Industry Leaders Weigh In on Investment: CPE 100 Survey

In the year's first survey of the industry leaders who comprise the CPE 100, executives weigh in on the outlook for commercial real estate investment, the performance of their own companies and what's ahead for the economy.

Concerns about the economy are beginning to inform executives’ outlook for real estate investment market, leading to a more muted forecast for its prospects, according to the year’s first CPE 100 Sentiment Survey.

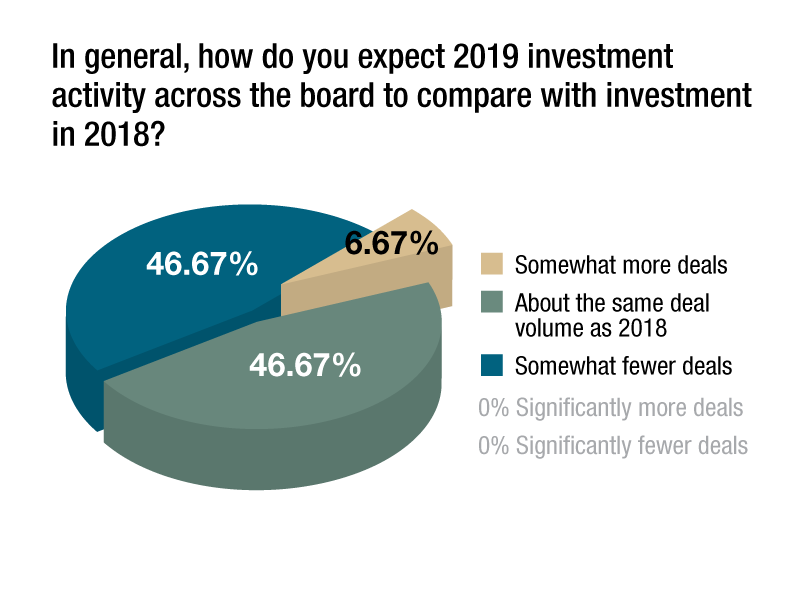

Deal volume comparable to 2018 or less is expected by a combined 93 percent of the CPE 100, an invited group of industry leaders representing a cross section of asset categories and business areas. Only about 7 percent responded that they expect deal volume to be at least somewhat greater in 2019 than it was in 2018.

Deal volume comparable to 2018 or less is expected by a combined 93 percent of the CPE 100, an invited group of industry leaders representing a cross section of asset categories and business areas. Only about 7 percent responded that they expect deal volume to be at least somewhat greater in 2019 than it was in 2018.

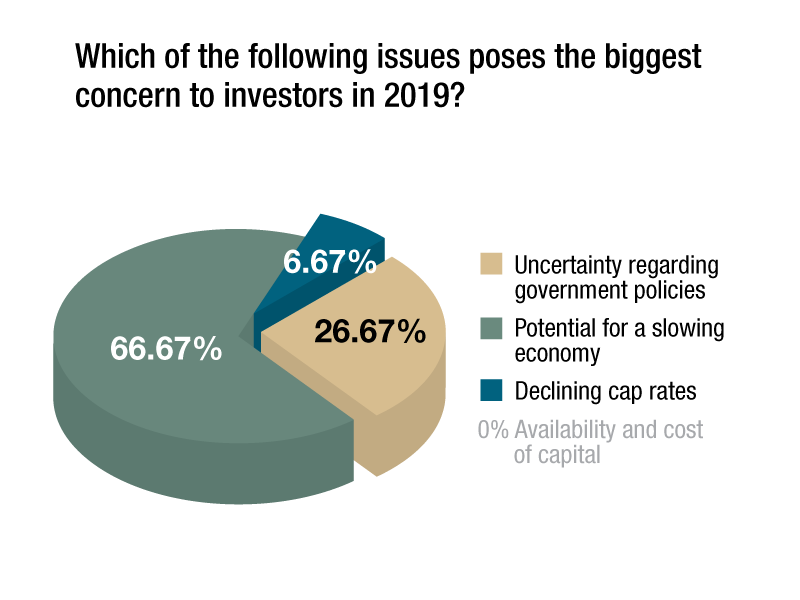

Asked to name their principal concern about the prospects for the investment market this year, two thirds cited the  prospect of an economic slowdown. Another 27 percent named uncertainty about government policy as the number-one hazard.

prospect of an economic slowdown. Another 27 percent named uncertainty about government policy as the number-one hazard.

