Economy Watch: Consumer Confidence Buoys Industrial Sector

The U.S. industrial real estate market enjoyed its eighth consecutive year of growth, according to Transwestern's year-end national report on the sector.

By D.C. Stribling, Contributing Editor

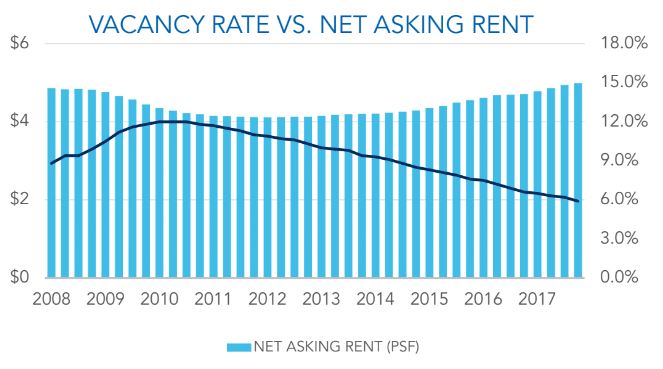

The U.S. industrial real estate market had another banner year in 2017, due in large part to consumer confidence, which hit a 17-year high in December. That’s according to Transwestern’s national industrial report for the year, which was published earlier this month. The report also found that the U.S. industrial market enjoyed its eighth consecutive year of growth in 2017, with 31 consecutive quarters of positive industrial space absorption and 29 consecutive quarters of declining vacancy.

The good news for the industrial market was widely spread across the country. For example, in New Jersey, vacancy and asking rents improved to historic levels, and net absorption turned out to be the second-highest on record. Vacancy in the greater Seattle market dropped to an historic low of 2.7 percent, pushing asking rents up 22.8 percent for the year (only Boston gained more for the year).

As for industrial development, the Inland Empire lead the nation with 23 million square feet as of the end of the year. Next were Atlanta and DFW, both with more than 20 million square feet under development. Both Chicago and New Jersey had more than 10 million square feet under way.

Ports set records for container volumes as e-commerce grew to 9.1 percent of retail sales by the end of 2017, up from 8.2 percent the prior year. Three of the largest transactions completed in the fourth quarter were in the country’s leading port markets. In the Inland Empire, Walmart and Solaris Paper took 1 million square feet and 862,000 square feet, respectively, and Best Buy signed for 725,000 square feet in New Jersey.

You must be logged in to post a comment.