Dodge Momentum Index Slips Slightly in July

Commercial and institutional construction planning activity remained well above where it was 12 months ago.

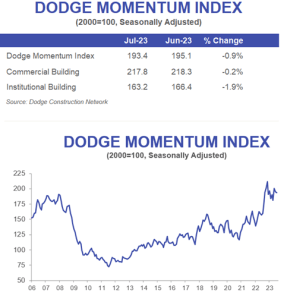

Overall, the DMI is 25 percent higher than 12 months ago. Image and data courtesy of Dodge Construction Network

The Dodge Momentum Index declined in July by 0.9 percent to 193.4 from the revised June reading of 195.1, Dodge Construction Network announced. During the month, the Index’s commercial component remained essentially flat, sliding down just 0.2 percent, while the institutional component fell by 1.9 percent.

“All commercial sectors pulled back or remained flat over the month of July… Education and health care—the two largest institutional segments—decelerated in July, as well, and really pulled down that piece of the Index,” said Sarah Martin, Dodge Construction Network’s associate director of forecasting, in a video that accompanied the announcement.

Nonetheless, the DMI remained substantially higher than 12 months ago, indicating sustained health overall for the industry.

Martin explained that there has been an ongoing bifurcation since the start of the year, with commercial planning down 10 percent through July—because of tighter lending standards and higher interest rates— and institutional planning up 16 percent over the same period, bolstered by public funding and lower sensitivity to interest rates. Overall, the DMI is down just 2 percent since January.

The Dodge official added that, overall, the DMI is 25 percent higher than 12 months ago, with commercial 13 percent higher and institutional 35 percent higher.

Still building big

The Index tracks nonresidential projects going into planning, leading actual construction spending by about 12 months.

The Dodge report noted that 15 projects valued at $100 million or more entered planning in July. The largest such commercial projects included the $400 million Kraft Heinz Distribution Center in DeKalb, Ill., and the $190 million PTC warehouse/distribution facility in San Antonio, Fla., in the Tampa–St. Petersburg metro.

You must be logged in to post a comment.