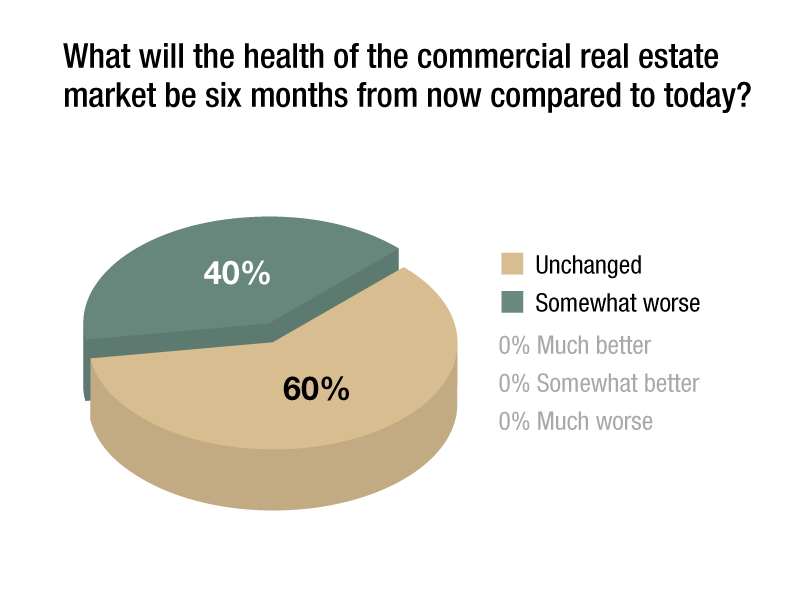

Worries about the economy also surfaced in the impressions of the industry’s prospects for 2019. A significant minority of respondents, four in ten, said they expect the health of the real estate industry to be somewhat worse in six months than it is today.

A slightly smaller cohort, 33 percent, expects the economy to get somewhat worse during the same stretch. That compares to two thirds of respondents who said that general economic conditions will remain unchanged over the next six months, while 60 percent likewise predict that the state of the commercial real estate will be unchanged over the same period.

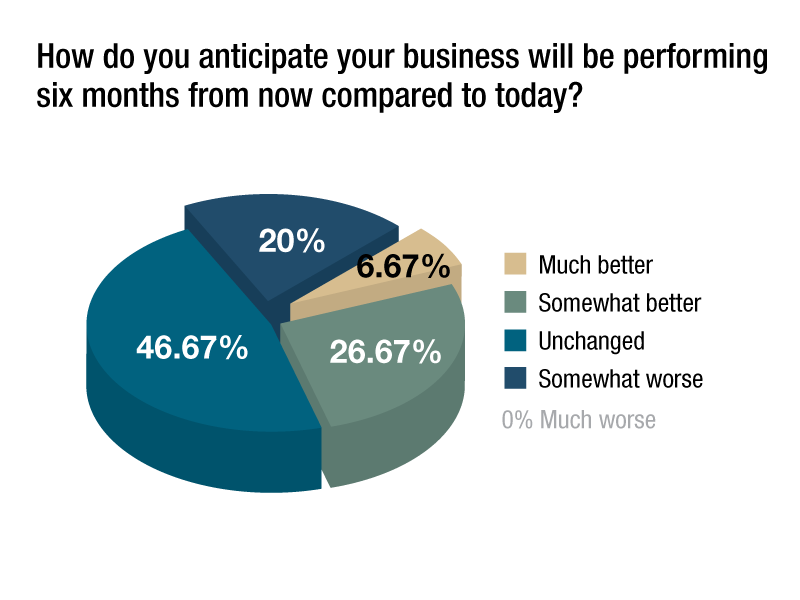

In one noteworthy finding, the expectations for the CPE 100’s own businesses drew a wider range of responses. Only one third of participants believe that their businesses will be doing somewhat better or much better six months from now. A plurality, 47%, believes that the performance of their business will be unchanged in six months.

In one noteworthy finding, the expectations for the CPE 100’s own businesses drew a wider range of responses. Only one third of participants believe that their businesses will be doing somewhat better or much better six months from now. A plurality, 47%, believes that the performance of their business will be unchanged in six months.

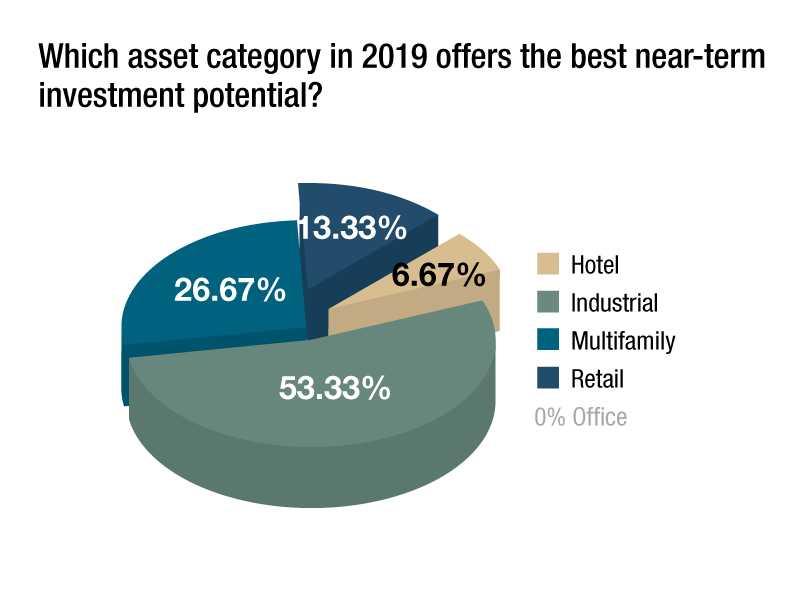

By asset category, industrial sector was far and away the top choice as the most promising asset category. A majority of those surveyed—53 percent—cited the category as the one with the best near-term investment potential. The multifamily sector made a solid showing as the top choice of about one quarter of survey participants.

By asset category, industrial sector was far and away the top choice as the most promising asset category. A majority of those surveyed—53 percent—cited the category as the one with the best near-term investment potential. The multifamily sector made a solid showing as the top choice of about one quarter of survey participants.

Of note, the office sector failed to chart with the CPE 100. Despite its well-publicized challenges, retail assets were cited by 13 percent of respondents.

You must be logged in to post a comment.