DLA Piper Conference Special Report: Industry Leaders Detail Change, Opportunity

Rapid change, a global appetite for U.S. real estate assets and ample financing characterized the market snapshot offered by a panel of industry leaders at DLA Piper’s real estate summit in Chicago.

By Paul Rosta, Senior Editor

Rapid change, a global appetite for U.S. real estate assets and ample financing characterized the market snapshot offered by a panel of industry leaders Tuesday at DLA Piper’s real estate summit in Chicago.

Speaking to several hundred executives representing a broad spectrum of the industry, Eastdil Secured CEO Roy March offered an overview of trends making commercial real estate increasingly attractive to investors at home and abroad. The U.S. economy is 20 percent larger today than it was in 2007, he noted. At the same time, “the slow growth in Europe has definitely created an opening for the U.S. as a safe haven.” Unlevered returns on Class A core real estate average 6 to 6.5 percent, far superior to yields in the global markets. Investment sales volume in the U.S. is on track to hit $295 billion this year, a 20 percent year-over-year gain.

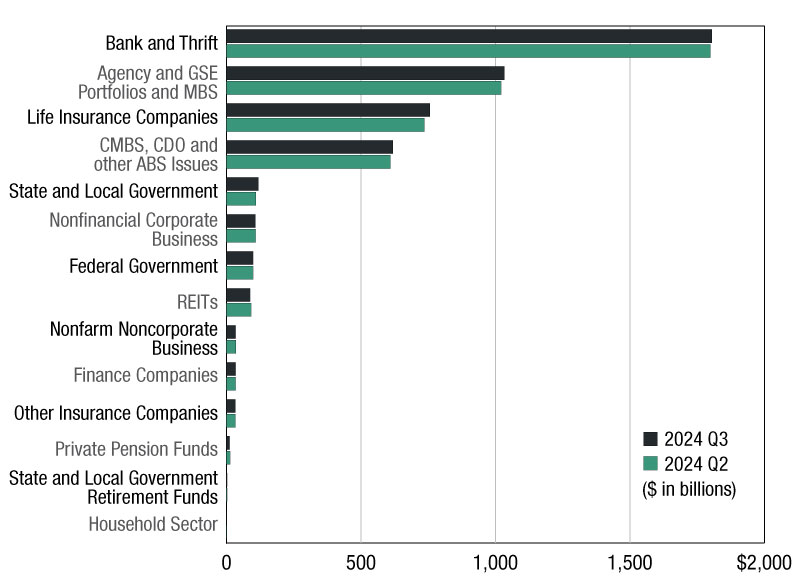

Real estate assets are drawing a strong interest from lenders, and debt issuance is expected to total more than $405 billion this year. March also cited the continued upturn in the CMBS market, which expanded 83 percent in 2013 and is on track to reach $110 billion this year. And in a sign of robust interest from offshore investors, last year, 46 percent of transactions in excess of $250 million were structured.

Against this backdrop, March’s fellow executives provided wide-ranging insights into the market trends. Medical office buildings are expanding past the traditional model of small facilities that serve one or two doctors, noted Ventas Inc. chairman & CEO Debra Cafaro. “Now you’re seeing buildings that are 50,000 to 100,000 square feet,” and used for sophisticated clinical functions. A new generation of seniors housing developers is emphasizing more attractive designs, Wi-Fi service and technology that accommodates electronic medical records, she added.

Along with real estate asset categories, the pecking order of geographic markets continues to shift. Jeffrey Barclay, a managing director for real estate investment management at Goldman Sachs, cited Denver as an example of a market that is shedding its presumed status as a secondary market. “Denver is becoming a No. 1 city in a variety of (areas) that have not been very well noticed,” he pointed out.

Former Vornado Realty Trust CEO Michael Fascitelli spoke to the influence of the Millennial generation on office space. He noted that Chicago’s Merchandise Mart is valued at about three times what Vornado paid for it in 1998. At that time, 200,000-square-foot floor plates like those at the Merchandise Mart couldn’t be given away. Now, “200,000-square-foot floor plates are cool and hip.” Fascitelli, whose new venture is MDF Capital L.L.C., joked about being “an unemployed guy” and encouraged the audience to experience a day in shared incubator space, as he did recently. He described a vibrant, communal atmosphere where 20-somethings played ping pong, swapped ideas and shared beers after 5 p.m. “It felt like you were in a kind of campus environment,” he said.