Despite Record Growth, CRE Industry Should Plan for Downturn

The economic expansion just became the longest in U.S. history, but now is the time to prepare for the next downturn, contends RCLCO Real Estate Advisors.

The U.S. economic recovery turned 10 years old on July 1, 2019, marking the longest period without an economic recession ever. However, according to RCLCO Real Estate Advisors’ latest RCLCO Sentiment Survey, players in the commercial real estate industry should still plan for the next downturn.

READ ALSO: Bulls Outnumber Bears in CRE C-Suites

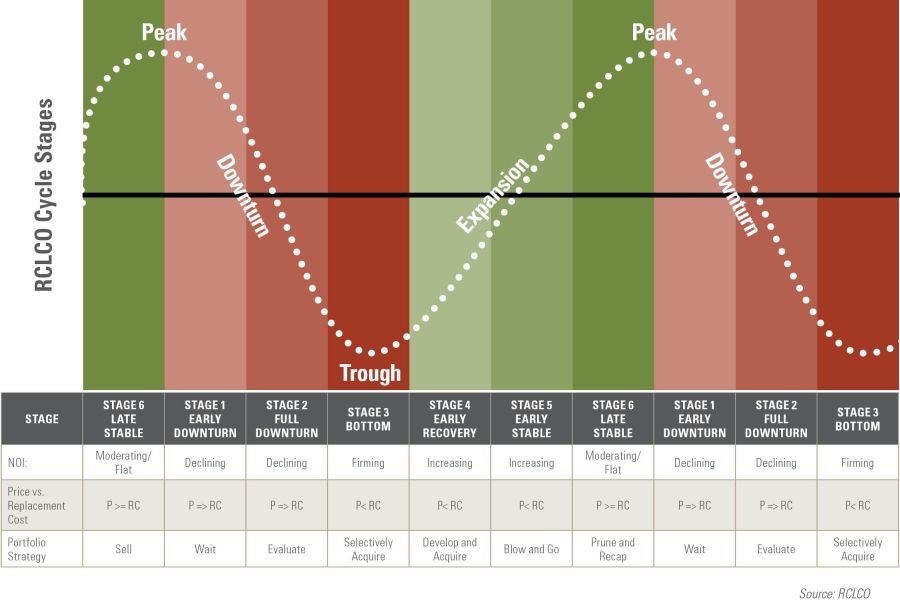

The expanding U.S. economy has been a boon to real estate. Positive operating fundamentals persist but the slower pace of growth rates along with capital market risks suggests that real estate’s “late stable” stage, or Stage 6, may be coming to a close, placing the “early downturn” stage, or Stage 1, on the horizon. From Stage 6 to Stage 1, net operating income will go from moderating/flat to declining. Additionally, the yield curve’s steady hold in an inverted form over recent weeks signals risk of recession within the near to medium term. The changing conditions in the economy and the real estate market mean real estate owners need to act now, per the report.

No sitting idly by

For the majority of commercial property owners, Stage 6 of the real estate cycle—which is apparently fading fast—is the time to sell. Any assets that would be unwanted post-peak should be discarded now, as they may be hard to sell at the desired price after the downturn is underway. Additionally, this “late stable” stage is a prime time for refinancing portfolios with low-debt, and for amassing a repository of funds for capitalizing on dislocations in the market during the downturn. RCLCO anticipates that the disruptions of the impending downturn won’t rise to the level of those seen during the Great Recession, but opportunities will abound.

Once Stage 1 hits, and it could do so at any time per the report, asset values will drop, and favorably termed credit will likely be more difficult to obtain. Investors that stored dry powder from Stage 6 should get capital in place to take advantage of opportunistic buys.

There’s no way to determine precisely when Stage 6 will move into Stage 1, so RCLCO promotes early planning and continuous monitoring of shifts in the economy and real estate, as well as a solid plan for each stage of the real estate cycle. Anticipating change and acting in a decisive and timely manner are key; the firm notes that historically, hesitation has resulted in failure. Finally, RCLCO reiterates that while a downturn is probable between now and 2022, nothing is certain except for the necessity of contingency plans.

You must be logged in to post a comment.