E-Commerce Fuels Repricing of Retail, Industrial Assets

Scott Crowe and Uma Pattarkine of CenterSquare Investment Management analyze online shopping's divergent effects on retail and logistics companies, as well as the properties they occupy.

By Scott Crowe & Uma Pattarkine

Scott Crowe & Uma Pattarkine

For many investors, REITs provide the opportunity to invest in high-quality commercial real estate but with the added convenience of liquidity. This liquidity, however, comes with higher measured volatility, which for some investors diminishes REITs’ appeal versus private real estate investments. These investors are remiss to ignore the REIT market, however, as REIT liquidity provides investors with a unique insight into private real estate: real-time price discovery. At CenterSquare, we have developed a proprietary database that helps us use the pricing of $1.5 trillion of real estate through the REIT market to provide insight into future potential private real estate pricing.

Opposing impacts

This perspective has been particularly telling as we have seen a repricing of retail and industrial property types as e-commerce has redefined consumer spending trends. As more sales have migrated online, retailers are struggling with competition and logistics players are reaping the rewards. The divergent impact on retail and logistics companies has quickly bled into the fundamentals of the real estate they occupy, creating secular headwinds for retail properties and secular tailwinds for industrial properties.

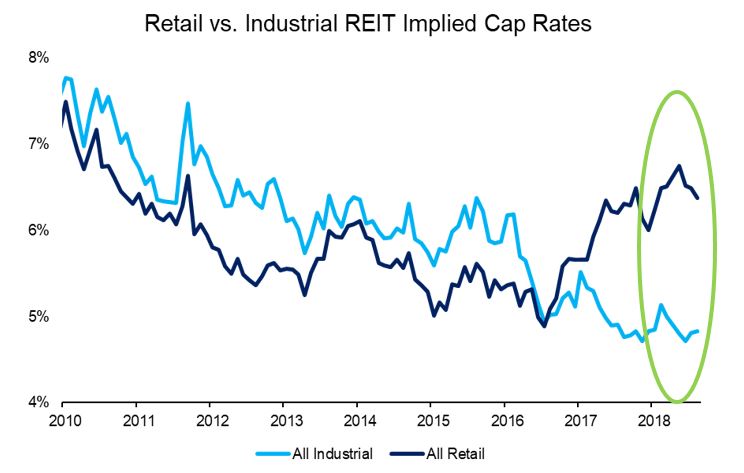

While the impacts of these trends on private real estate pricing have only been evident recently, for those paying attention to the REIT market, the problem in retail and the tailwinds for industrial emerged as early as 2016. The REIT market began to correctly imply that retail cap rates were on the rise to levels not seen in decades and industrial cap rates were on their way to all-time lows—something we are seeing play out in the private real estate markets today. The benefit of this information to private real estate investors is clear: Using the real-time and forward-looking pricing information of the REIT market can help guide better investment decisions.

Note: All ending as of August 2018 (i.e. three-month change represents the change from financials reported in August 2018 to August 2018). REIT Implied cap rates are generated by a proprietary calculation that divides a company’s reported net operating income (“NOI”) adjusted for non-recurring items by the value of its equity and debt less the value of non-income producing assets. Sources: CenterSquare Investment Management, REIT company reports

Interestingly, while the repricing of retail and industrial properties in private markets is now in full swing, REIT markets today are experiencing a stabilization in the repricing trend, as several new factors have emerged.

Quality Bifurcation

Within retail REITs, cap rates seem to have reached a ceiling as valuations are giving way to opportunistic privatization bids. This process began in the listed real estate market in late 2017 as we saw takeover bids for General Growth Properties, Westfield and INTU Properties in response to overly discounted valuations. Additionally, U.S. tax reform gave consumers and retailers additional spending power. Retailers are now more bullish, given the ability to reinvest capital into their stores and supply chains. These fundamentals are once again quickly impacting retail properties as landlords are seeing healthy sales, increased tenant demand and leasing progress.

One important factor to note is that retail valuations have seen a stark bifurcation driven by quality. As retailers rationalize their physical footprint, brick-and-mortar retail spaces are becoming more strategically occupied. The problem is that the number of stores has remained constant, but there are now fewer retailers. The issue is not a broad-based decline in rents. It is that low-quality property landlords are finding it difficult to find tenants, and are therefore faced with either vacancy or heavy capital expenditure spend to repurpose the asset for a different use. This, in fact, is what has led to the oft quoted “bifurcation” in retail, with high-quality assets in the best locations seeing stabilizing fundamentals and low-quality assets in secondary and tertiary locations facing obsolescence risk. On the industrial front, REIT implied cap rates seem to have reached a floor after a strong run of compression as supply is catching up to demand.

Reading the signals

At CenterSquare, we have found significant utility in the movement of REIT implied cap rates to inform expectations for cap rates in the private market. We believe that paying attention to these REIT market signals can help create better decisions for private real estate investors. Whether helping to determine new lows for industrial cap rates or the point of stabilization of higher cap rates in retail, REIT implied cap rates can paint a real-time picture of changing fundamentals in commercial real estate.

In the analysis above, CenterSquare uses proprietary REIT implied cap rates for the retail and industrial sectors. CenterSquare’s REIT Cap Rate Perspective report contains information on the methodology of these cap rates.

The statements made, and the conclusions drawn in this article are not guaranteed and are merely the opinion of CenterSquare Investment Management employees. Material in this article is for general information only and is not intended to provide specific investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

You must be logged in to post a comment.