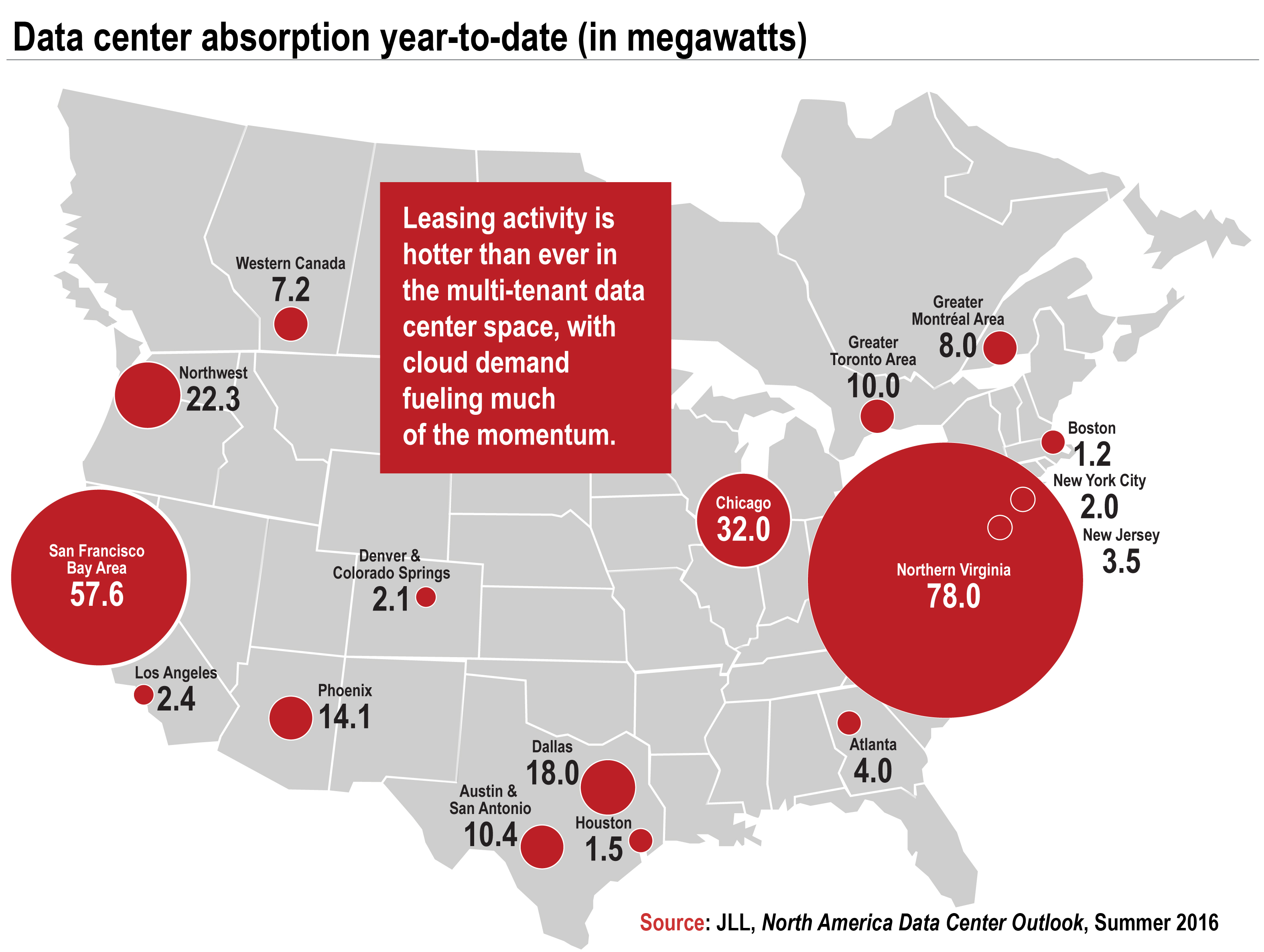

Digital Content, Data Sovereignty Drive North American Data Center Demand

By Mark Bauer, Managing Director and co-lead of Data Center Solutions, JLL Cloud technology adoption, rising data consumption and new data sovereignty laws are forcing companies to re-think how and where their servers filled with data will be located. Multi-tenant data centers (MTDC) are expanding across the continent, driven by the growing appetite for content,…

By Mark Bauer, Managing Director and co-lead of Data Center Solutions, JLL

Cloud technology adoption, rising data consumption and new data sovereignty laws are forcing companies to re-think how and where their servers filled with data will be located. Multi-tenant data centers (MTDC) are expanding across the continent, driven by the growing appetite for content, according to JLL’s latest Data Center Outlook (2016).

At the same time, the first wave of MTDCs are seeing their tenants’ 10-year leas

es coming up for renewal. As a result, many tenants are renegotiating terms to include greater flexibility to adjust to changing technologies and space requirements. A look inside a few of the growing North American data center markets highlights how this confluence of trends is playing out:

- Northern Virginia: Rich fiber optic networks, competitive energy rates and low latency make Northern Virginia the hottest spot on the globe for data centers. Three new TransAltantic subsea cables will further improve international connectivity. The development surge happening across the United States is clearly evident in Northern Virginia, where 1.13 million square feet is under construction and another 2.67 million square feet is planned; we are expecting absorption to be rapid.

- Greater Montreal and Toronto: Cloud providers are flooding southeast Canada’s top two largest cities. Earlier this year, Amazon announced its plans for a new Amazon Web Services data center in Montreal, the first outside of the United States. Microsoft Cloud also recently opened data centers in Toronto and Quebec City (and elsewhere). One compelling reason is the growing trend with compliance with data sovereignty laws that require Canada-based organizations to store certain kinds of sensitive data within Canadian borders.

- Pacific Northwest (Seattle/Washington/Oregon): The Pacific Northwest has become a popular area for Asian companies looking to establish data and routing equipment in the United States. Two Seattle-area companies opened a new 86-acre data and computing center this year, called the Transpacific Hub, enabling Asian-based companies to store and process information directly on site. Oregon’s enticing tax breaks and alternative energy options, such as hydropower, are also a lure for energy-hungry data centers. Infomart Data Centers is one of the many operations expanding in the region, adding 100,000 square feet to its Hillsboro location, just outside of Portland. LinkedIn recently announced plans to lease space inside the center and build an additional facility on the property.

The energetic growth in the market is somewhat tempered by operators and users that now have improved abilities to forecast future needs. More sophisticated predictive analytics and new technologies are helping data centers better project demand and improve operational efficiencies, minimizing massive redundancies that were necessary in the past.

Still, demand (especially for cloud data storage) is expected to remain aggressive for the near future. For now, the trend is shifting toward more data centers in more places. As Microsoft’s CEO Satya Nadella noted in its July quarterly earnings call, “…we want to serve customers where they are and not assume very simplistically that the digital sovereignty needs of customers can be met out of a fewer-data center approach.” Microsoft, like many other large data center owners, is moving toward demand-driven data center real estate strategies with built-in flexibility that give them room to adjust quickly to market changes.

The big question is: what real estate markets will benefit as companies decide where their data will live?

You must be logged in to post a comment.