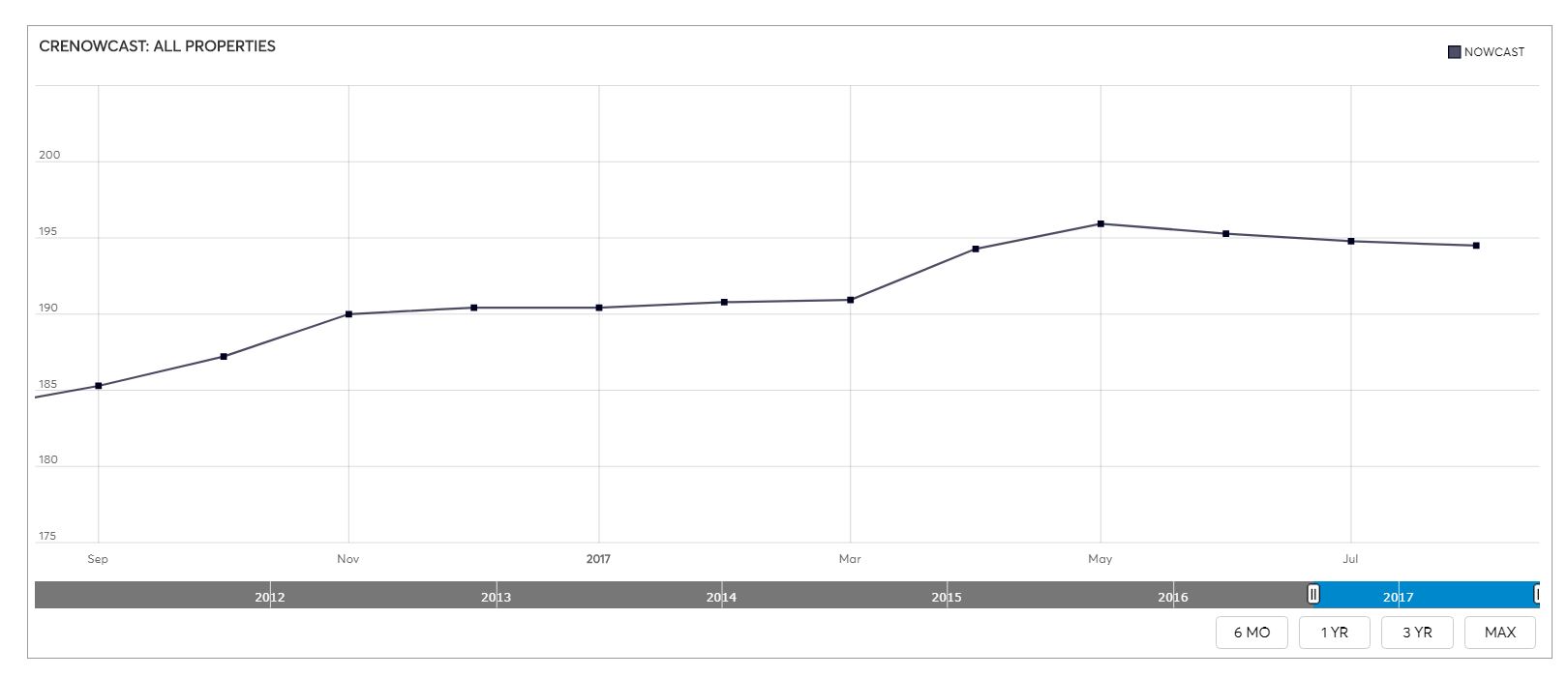

Economy Watch: CRE Prices Edge Down in December

The Ten-X Commercial Real Estate Nowcast posted its eight consecutive month of contraction, with pricing just 1 percent higher than a year ago.

By D.C. Stribling, Contributing Editor

U.S. CRE prices in December edged down 0.3 percent from November, marking the eighth consecutive month of contraction for the Ten-X Commercial Real Estate Nowcast index. That puts prices at just 1 percent higher than a year ago, the weakest appreciation pace in this cycle.

The monthly index combines Google Trends data, Ten-X Commercial’s proprietary transaction data and investor surveys to indicate CRE pricing trends.

Sector Variation

The Ten-X Retail Nowcast was one of two sectors to post a monthly gain, a surprising result considering that sector’s malaise, inspired by e-commerce and changing consumer preferences. Nevertheless, the national retail index recorded a 0.4 percent rise in December—its seventh consecutive monthly gain. However, the segment’s annual pricing growth shrank to 4.3 percent.

The Ten-X Office Nowcast, which had seen gains in recent months despite weak fundamentals, dropped 1.6 percent in December. Office pricing is down 0.8 percent from a year ago, one of only two segments to post an annual pricing decline. The sector’s weakness was in all regions, encompassing markets that never recovered from the last recession’s job losses and markets where strong recovery drove new construction, resulting in increased supply, according to Ten X.

The apartment sector continued to weaken, as it has since mid-2017. The Ten-X Apartment Nowcast posted a 0.3 percent decline—its sixth consecutive monthly drop—leaving apartment pricing just 2.6 percent higher than a year ago.

On the other hand, the Ten-X Hotel Nowcast continues to bounce around, with the index edging up 0.8 percent in December. Hotel pricing is now 2 percent higher than a year ago, its strongest annual reading since May. A range of factors, including improving business travel indicators, a weaker dollar and improved economic conditions abroad, all helped hotel pricing to plateau.

Finally, The Ten-X Industrial Nowcast recorded a 0.6 percent monthly decline in December, with industrial pricing down 3.5 percent compared to a year ago—the weakest annual movement among all five sectors. That comes despite the sector’s strong fundamentals and new sources of demand, including e-commerce growth, demand from cloud computing centers and cannabis legalization in some states.

You must be logged in to post a comment.