Economy Watch: CRE Cap Rates Mostly Stable in 2H 2017

Despite strong global capital inflows into U.S. commercial real estate, CBRE expects higher interest rates and inflation will put pressure on cap rates this year.

By D.C. Stribling, Contributing Editor

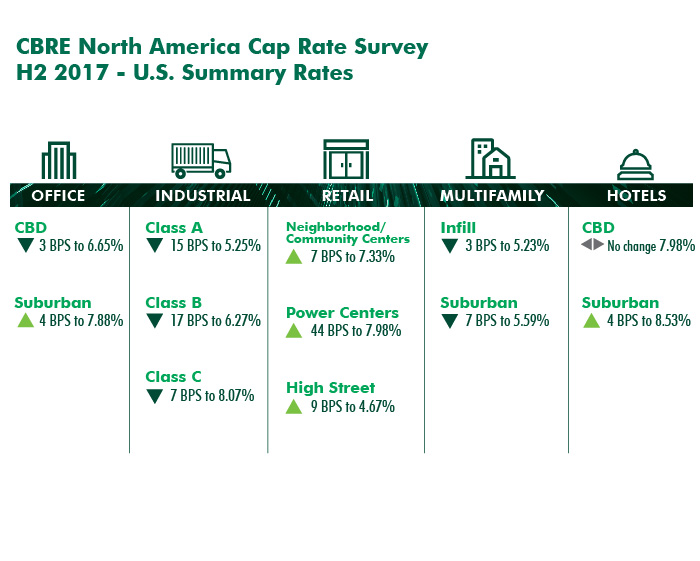

Capitalization rates for U.S. commercial real estate assets were broadly stable in the second half of 2017, CBRE reported recently in its North America Cap Rate Survey, though with some variation by property sector. For instance, industrial cap rates tightened the most, and multifamily rates also edged down. Office and hotel cap rates experienced some modest changes in both directions. Retail cap rates increased, mostly for power center assets. Overall, CBRE expects the recent rise in inflation and higher interest rates to put upward pressure on U.S. cap rates in 2018, despite strong global capital flows into the commercial real estate sector.

Sector Specifics

Cap rates for stabilized CBD office properties decreased modestly in the second half of 2017, from 6.67 percent to 6.65 percent, the report noted, reversing the upward trend that began in the second half of 2015. Near-term cap rate stability is expected for the majority of CBD and suburban markets, both for stabilized and value-add office product.

Industrial cap rates fell by 13 basis points for stabilized assets, finishing the second half of 2017 at 6.52 percent, CBRE said. Most survey respondents (79 percent) expect no changes to stabilized and value-add industrial cap rates in the first half of 2018.

In the retail sector, average cap rates for stabilized power centers increased in nearly all markets in the second half, and the average cap rate for all stabilized retail properties increased by 44 basis points to 7.98 percent. Cap rates for value-add product rose by 38 basis points, to 9.43 percent.

Robust investment activity and sustained investor interest in the multifamily sector kept cap rates for stabilized property acquisitions at historically low levels in the second half of 2017 (properties in urban markets at 5.23 percent and in suburban markets at 5.59 percent).

In the hotel sector, the report said, cap rates remained steady in the second half of 2017, especially in CBDs. The average CBD hotel cap rate remained just below 8 percent and under the long-run average of 8.21 percent.

You must be logged in to post a comment.