Development Boom Tempers Chicago Rent Growth

The city is preparing to receive a record level of new deliveries, with more than 8,000 units expected to come online this year, Yardi Matrix data shows.

By Alexandra Pacurar

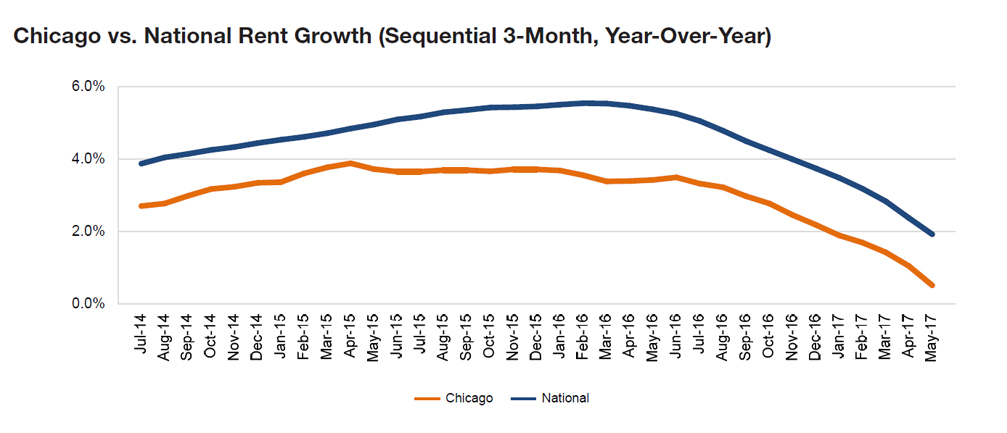

Chicago has seen rents moderate, in keeping with the nation as a whole, and features a bifurcation between luxury and working-class units. The boom in supply of luxury apartments has caused rent growth to slip in that segment, while increases continue among Renter-by-Necessity units. Chicago is preparing to receive a record level of new deliveries, with more than 8,000 expected to come online in 2017. Developers are focusing on high-rise residential communities in areas rich with amenities, making affordability a challenge.

Disparity characterizes the employment market, as well. Over the last year, Chicago gained 12,000 jobs in professional sectors but lost 11,000 positions in blue-collar segments. The metro has benefited from corporate expansions and relocations, such as those of Hickory Farms and Caterpillar, which moved downtown. As developers, investors and young renters continue to eye core markets, authorities are launching initiatives to support the revival and reinvention of the metro’s industrial areas, such as Little Village.

Investor demand is robust, with $3.8 billion in transactions having closed in 2016. Although downtown Chicago is gaining in prestige with renters, overall population is shrinking slightly, which serves to temper demand. We expect 2.5 percent rent growth for the metro in 2017.

You must be logged in to post a comment.