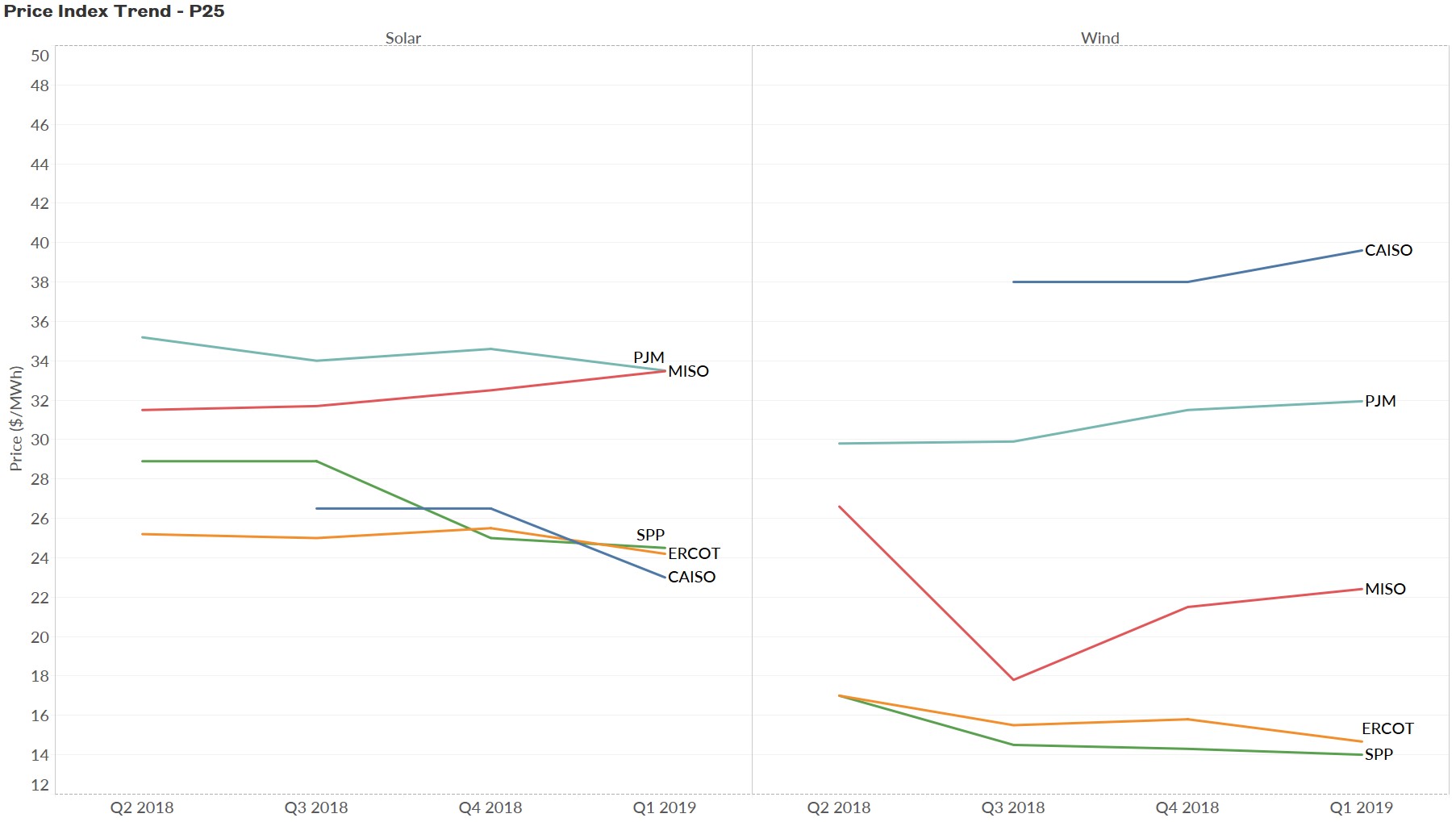

Prices for wind and solar in power purchase agreements generally edged downward during the first quarter, according to Level10 Energy.

LevelTen Energy, the Seattle-based renewable energy procurement company behind LevelTen Marketplace, an online platform that connects electricity sellers and buyers, has released its quarterly PPA Price Index report. The study provides an in-depth look at power purchase agreement price averages submitted through the platform, for both wind and solar projects, in five independent system operator regions, including CAISO, ERCOT, MISO, PJM and SPP.

The analysts included more than 1,100 price offers from more than 340 renewable energy projects submitted through the company’s marketplace. Compared with the findings from the previous quarter—when the solar PPA prices generally rose and wind prices were a mixed-bag—the first quarter registered a buyer’s market with a rising number of active projects.

