Economy Watch: Commercial Property Valuations Gain in April

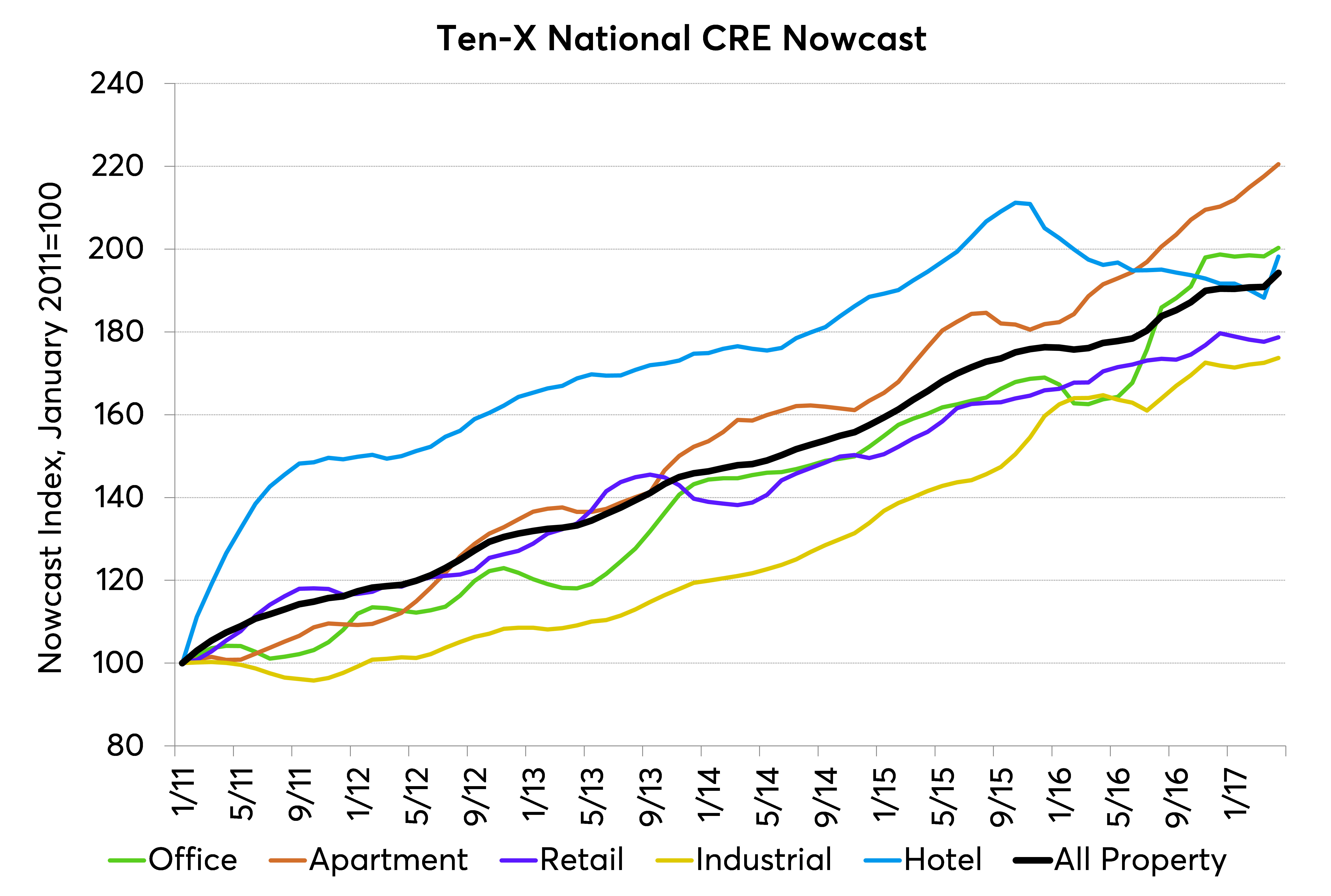

The commercial real estate industry saw its strongest price growth since the election, according to Ten-X's latest Commercial Real Estate Nowcast. CRE pricing has risen 9.6 percent in the last 12 months, the strongest annual growth rate since early 2016.

By Dees Stribling, Contributing Editor

Commercial real estate valuations nationwide grew by an average of 1 percent during April, representing the industry’s strongest price growth since the election in November, according to Ten-X’s latest Commercial Real Estate Nowcast. The monthly uptick comes after generally tepid growth in valuation during the months after the election, including a 0.5 percent increase in March.

The report also noted that CRE pricing has now risen 9.6 percent over the last 12 months, which is the strongest rate of annual growth since early 2016.

According to the Nowcast, the hotel sector experienced a surprising pop in pricing, surging 1.3 percent during April. That places prices 1 percent above their April 2016 levels, breaking a streak of 11 consecutive months with negative annual growth.

Pricing for hotel properties in the Northeast continued to decline, however, with New York likely weighing down the region because of its sizable supply pipeline, and the new administration’s travel restriction efforts spurring a decline in tourism to major gateway markets.

Also posting a significant monthly increase in pricing is the apartment sector, which continued its run of success in April. The sector’s 1.3 percent growth was on par with its performance the previous two months, and overall pricing is now up 15.1 percent year-over-year. Despite tight cap rate spreads, which indicate that apartment properties may have reached peak value, investors remain bullish on the segment, noted Ten-X.

Office properties enjoyed an increase of 1.1 percent in April, ending a streak of four months with either flat or middling growth. Pricing across the sector now stands 22.4 percent above its year-ago levels, the strongest annual gain since 2014.

The pricing index combines Google Trends data, Ten-X’s proprietary transaction data, and investor surveys to forecast CRE pricing trends. It’s published monthly.

You must be logged in to post a comment.