Economy Watch: 2018 to Be Another Good Year for CRE

As we head into 2018, we can expect stability in the U.S. economy and real estate market, according to a new LaSalle Investment Management report. But how will individual sectors perform?

By D.C. Stribling, Contributing Editor

A stable 2018 is expected for both the U.S. and Canadian economies and the countries’ respective real estate markets, according to a new report from LaSalle Investment Management. Long-term trends will continue to drive strong financial performance.

“North American property market fundamentals continue to experience strong, positive momentum, thanks to demand-side growth that is keeping pace with an active supply pipeline,” said, Jacques Gordon, global head of research and strategy at LaSalle, in the report. “However, uncertainties still exist surrounding tax reform, healthcare reform, trade treaties and foreign policy.”

Property portfolios that balance “goldilocks” and “bear” scenarios are recommended by the report, which also has forecasts for the main food groups.

Warehouses/Industrial/Logistics: The industrial hub markets, such as Riverside, Calif.; Chicago; Atlanta; and Dallas, are experiencing high levels of construction combined with very strong demand, according to the report. This positions those markets to perform well in 2018, although risks would escalate should economic growth slow. E-commerce continues to reshape the industrial market and boost warehouse demand, particularly in the major population centers.

Apartments: Low yields and slowing income growth are proving to be short-term challenges for the apartment sector, the report said. Urban apartment markets are continuing to see high levels of supply, especially among the high-quality/high-rent segments of the market, although construction should slow in 2018. Suburban markets, where market fundamentals are more balanced, should see steady inflationary rent growth.

Retail: E-commerce will continue to reshape this sector and impact real estate investment performance, the report predicted. Retailers will be forced to invest in innovation and advanced data analytics. Grocery-anchored retail space in well-located centers will remain in demand, which is reflected in the strong capital market activity targeting these centers.

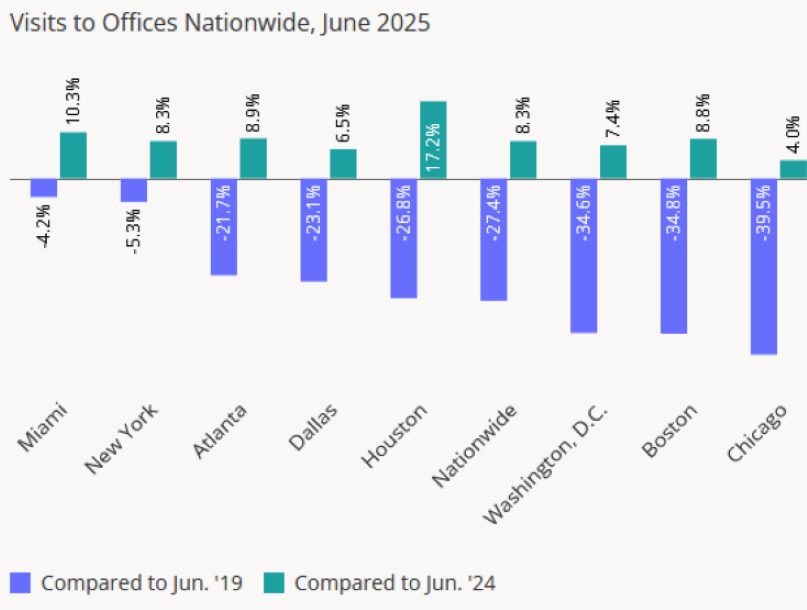

Office: Gateway CBD office markets such as New York, Washington, D.C., and San Francisco are experiencing above-average levels of supply and constrained demand, which will continue to constrain returns. Success in this sector will be asset-specific, with a continued growing importance of amenities, the report noted.

You must be logged in to post a comment.