Overall, the study found that wind and solar prices decreased $0.39/MWh or 2.3 percent across all markets, with CAISO marking the biggest drop for solar PPAs, a 15 percent slide from the last quarter of 2018. Wind prices, on the other hand, saw a 4 percent increase in the region, and the report’s authors anticipate the CAISO wind market to remain volatile and illiquid for the near future.

In the ERCOT region, PPA price averages for solar prices dropped by 6 percent, led by a 9 percent cutback in its west area. Prices in ERCOT for wind projects decreased the most, down 8 percent from the previous quarter, with its west zone marking the largest contraction of 11 percent. In the MISO district, solar and wind prices increased at Illinois, Indiana and Michigan hubs. In the PJM region, solar prices contracted by 3 percent, while wind prices rose slightly. In the SPP district solar prices contracted by 1 percent, and wind agreements slid marginally.

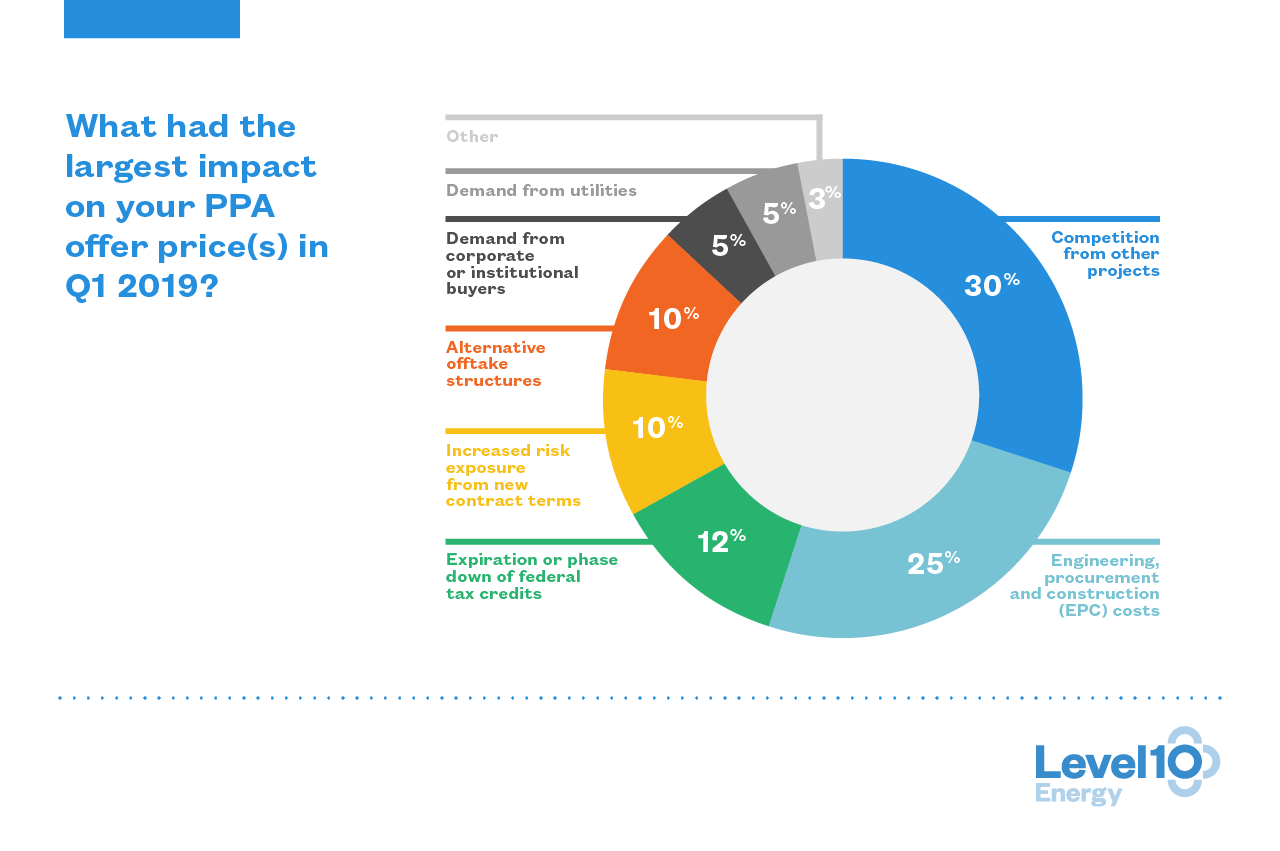

LevelTen conducted a survey of 40 utility-scale wind and solar project developers to determine the main drivers of these price fluctuations. Their findings reveal that of the six major market development factors, 30 percent of respondents said increased competition among developers had the largest impact on their project prices, while 25 percent of respondents attributed their price fluctuation to the changes in engineering, construction and procurement costs.

