Development’s Return in Los Angeles

Office development reached a cycle high of 2.3 million square feet in 2017, marking a 53.7 percent year-over-year increase. Construction has picked up in less popular areas such as Jefferson Corridor and downtown Long Beach, while North Hollywood emerged as the most active suburban submarket.

By Razvan Cimpean

Los Angeles’ office market is booming, thanks in part to developers targeting submarkets that can accommodate new inventory and ensure steady absorption rates throughout 2017. As average asking prices keep increasing in well-established submarkets, we expect tenants to look for alternatives in those with lower rental rates and similar office stock, such as Burbank and Culver City. Los Angeles is also the only West Coast city shortlisted for Amazon’s second headquarters.

Completions reached a cycle high of 2.3 million square feet in 2017, a 53.7 percent increase from the previous year. Development has picked up in less-established urban submarkets, such as Jefferson Corridor and Long Beach–Downtown. North Hollywood emerged as the most active suburban submarket when factoring in existing inventory. With the completion of Merlone Geier Partners’ giant NoHo West mixed-use project, the submarket is set to increase its office inventory by more than 15 percent by mid-2018.

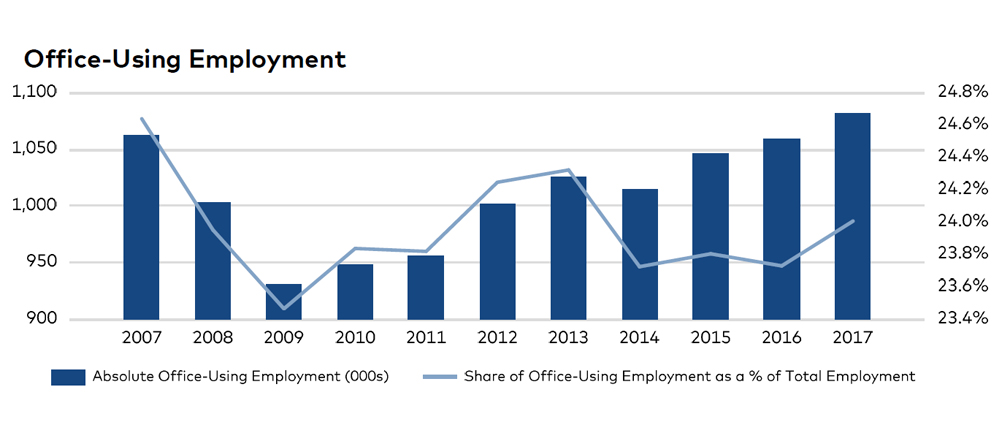

Some 37,000 jobs were added year-over-year through November, and the metro’s office-using job growth continues to outpace the national average. Office jobs gained 2.2 percent from the previous year and now account for 24.0 percent of Los Angeles’ total employment pool of 4.5 million jobs. Significant gains in education and health services (26,300 new jobs) and construction (8,200 new jobs) have been offset by losses in other sectors, such as government and manufacturing. As the metro’s minimum wage is poised to reach $15 per hour by 2020, Los Angeles is likely to see an uptick in its overall modest job growth.

You must be logged in to post a comment.