Construction Stays on a Roll—For Now: Dodge

Despite a dip in one key area, the tracker shows year-over-year improvement.

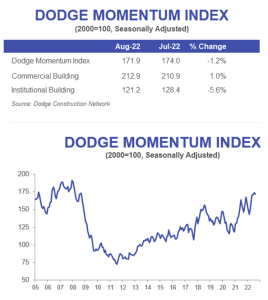

Dodge Construction Network’s Dodge Momentum Index, which offers a monthly snapshot of the initial report of nonresidential building projects in the planning stage in the U.S., dipped 1.2 percent in August. The index rested at 171.9, following a revised index reading of 174 in July.

The Momentum Index is a vital benchmark in the construction industry, as it serves as an indicator of construction spending for nonresidential projects by an entire year. The slight reduction in the August figure is attributed to the institutional component of the Momentum Index, which dropped 5.6 percent due to the fact that fewer health-care projects made it to the planning stage. The commercial component tempered the decrease in the Momentum Index just a bit, with a 1 percent increase as a result of a rise in hotel projects.

Despite the relatively minute decline, Dodge considers August’s figures a positive outcome. The company noted in prepared remarks that the August Momentum Index remains just below the July figure, which marked a 14-year high. The year-over-year numbers are encouraging as well. The Momentum Index increased 14 percent from August 2021 to August 2022, with the commercial component jumping 16 percent and the institutional component rising 10 percent.

READ ALSO: H1 Net Lease Volume Up Across Sectors: JLL

Largest projects

In August, a total of 26 commercial and institutional projects valued at $100 million or more entered the planning stage, keeping the Momentum Index above 170. A commercial project, the Two Tower office building in Chicago, on the books at $400 million, is the largest project in the works in terms of investment, followed by the $300 million phase 2 of Timberline Real Estate Partners’ mixed-use Sungate Logistics Park in Daytona Beach, Fla. Aligned Data Centers’ $275 million hyperscale data center campus in Sterling, Va., entered planning in August as well. Phase one of the project will yield a 430,000-square-foot, 72 MW data center on the 10-acre campus.

The top institutional projects that entered planning in August include Scripps Mercy Hospital’s expansion, a $360 million endeavor in San Diego. The $275 million Triton Center, a multi-purpose campus center redevelopment project at the University of California San Diego, also entered the planning stage. For the Momentum Index’s purpose, institutional projects also include non-manufacturer-owned laboratories, medical office properties and public buildings.

Forecast

While the August Momentum Index proved no cause for concern, the forecast for next year is quite a different story. Weaker economic conditions and rising interest rates, however, may grind down overall consumer and business confidence as we move into 2023, Sarah Martin, senior economist for Dodge Construction Network, said in a prepared statement. This will translate into fewer nonresidential building projects breaking ground, she concluded.

You must be logged in to post a comment.