“We are seeing an increasing number of solar projects submitting requests to utilities to connect to the grid, and competition to interconnect and to sell electricity is increasing,” Henry Weitzner, CEO of Walden Renewables, told the researchers.

Other factors that influenced price changes include the phase down of federal tax credits (12 percent), increased risk exposure from new contract terms (10 percent), alternative offtake structures (10 percent) demand from utilities (5 percent) and demand from corporate buyers (5 percent).

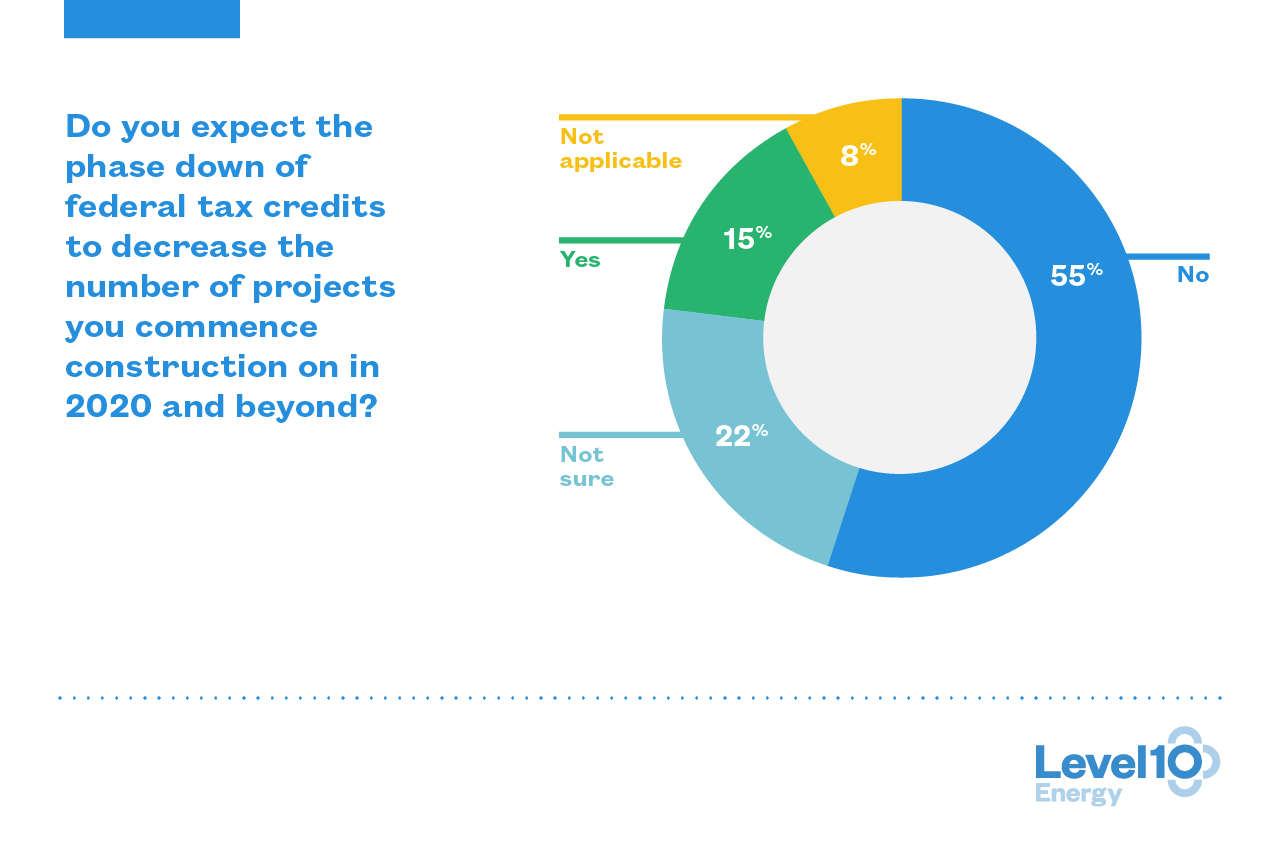

The production tax credits and the investment tax credits for large wind projects will expire in 2020. For solar projects, the ITC will be reduced from 30 percent in 2019 to 26 percent in 2020. According to LevelTen’s survey, the tax credit changes may not have a dramatic impact on the rate of project development, according to 55 percent of respondents.

“Alongside this increase in competition, we’re seeing an increase in demand from corporations and utilities. It’ll be interesting to see the supply-demand dynamics shake out. For now, the growing supply of clean energy projects serves as an opportune time for energy buyers to take full advantage of a competitive market,” Rob Collier, vice president of development at LevelTen Energy, told Commercial Property Executive.

You must be logged in to post a comment.