Economy Watch: Consumers, Investors More Optimistic Than in Years

The Conference Board Consumer Confidence Index and State Street Confidence Index improved in March, which bodes well for the continued expansion of the economy and demand for real estate.

By Dees Stribling, Contributing Editor

The Conference Board Consumer Confidence Index, which had increased a fair amount in February, improved even more sharply in March. If sustained, that’s is good news for the continued expansion of the economy, and demand for real estate. The index now stands at 125.6 (1985 = 100), up from 116.1 in February. Both components were up: The Present Situation Index rose from 134.4 to 143.1 and the Expectations Index increased from 103.9 last month to 113.8.

That’s the highest level for the index since December 2000, according to Lynn Franco, director of economic indicators at the Conference Board. Consumers’ assessment of current business and labor market conditions improved considerably, and they’re also expressing much greater optimism regarding the short-term outlook for business, jobs and personal income prospects.

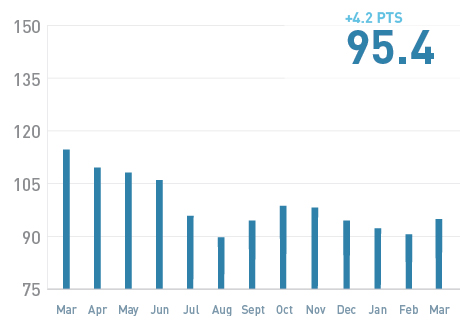

As for investors, the State Street Investor Confidence Index increased to 95.4 in March, up 4.2 points from February’s revised reading of 91.2. Though it’s probably good for the economy, broadly speaking, for investors to be optimistic, that might also mark a slight turn away from real estate investment.

That’s because the index measures investor confidence (or risk appetite) by analyzing the actual buying and selling patterns of institutional investors. The greater the percentage allocation to equities—historically more volatile than real estate—the higher risk appetite or confidence. A reading of 100 is neutral; it is the level at which investors are neither increasing nor decreasing their long-term allocations to risky assets.

You must be logged in to post a comment.